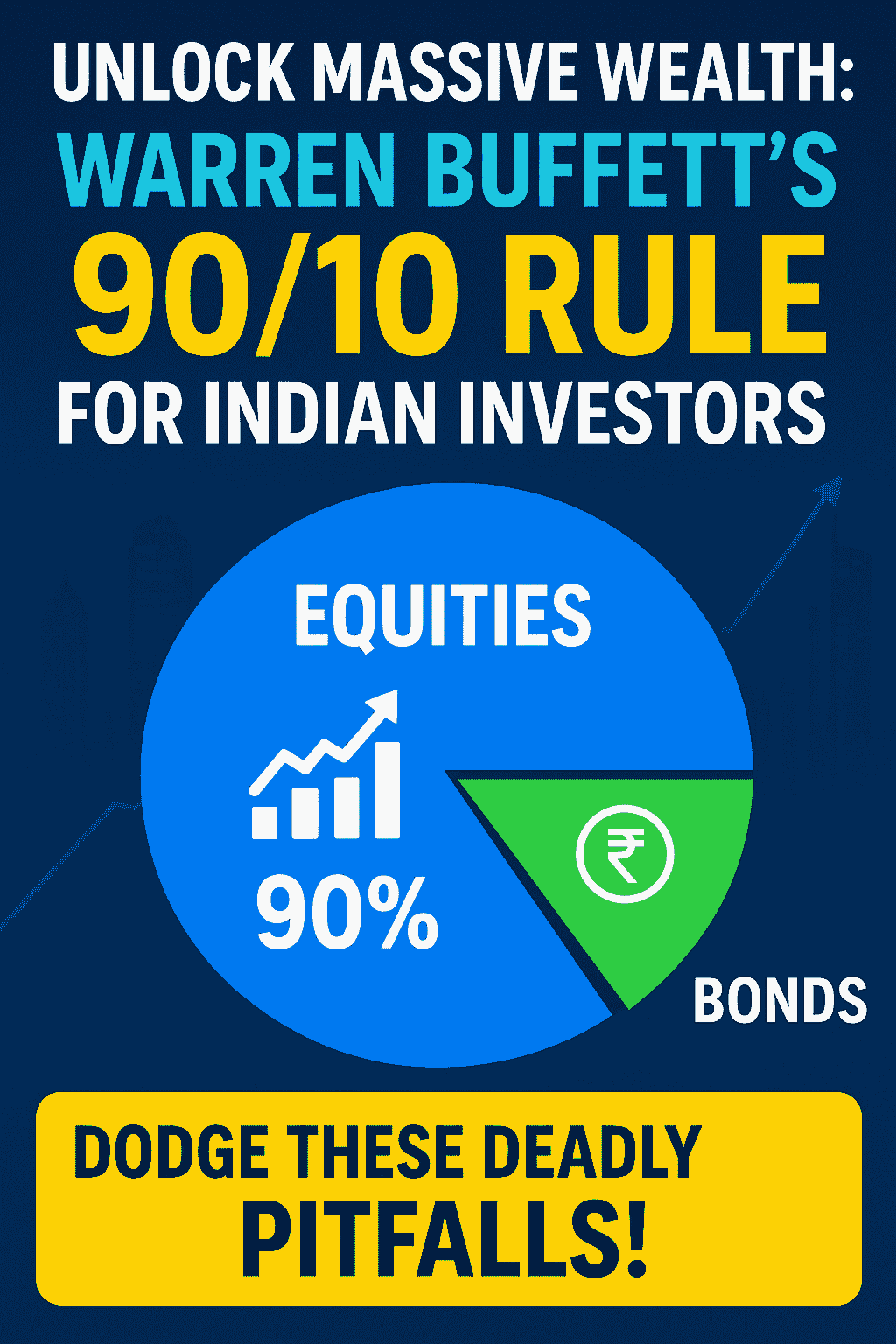

Discover Warren Buffett’s powerful 90/10 rule for Indian investors in 2025 – allocate 90% to index funds and 10% to bonds for explosive growth. Uncover adaptations for Nifty highs, bond yields, pros, cons, real risks, historical returns, and step-by-step guides to build enduring wealth in India’s volatile market. #90/10 rule for Indian investors, #Warren Buffett 90/10 strategy India, #Buffett investment mantra for Indians, #passive investing in India, #low-cost investment strategies India

Introduction

With the Indian stock market always changing with the Nifty 50 closing at 24,712 on August 26, 2025, after a tumultuous session that saw a 1.02% decline, Warren Buffett’s 90/10 rule for Indian investors remains a timeless guide to building wealth. Buffett personally advised this approach for his family’s financial future, allocating 90% of the portfolio to inexpensive index funds that track broad market indices and 10% to short-term government bonds. India’s economy is booming thanks to digital innovations and strong GDP projections. The 90/10 rule for Indian investors promises simplicity, discipline, and compounding magic. But is this American-born maxim really applicable to Indian conditions given the volatility of bond yields—the 10-year government bond is currently at 6.60%? This comprehensive guide explores its history, 2025 modifications, overwhelming advantages, hidden risks, real-world implementation, and professional opinions to enable you to determine whether the 90/10 rule for Indian investors is a safe bet or your ticket to success.

The Timeless Foundations of Warren Buffett’s 90/10 Rule

In his 2013 shareholder letter, Berkshire Hathaway’s renowned investor Warren Buffett presented the 90/10 rule as the best strategy for regular investors. The basic idea is to invest 10% in short-term U.S. Treasury bonds as a safety net and 90% in an inexpensive S&P 500 index fund to benefit from broad market expansion. Buffett’s confidence was based on his conviction that markets outperform most active managers after fees over time. He even made this a requirement for his wife’s trust fund.

Translating the 90/10 rule for Indian investors means localizing it to India’s vibrant yet unpredictable markets. The Nifty 50 and Nifty 500, which include leading businesses in industries like consumer goods, financial services, and information technology (13.76% and 32.76%, respectively), can be tracked via the equity component. The Nifty 50’s close at 24,712 on August 26, 2025, builds on year-to-date gains driven by foreign investors and shows endurance despite a 255-point decline. Bonds with short-term G-sec yields of about 5.47% for three months or 6.58% for a year offer liquidity free from foreign exchange problems. India’s historical equities returns of 12–15% per year over the past 20 years, during which the Nifty 50 TRI produced positive outcomes in 17 of 22 calendar years, are leveraged in this application of the 90/10 rule for Indian investors.

The genius of the rule is its inaction: No need to time the market or be an expert stock picker. Betting on India’s long-term story—demographic dividends, urbanisation, and tech booms—while the bond slice absorbs short-term shocks is the goal of the 90/10 rule for Indian investors.

Why the 90/10 Rule Captivates Indian Investors in 2025

The 90/10 rule is more relevant than ever for Indian investors in 2025, as the Sensex fell below 80,786 on August 26 in response to international influences. Buffett promoted it as a way to avoid expensive managers who frequently fall short of expectations. In India, where SIPs helped retail investors soar, many people follow trends only to lose money. By concentrating on broad indices that have recovered from crises like 2008 and 2020, the 90/10 rule for Indian investors disciplinedly combats this.

Cost reductions are tremendous: index funds in the 90/10 rule for Indian investors hover at 0.5%, which boosts compounding, while active funds’ 1-2% expense ratios diminish returns. Nifty’s 12.99% CAGR over a ten-year period highlights its potential.

Customizing the 90/10 Rule for India’s Unique Market in 2025

India’s market differs from the US market in that it is less efficient and more concentrated, with financials making up the majority of the Nifty 50. Experts advise making the following adjustments because a strict 90/10 guideline for Indian investors may increase risks: Maintain 90% equity by allocating 60% to Nifty 50 ETFs for stability, 15% to mid-cap index funds for growth, and 15% to flexi-cap funds for balance.

Choose short-term G-secs or liquid debt funds with yields of 6–7% for the 10% bonds, since rates will remain stable due to the RBI’s stability in 2025. A more cautious version: 10% in G-secs, 15% in active funds for alpha, and 75% in the Nifty 500. Age is important; retirees lean 80/20, whereas younger people thrive on 90/10’s aggression.

Back tests indicate promise: comparable portfolios produced positive months 62% of the time between 2005 and 2025, with robust post-crash recoveries.

Explosive Benefits: Why the 90/10 Rule Supercharges Wealth

The 90/10 rule for Indian investors unleashes unparalleled advantages. Its groundbreaking simplicity makes it perfect for busy professionals without requiring prolonged analysis. Massive savings result from low prices; over decades, a 1% fee reduction adds lakhs.

Diversification is powerful because it lowers the risk of single-stock catastrophes by involving hundreds of companies. By reducing volatility, the bond buffer minimises panic selling during the declines in 2025. With debt indexation and 12.5% LTCG on stocks over ₹1.25 lakh, tax efficiency is evident.

Historical gains: In 15 to 20 years, ₹10 lakh may become ₹1 crore thanks to the Nifty’s 18.37% 5-year CAGR to 2025. By eliminating emotional traps, it allows compounding to thrive.

Deadly Pitfalls: The Hidden Dangers Lurking in the 90/10 Rule

Beware—the 90/10 rule for Indian investors harbours serious risks. 90% stock exposes you to extreme volatility; the 40% 2020 Nifty drop might momentarily wipe out 30–50%, upsetting risk-averse individuals who prefer fixed deposits at 6-7%.

Rigid 90/10 misses alpha in booming areas like renewables since active funds frequently outperform passives in mid- and small-cap stocks due to India’s less efficient marketplaces. Risk bites for concentration: Sector slumps are exacerbated by heavyweights like Reliance controlling the Nifty.

If equities flounder, inflation of 5–7% reduces bond returns, and rising rates (10-year up to 6.62%) in 2025 indicate rises. It is doomed by short horizons—not because of liquidity demands. India’s thematic prospects in EVs or digitisation are overlooked by over-passivity.

Suitability varies: Terrible for conservatives or short-timers, but excellent for those looking for long-term growth.

Step-by-Step Mastery: Implementing the 90/10 Rule in 2025

Introduce the 90/10 rule to Indian investors by using advisors or applications to evaluate risk. Use Groww or Zerodha to open a demat.

- Equity: Invest in inexpensive ETFs such as ICICI Pru Nifty 500 or Nippon India Nifty 50 Bees.

- Bonds: Select SBI short-duration funds with yields ranging from 6 to 7% or the Bharat Bond ETF.

When the Nifty reaches its peak in 2025, use SIPs to average rupee costs. Every year, rebalance; if stocks rise to 95%, cut back to purchase bonds. Keep tabs on taxes: For a 12.5% tax, hold stocks for at least a year.

For example, a 30-year-old can accumulate ₹2–3 crore over 30 years with a ₹10,000 monthly SIP at 12% equity/6% bond returns.

Pro Tips to Amplify Success with the 90/10 Rule

Invest in a variety of stocks. Keep an eye on the RBI for changes in yields; bonds benefit from the 2025 repo rate of 5.50%. A separate emergency fund. To gain perspective, read Buffett’s letters. Start modest and refrain from fiddling.

Conclusion

Warren Buffett’s 90/10 rule for Indian investors is a revolutionary force in 2025, merging aggressive growth with prudent safeguards via Nifty funds and G-secs. Its simplicity, cost savings, and past successes make it a must-consider for lasting wealth, despite its fatal volatility and efficiency gaps. Avoid errors by being flexible; use the 90/10 rule for Indian investors now to take control of your financial future.

FAQs

Q1: What defines the 90/10 rule for Indian investors?

Bonds for passive growth make up 10% and index funds like the Nifty make up 90%.

Q2: Is the 90/10 rule for Indian investors beginner-proof?

Yes, choosing funds and holding onto them requires little skill.

Q3: What effect do taxes have on Indian investors’ compliance with the 90/10 rule?

Indexation benefits for bonds; 12.5% LTCG post-year for stocks.

Q4: Can the 90/10 criteria for Indian investors be changed based on age?

Young: Full 90/10; older: 70/30 for safety.

Q5: What happens to Indian investors if the 90/10 rule causes markets to plummet?

Bonds level out, and long-haulers benefit from the Nifty’s recoveries.

Q6: 2025 outlook for the 90/10 rule for Indian investors?

The Nifty at 24,712 and yields of 6.60% indicate great potential.

Disclaimer

This article on the 90/10 rule for Indian investors is for informational purposes only and not financial advice. Principal loss is one of the dangers associated with investments; past performance does not guarantee future results. For individualised alignment, speak with a qualified advisor.

Also Read:

- Warren Buffett Crash Strategy: 7 Proven Steps to Conquer Market Downturns

- Warren Buffett Cash Cushion Strategy

- Warren Buffett Quotes for Success to Transform Your Investing

- Warren Buffett Achievements and Legacy: His Impact in 2025 and Beyond

- Warren Buffett backs THIS ‘90/10’ investment mantra for his family

- Bankrate: Warren Buffett’s 90/10 Portfolio in 2025

- Government Bonds & Safe Investment Options