Learn how to calculate advance tax with this step-by-step guide. Avoid penalties by estimating your tax liability accurately and paying on time.

A key component of the income tax system is advance tax, which makes sure that taxpayers pay their taxes in installments over the course of the year rather than all at once. You must pay advance tax if, after deducting TDS (Tax Deducted at Source), your tax liability for the year is more than ₹10,000. But figuring out advance tax can be intimidating, particularly if you have several sources of income. We’ll simplify the advance tax calculation procedure in this blog article so you can stay in compliance and keep out of trouble.

What is Advance Tax?

Paying income tax in instalments throughout the fiscal year rather than at the end is known as advance tax. It is applicable to professionals, businesses, freelancers, and salaried persons who anticipate having a tax burden of more than ₹10,000 throughout a fiscal year. Advance tax payments are due on the following dates:

- June 5th: 15% of the estimated tax amount

- September 15th: 45 percent of the estimated tax amount

- December 15th: 75% of the estimated tax amount

- 15th March: 100% of the estimated tax liability (last installment).

Interest penalties under Sections 234B and 234C of the Income Tax Act may be imposed for late advance tax payments.

Who Needs to Pay Advance Tax?

You must pay taxes in advance if:

- After subtracting TDS, your annual tax liability exceeds ₹10,000.

- You make money from a variety of sources besides your wage, including capital gains, interest, rental income, and company income.

Since their employer deducts TDS, salaried people without any additional sources of income usually do not have to pay advance tax.

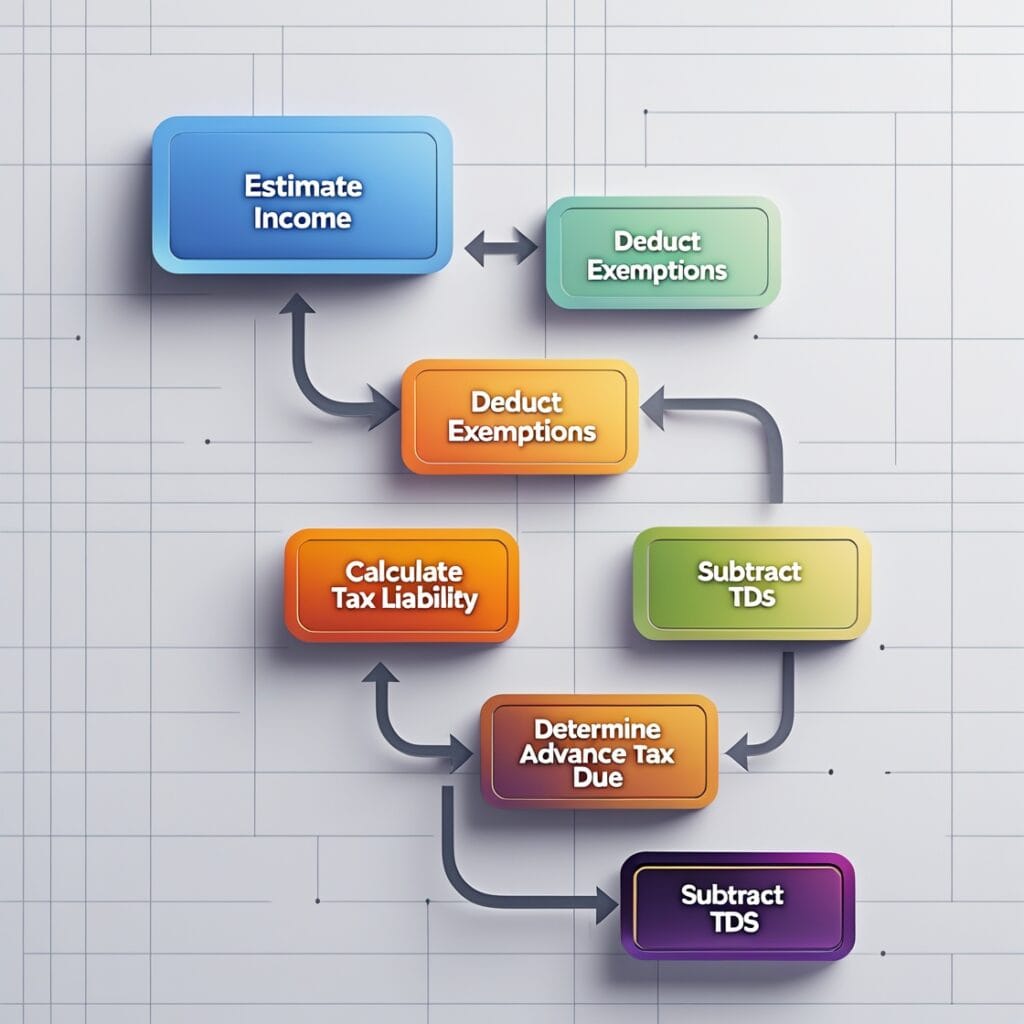

Step-by-Step Guide to Calculate Advance Tax

Step 1: Estimate Your Total Income for the Year

To begin, figure out how much money you will make overall over the fiscal year. This contains:

- Salary income

- Professional or business income

- Revenue from rental property (household income)

- Both short-term and long-term capital gains

- Interest from fixed deposits, savings accounts, and other sources

- Additional revenue streams, such as royalties and dividends

Step 2: Deduct Applicable Exemptions and Deductions

Deduct any exemptions or deductions that you qualify for under Sections 80C, 80D, 80G, and so forth. Your net taxable income will be determined by this.

Step 3: Calculate Your Total Tax Liability

Calculate your tax liability using the applicable income tax bands for the current fiscal year. Please remember to include:

- Surcharge (if present)

- A health and education levy (four percent of the overall tax)

Step 4: Subtract TDS and Advance Tax Already Paid

Deduct any advance tax payments you make in the June, September, and December installments, as well as the TDS that has already been withheld by your employer or other organisations.

Step 5: Determine the Advance Tax Due

Your advance tax owed for the next installment is the amount that remains after TDS and advance tax payments are subtracted.

Example Calculation

Assume that you will make ₹12,000,000 in total this year. Your net taxable income is ₹10,25,000 after deductions under Section 80C (₹1.5 lakh) and Section 80D (₹25,000).

- Tax Liability: As per the income tax slabs, the tax on ₹10.25 lakh is ₹1,30,000 (including cess).

- TDS Deducted: ₹40,000

- Advance Tax Paid (June and September): ₹50,000

- Advance Tax Due (December): ₹1,30,000 – ₹40,000 – ₹50,000 = ₹40,000

How to Pay Advance Tax

Online Payment (Recommended)

- Go to https://incometaxindia.gov.in, the official Income Tax e-Filing Portal.

- Go to the section on e-Pay Tax.

- Choose Advance Tax and provide the necessary information, such as your PAN and the payment amount.

- Select your desired payment option, such as UPI, debit card, or net banking.

- Download and preserve the challan (Challan No. 280) for your records after making the payment.

Offline Payment

- Visit the nearest bank branch that facilitates tax payments.

- Fill out Challan No. 280 for advance tax payment.

- Submit the challan along with the payment (cash or cheque).

- Collect the receipt as proof of payment.

Consequences of Not Paying Advance Tax

Failing to pay advance tax or underpaying can result in:

- Interest under Section 234B: You will be assessed interest at the rate of one percent per month if 90% of your tax liability is not paid before March 31.

- Section 234C interest: Interest at 1% per month will be charged if the advance tax payments are not completed in the designated instalments.

Tips for Accurate Advance Tax Calculation

- Use Online Tax Calculators: You can determine your precise tax liability with the use of tools such as the Income Tax Department’s calculator or third-party apps.

- Track Your Income and Deductions: Throughout the year, keep track of your income, TDS, and deductions.

- Consult with a CA: For precise computations, think about speaking with a chartered accountant if your revenue streams are complicated.

- Plan Ahead: Estimate your income and tax liability ahead of time to avoid last-minute calculations.

Conclusion

Advance tax computation and payment don’t have to be challenging. By following the previous steps, you can ensure that your payments are made on time and that you have an accurate assessment of your tax burden. Following advance tax regulations encourages better financial planning in addition to avoiding penalties.

If you think this lesson is helpful, please share it with others. Additionally, you should always consult a tax professional to be sure you’re on the proper track.

Disclaimer

This blog post’s content is solely intended for general guidance and educational purposes. It is not the same as expert tax advice. Individual situations may differ, and tax rules and regulations are subject to change. Please speak with a certified chartered accountant or tax expert for precise and tailored advice.

FAQs

1. Who is required to pay advance tax?

If, after deducting TDS, your total tax burden for the year exceeds ₹10,000, you must pay advance tax. Professionals, companies, and individuals with revenue streams such as capital gains, rental income, or company income are all covered by this.

2. What are the due dates for advance tax payments?

The due dates for advance tax payments are:

- 15th June: 15% of the estimated tax liability

- 15th September: 45% of the estimated tax liability

- 15th December: 75% of the estimated tax liability

- 15th March: 100% of the estimated tax liability (final installment)

3. What happens if I miss paying advance tax?

Sections 234B and 234C of the Income Tax Act may require you to pay interest if you fail to pay advance tax or if you underpay. The interest rate on the outstanding balance is 1% per month.

4. Can I pay advance tax online?

Yes, you can use UPI, debit cards, or net banking to pay your taxes in advance online through the Income Tax e-Filing Portal.

5. Is advance tax applicable to salaried individuals?

Since their employer deducts TDS, salaried people without any additional sources of income usually do not have to pay advance tax. You might have to pay advance tax, though, if you have other sources of income.