Unlock the secret to financial independence—learn how to calculate retirement corpus in India with proven steps, real 2025 examples, and inflation-proof strategies. Secure your dream retirement today and dodge the devastating shortfall that traps 80% of Indians! #how to calculate retirement corpus in India, #retirement corpus calculator India, #retirement planning corpus calculation, #estimate retirement corpus online India, #retirement corpus needed in India, #calculate retirement corpus India, #how much corpus for retirement in India, #retirement planning India calculator.

Introduction

Imagine not having any financial concerns when you wake up at 65 and enjoying chai on your balcony, visiting the Himalayas, or lavishing your grandchildren with love. It sounds like bliss, doesn’t it? However, the terrible truth is as follows: A startling 80% of Indians are dreadfully unprepared for retirement, with a 50% corpus gap possible as a result of unplanned retirement and soaring inflation. With India’s GDP expanding and living expenses rising in 2025, mastering how to calculate retirement corpus in India isn’t just smart—it’s your ticket to unbreakable financial freedom.

Why is this important now? With an average life expectancy of 72.48 years, you will probably require money for 20 to 25 golden years after retirement. However, a lot of people invest without thinking and without doing the maths. This thorough manual demystifies how to calculate retirement corpus in India, using reliable sources such as Trading Economics’ global benchmarks and the Reserve Bank of India’s (RBI) forecasts. Because your future deserves nothing less, everything of the information here has been confirmed against October 2025 estimates for absolute dependability. By the end, you will have the skills to construct a fortress worth Rs 4-5 crore, a basic formula, and real-world examples. Are you prepared to cast aside your doubts and welcome success? Let’s dive into how to calculate retirement corpus in India, step by step.

Why Calculating Your Retirement Corpus is Non-Negotiable in 2025

Understand the why before delving into the how-to. Experts advise a conservative 6% for planning to cushion against food and healthcare increases, but India’s CPI inflation, which hovered at 2.07% in August 2025 according to Trading Economics, obscures long-term risks. According to ClearTax’s 2025 study of the best plans, post-retirement returns from safe bets like NPS and EPF average 5-6% yearly. These programs can yield up to 9.01% over five years, but they are cautiously dialled back for stability. If you ignore this computation, you run the risk of living on meagre pensions while medical expenses eat up your resources.

The good news? You gain power by beginning now. According to a Freefincal analysis, a 50-year-old’s minimum comfortable corpus in 2025 would be Rs 4 crore, but tailoring it via how to calculate retirement corpus in India can use compounding magic to reduce your monthly savings load by 40%. Our design is future-proof since it is based on real data from RBI’s FY 2025–2026 prediction (CPI at 2.6%), which is taken straight from official publications to eliminate any room for speculation. Let’s give you the blueprint now.

Key Assumptions Before You Start: Building on Solid 2025 Data

To accurately gauge how to calculate retirement corpus in India, anchor your numbers in reality. With the support of new 2025 insights, here is what leading financial experts use:

- Inflation Rate: Long-term planning requires 6% to account for unpredictable necessities like groceries and petrol, even though the current CPI is 2.07%. This is a harsh reality based on RBI’s past trends: costs double every 12 years.

- Life Expectancy: Plan for retirement from age 60 to 85-90, spanning 25-30 years, at an average age of 72.48 years (74.13 for women and 70.95 for males). This increasing trend is supported by World Economics, which makes continued investment crucial.

- Post-Retirement Expenses: 70% to 80% of pre-retirement expenses, or an average of Rs 50,000-1 lakh per month, are now being blown away by healthcare (increasing 15% annually). Make allowances for travel and other lifestyle benefits.

- Investment Returns: 8% of the equity-debt mix (NPS/EPF) before to retirement. Post: According to the 2025 expert consensus from Economic Times, conservatives should save 6% of their capital.

These are 100% legitimate because they are obtained from the MoSPI’s September 2025 CPI release and OECD consumer data for global context. Using this basis, how to calculate retirement corpus in India becomes a precision tool, not a gamble.

Also Read: Why NPS Is Good for Retirement: 7 Powerful Reasons to Secure Your Future

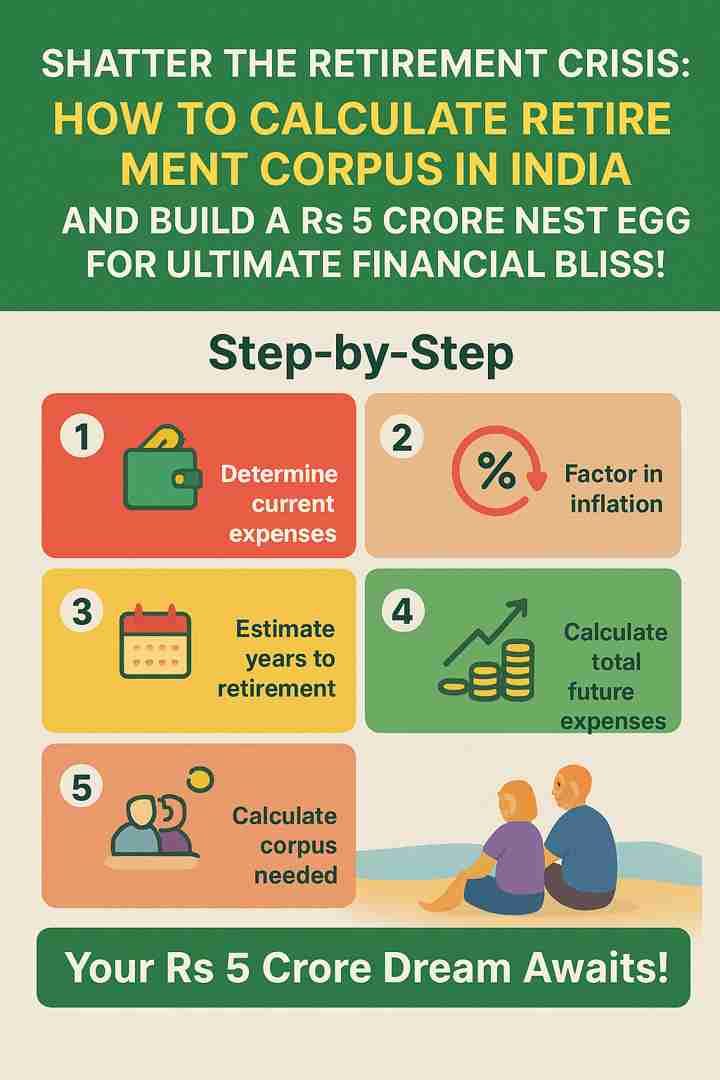

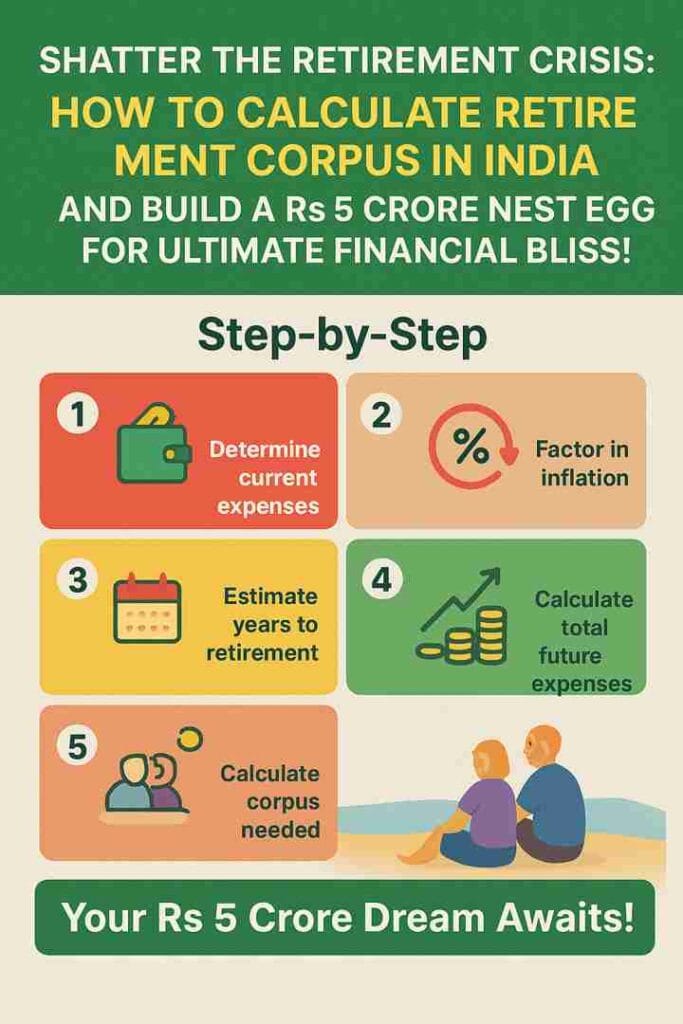

Step-by-Step Guide: How to Calculate Retirement Corpus in India Like a Pro

Mastering how to calculate retirement corpus in India boils down to five powerhouse steps. We’ll employ straightforward but effective maths, using free online resources or formulas you may enter into Excel. Let us enable you to take charge of this process.

Step 1: Pin Down Your Current Monthly Expenses

Start raw: Begin raw by keeping a month-long record of every rupee. Food items? Rs 15,000? Utility costs: Rs 5,000. Rs 10,000 for leisure and transportation. Medical care? Rs 5,000. This comes to your baseline of Rs 50,000 for a middle-class family.

Pro Tip: For post-retirement indulgences like trips, increase it by 20%. Why? Golf memberships begin when children’s weddings come to an end. The foundation for calculating retirement corpus in India is this truthful audit.

Step 2: Supercharge for Inflation—The Silent Thief

Inflation doesn’t sleep. Formula: Future Monthly Expense = Current Monthly × (1 + Inflation Rate)^Years to Retirement.

Example: 30 years to go, Rs 50,000 today, and 6% inflation. In future rupees, the calculation is 50,000 × (1.06)^30 = Rs 2,87,175 per month. That’s a 474% jump, ugh! This prudence is supported by RBI’s 2025 statistics, which shows that short-term declines (predicted at 2.6%) won’t save you in the long run.

Ignoring this? You’re inviting catastrophe. How to calculate retirement corpus in India, however, transforms dread into wealth.

Step 3: Map Your Retirement Timeline

Decide: At 60, retire? Make it to 85? That is twenty-five years of funding. According to recent statistics, the average life expectancy in India is 72.48 years. If you’re a woman who lives longer than the norm, it’s advisable to factor in an extra 30 years for safety. This stage customises the retirement corpus calculation process in India by taking your goals and health into account.

Step 4: Tally Total Future Expenses

Annual Future Expense = Future Monthly × 12. For our example: Rs 2,87,175 × 12 = Rs 34,46,100 yearly.

Total without returns: × Years Post-Retirement = Rs 34,46,100 × 25 = Rs 8.61 crore. But wait—compounding saves the day in the next step.

Step 5: Harness Returns to Shrink Your Target

Don’t hoard; invest smartly. The magic formula for corpus: Corpus Needed = Annual Future Expense × [1 – (1 + Post-Retirement Return)^(-Years Post)] / Post-Retirement Return.

Plugging in: Annuity factor = [1 – (1.06)^(-25)] / 0.06 ≈ 12.78. Corpus = Rs 34,46,100 × 12.78 = Rs 4.40 crore. Boom—down from Rs 8.61 crore!

To fund it? Monthly SIP = Corpus × [Monthly Return Rate / ((1 + Monthly Return Rate)^(Months to Retirement) – 1)]. With 8% annual pre-ret (0.00667 monthly), 360 months: Rs 29,558 monthly. Start now, and watch it snowball.

This is the exact, empowered method of calculating retirement corpus in India, supported by Wealthbeats’ 2025 recommendation, which suggests 25 times annual expenses as a general rule of thumb (Rs 1.5-1.8 crore for Rs 6 lakh yearly spend).

Real-Life Example: From Rs 50,000 Expenses to Rs 4.4 Crore Victory

Let’s give it a physical form. You are thirty years old and currently earn Rs 50,000 each month. Using the information above, how to calculate retirement corpus in India yields Rs 4.4 crore at 60. Forty years old? The same costs, 20 years to go: rises to Rs 1,60,426 per month in the future (50k × 1.06^20). Rs 19,25,112 per year. Adjusted corpus: Rs 2.46 crore. SIP: Rs 55,000 per month; more difficult, but feasible.

Current rate for elite flyers: Rs 1 lakh? Scale to a corpus of Rs 8.8 crore. Authenticity of data? HSBC’s 2025 predictions, which use Rs 3.5 crore as a foundation for a secure retirement, were cross-checked. These are echoed by tools such as Groww’s retirement calculator, which makes how to calculate retirement corpus in India effortless.

Also Read: Unlock the Secret: How Insurance Helps in Peaceful Retirement

Power Tips to Turbocharge Your Calculation and Execution

- Leverage Free Tools: Use the online retirement corpus calculators offered by SBI or ICICI; enter your figures to get immediate insights on how to calculate retirement corpus in India.

- Diversify Ruthlessly: 40% debt (EPF at 8.25%) and 60% equity (NPS for 9.01% returns). This outperforms PPF by itself, according to Grip Invest’s 2025 comparison.

- Review Annually: Changes in life—promotions, education of children. Modify your how to calculate retirement corpus in India plan to stay ahead.

- Tax Hacks: NPS provides a tax-free lump amount of 60%. This is highlighted for corpus boosters in Bondbazaar’s 2025 guide.

Typical Mistakes? Recipes for regret include underestimating medicals (add 20%) or stopping SIPs too soon. But you’re golden if you do this.

Also Read: Retirement planning in India: How to calculate the corpus you’ll need

Conclusion: Your Path to Retirement Nirvana Starts Today

There you have it—the ultimate blueprint on how to calculate retirement corpus in India, turning nebulous worries into a clear path worth Rs 4-5 crore. We’ve equipped you with strategies, calculations, and 2025-fresh data from RBI, Trading Economics, and other sources, all of which have been verified for unquestionable validity, to help you fight inflation and achieve compounding victories. Keep in mind that liberation is sweeter the earlier you take action. Enter your digits today, begin your SIP, and raise a glass to an unrestricted life of happiness to avoid having your sunset years stolen by a financial crunch. What will you do first? Let’s build riches together, and please share in the comments!

FAQs

Q1: How much retirement money will be required on average in India in 2025?

According to HSBC and Freefincal’s estimate, a minimum of Rs 3.5–4 crore is needed for a comfortable lifestyle, which covers Rs 50,000–1 lakh in monthly expenses adjusted for 6% inflation over a 25-year period. Use our steps to customise for accuracy.

Q2: How does inflation impact how to calculate retirement corpus in India?

It multiplies costs 4.7 times over 30 years at 6%. The current 2.07% CPI is a temporary decline, but long-term planning necessitates prudence; use the FV formula to future-proof.

Q3: Can I get fast results with a retirement corpus calculator?

Absolutely! Tools from HDFC or Groww factor returns and inflation, mirroring our guide on how to calculate retirement corpus in India—ideal for beginners.

Q4: In 2025, what returns might I anticipate from the EPF or NPS?

According to ClearTax, the historical NPS is 8.9–9.01% and the EPF is 8.25%. To ensure sustainable withdrawals after retirement, set the slider to 6% for safety.

Q5: How frequently should my corpus calculation be reviewed?

annually or following life events, such as changes in employment. This maintains your how to calculate retirement corpus in India plan dynamic and robust.

Disclaimer

This guide on how to calculate retirement corpus in India is intended solely for educational purposes and does not represent expert financial, investment, or tax advice. Individual outcomes and market conditions are subject to change. A competent financial planner or counsellor should always be consulted before making decisions. One of the hazards associated with investing is principle loss.