Discover 10 powerful strategies for market volatility to build resilient portfolios, ignore short-term noise, and focus on long-term goals. Learn how to diversify, manage risks, and stay calm amid economic ups and downs for financial success. #strategies for market volatility, #resilient portfolios in volatile markets, investing during market turbulence, #diversification strategies for volatility, #avoiding market noise, #behavioural finance in volatility, #portfolio resilience techniques

Introduction

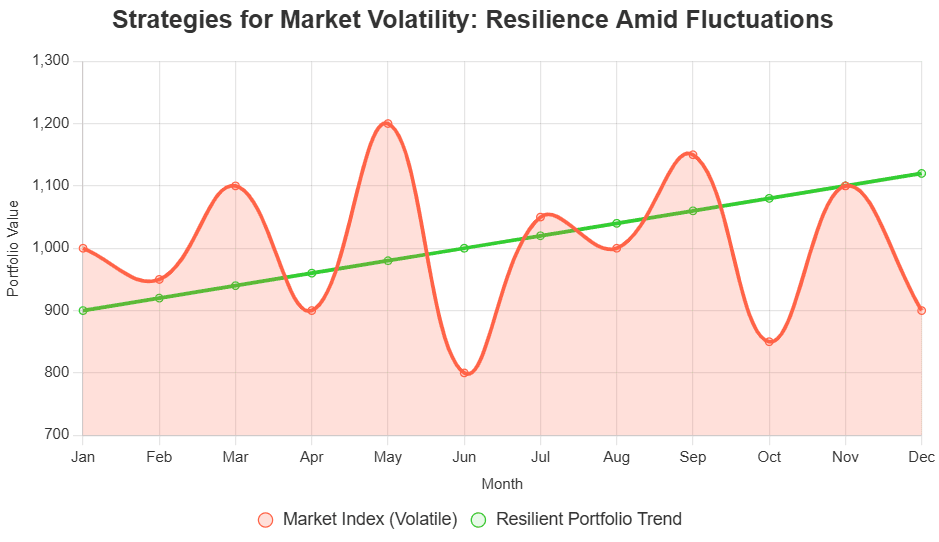

Market volatility has become the new normal in the lightning-fast financial world of today. Investors frequently have to navigate erratic ups and downs due to geopolitical tensions and economic changes. But here’s the good news: with the right strategies for market volatility, you can transform these challenges into opportunities for growth. This in-depth manual examines ten effective market volatility techniques that prioritise creating robust portfolios, concentrating on long-term objectives, and blocking out the cacophonous sound of short-term swings.

Strategies for market volatility aren’t about predicting the future—they’re about preparing for it. You can reduce risks, protect cash, and set yourself up for long-term wealth building by taking a methodical approach. These market volatility methods will help you overcome uncertainty and succeed whether you’re an experienced investor or a novice. We’ll explore useful advice that puts your particular financial situation ahead of the general consensus, based on tried-and-true ideas. Let’s get started and support your financial endeavours.

1. Embrace Diversification as Your Core Defence

One of the foundational strategies for market volatility is diversification. Investing in a variety of asset classes, including stocks, bonds, commodities, and real estate, lessens the impact of any one market downturn. For example, bonds frequently offer a stabilising offset when stocks fall as a result of economic news.

Diversification in volatile markets involves correlation as much as variety. Try to find assets that don’t move in unison. Strategies for market volatility like this ensure that while one sector suffers, others may flourish. Think about a portfolio that is composed of 10% alternatives, 30% fixed income, and 60% stocks. In the past, this allocation has fared better during downturns than concentrated wagers.

Review your assets every three months to put this into practice. For simple diversification, use products such as ETFs. Remember, strategies for market volatility rooted in diversification help you sleep better at night, knowing your eggs aren’t all in one basket. Avoiding excessive exposure to high-risk situations helps you develop long-lasting resilience.

2. Prioritize Long-Term Goals Over Short-Term Noise

Strategies for market volatility thrive when you anchor your decisions to long-term family or personal objectives rather than reacting to daily headlines. True resilience comes from unwavering focus, but market noise—think dramatic news or social media hype—can push you into rash decisions.

Consider retirement planning: consider your 20-year horizon rather than selling during a downturn. Strategies for market volatility like goal-based investing involve setting clear milestones, such as saving for a home or education, and aligning your portfolio accordingly. This strategy reduces emotional trading, which frequently results in losses.

Investors who ignore noise fare better than those who don’t, according to behavioural finance. Make a written investment policy statement that outlines your objectives and risk tolerance, then include strategies for market volatility. Examine it once a year, without stress. This strong habit transforms turbulence into a brief setback on your journey to success.

3. Implement Robust Risk Management Techniques

Effective strategies for market volatility always include strong risk management. This entails determining your level of loss tolerance and safeguarding your cash with strategies like position sizing and stop-loss orders. Understanding when to cut losses keeps little failures from turning into catastrophic events during tumultuous times.

Don’t make more than 5% of your portfolio in any one investment, for instance. Strategies for market volatility such as this prevent one bad apple from spoiling the bunch. Additionally, when uncertainty is high, think about using options or inverse ETFs for hedging.

Frequent stress testing is essential; model events such as a 20% decline in the market and make necessary adjustments. Risk management-based strategies for market volatility provide you confidence so you can seize chances when others run away. You may ensure the lifespan of your portfolio by converting potential drawbacks into controlled variables through the quantification of risks.

4. Leverage Asset Allocation for Stability

One of the mainstays of market volatility strategies is asset allocation. It entails allocating your investments according to your age, objectives, and tolerance for risk; as you get closer to retirement, you might want to consider more bonds. As markets change, this dynamic balancing act adjusts weights to counteract volatility.

More than 90% of portfolio performance can be attributed to appropriate allocation, according to historical statistics. Strategies for market volatility here might include a 50/50 stock-bond split for moderate risk profiles. Every year or when allocations deviate by 5%, rebalance.

Spread off geographic risks by incorporating global assets. Tactical allocation is one strategy for market volatility that allows you to make small modifications based on economic indications without completely changing your plan. This approach is a win-win for resilient investing since it reduces volatility while increasing rewards.

5. Cultivate a Contrarian Mindset

Among the bolder strategies for market volatility is adopting a contrarian approach—buying when others sell and vice versa. Contrarians see value in assets that are undervalued while the masses panic. This pays out handsomely, but it takes discipline.

The well-known statement by Warren Buffett that “be fearful when others are greedy” exemplifies this. Strategies for market volatility in contrarianism involve thorough research to avoid value traps. When there are brief declines, look for solid fundamentals.

Start modestly by allocating 10–20% of your portfolio to bets that are against the trend. These kinds of market volatility strategies benefit greatly from patience because markets eventually correct. You may turn volatility into your ally and position yourself for significant gains by zigging when others zag.

6. Utilize Dollar-Cost Averaging for Consistency

Dollar-cost averaging (DCA) is one of the simplest yet effective strategies for market volatility. To average out expenses over time, invest a certain sum on a regular basis, regardless of price. This eliminates the uncertainty involved in market timing.

DCA excels during volatile times because you purchase more shares at low prices and less at high ones. Strategies for market volatility using DCA have shown to outperform lump-sum investing in choppy markets, per studies.

Automate it via retirement accounts or apps. Strategies for market volatility rooted in consistency build wealth steadily, reducing emotional stress. Over decades, this compounding powerhouse turns market swings into smoothed growth trajectories.

7. Focus on Quality Over Quantity in Holdings

Quality investing is a premium strategy among strategies for market volatility. Give preference to businesses with competitive moats, steady earnings, and solid financial sheets. Compared to speculative assets, these “blue-chip” assets are more resilient to storms.

Quality shines in times of instability; consider low-debt companies with a track record of dividend payments. Here, strategies for market volatility include looking for indicators such as debt-to-equity below 0.5 and ROE above 15%.

Within quality, diversify by combining industries such as consumer products and technology. Strategies for market volatility emphasizing quality ensure your portfolio rebounds faster post-downturns, providing both defense and offense in uncertain times.

8. Incorporate Alternative Investments for Hedging

To enhance strategies for market volatility, add alternatives like gold, real estate, or cryptocurrencies (in moderation). These assets, which are frequently uncorrelated, offer protection from conventional market hazards.

For example, gold increases in times of crisis or inflation. Equity volatility is mitigated by market volatility strategies that include 5–10% alternatives. Income stability is provided by REITs.

Do your homework; alternatives can sometimes be unstable. This combination of strategies for market volatility ensures broader resilience by forming a multi-layered defence.

9. Stay Educated and Adapt to Economic Indicators

Knowledge is power in strategies for market volatility. Keep an eye on metrics like GDP, interest rates, and inflation rates without going overboard. Utilise them to guide minor modifications.

Take classes or rely on trustworthy sources. Market volatility strategies rely on well-informed choices rather than impulsive responses.

Aim for defensive sectors when volatility is high to adjust. Continuous learning and other market volatility strategies help you stay ahead of the curve by converting data into useful knowledge.

10. Build Emotional Resilience Through Mindfulness

Finally, strategies for market volatility must address the human element. Be alert to steer clear of greed-driven purchases or fear-driven sales. Note your choices in a journal to identify trends.

Establish guidelines such as no trading after the market closes. Incorporating psychology into market volatility strategies produces greater results since composed minds make better decisions.

Incorporate with expert counsel to ensure impartiality. The key to flourishing in the midst of turmoil is employing emotional control-based strategies for market volatility.

Conclusion

Mastering strategies for market volatility is about discipline, preparation, and perspective. You can create portfolios that not only endure but also prosper during difficult times by putting these ten effective strategies into practice, which range from diversity to emotional resilience. Recall that while volatility is unavoidable, success is determined by how you respond to it. Review your portfolio, make goals, and make a commitment to long-term thinking as you begin using these market volatility tactics today. You may overcome uncertainty and ensure a better financial future with perseverance and patience. Your riches rests on your ability to empower yourself.

FAQs

Q1: What are the best strategies for market volatility for beginners?

Start with dollar-cost averaging and diversification. These easy methods for handling market volatility lower risk without requiring complex expertise.

Q2: How does diversification help in strategies for market volatility?

It distributes risk among assets, preventing your portfolio from being completely destroyed by a single downturn. This is a crucial component of robust strategies for market volatility.

Q3: When the market is volatile, should I sell?

No, follow your long-term strategy. Keeping high-quality assets and tuning out short-term noise are key components of market volatility strategies.

Q4: How does risk management fit into market volatility strategies?

It is essential for improving overall portfolio stability by safeguarding capital with instruments like stop-losses and position restrictions.

Q5: Is it possible for alternative investments to enhance market volatility strategies?

Indeed, they offer uncorrelated returns and serve as hedges in all-encompassing market volatility strategies.

Q6: How frequently should I use market volatility tactics to rebalance?

To keep your chosen level of risk, adjust your allocations every year or whenever they change considerably.

Q7: Why is emotional regulation crucial for market volatility strategies?

It keeps you from making snap decisions, which enables you to successfully implement market volatility techniques.

Disclaimer

This article is not financial advice; rather, it is merely informational. The possible loss of investment is one of the dangers associated with investing. Before putting any market volatility plans into action, speak with a certified financial advisor. Performance in the past does not guarantee future outcomes. Any losses suffered are not the publisher’s or author’s responsibility.

Also Read: