Lien marked on bank account in India? Learn its meaning, 9 real causes, RBI rules, and how to remove a bank lien step by step. lien marked on bank account, lien marked on bank account India, bank account lien meaning, how to remove lien from bank account, lien vs freeze bank account India, RBI rules on lien marking, lien amount debit restriction.

Introduction — Why “Lien Marked” Is a Serious Banking Warning

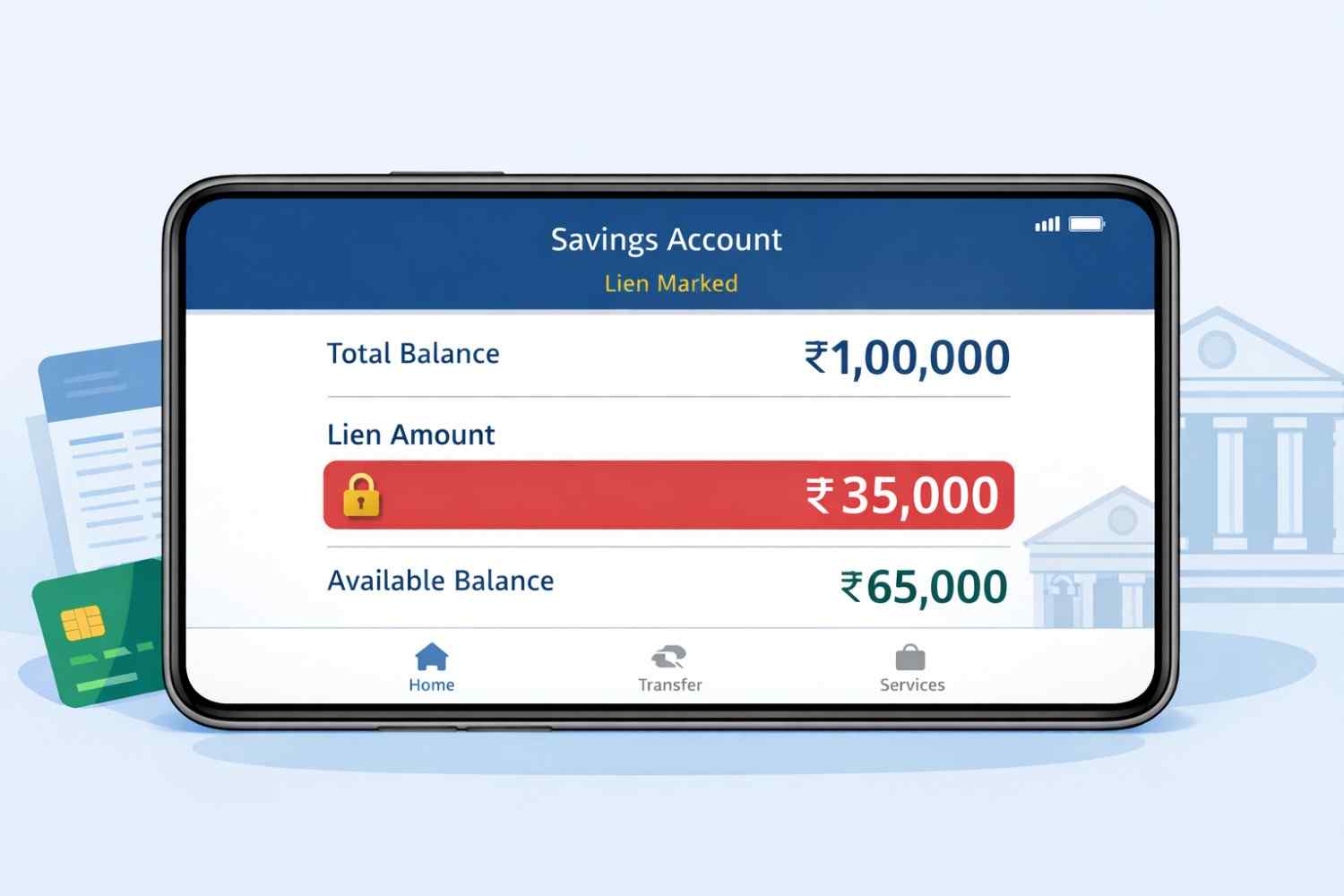

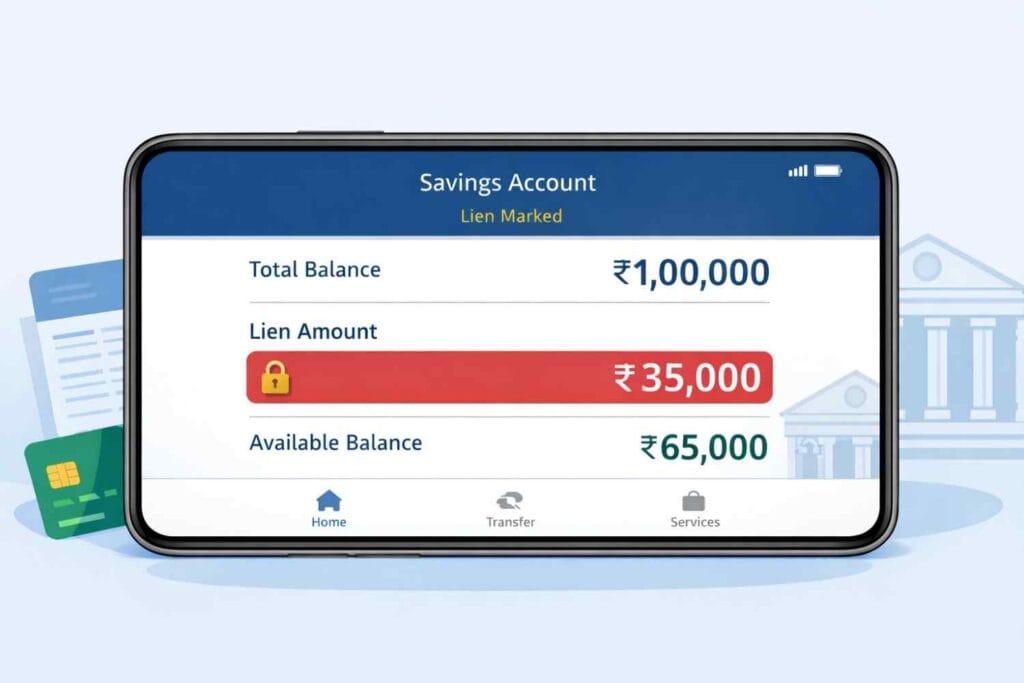

Seeing “lien marked on bank account” in your bank statement or mobile app can be alarming. Your money is visible, yet a portion of it is suddenly unavailable. Many people wrongly assume this is a technical error or confuse it with account dormancy or freeze.

In reality, lien marking is a legally backed recovery mechanism. If ignored, it can silently restrict access to your funds for months. Understanding why a lien is applied and how to remove it correctly is critical to regaining full control of your money.

What Does “Lien Marked on Bank Account” Mean?

A lien gives a bank or authorised authority the legal right to earmark a specific amount in your account to recover outstanding dues or secure a legal claim.

Key clarifications:

- Only a fixed amount is blocked

- Remaining balance is usually usable

- Liened funds cannot be withdrawn, transferred, or used via UPI/ATM

Example:

If your balance is ₹1,00,000 and ₹30,000 is lien-marked, only ₹70,000 is freely available.

How Lien Marking Works in Indian Banks

Indian banks can mark a lien only when:

- You have contractually agreed (loan, credit card, overdraft terms), or

- A court or statutory authority issues binding instructions

Once applied, banks internally separate:

- Total balance

- Lien amount

- Available balance

Savings account interest usually continues, but access to the liened amount remains restricted until release.

9 Real Reasons Why Banks Mark a Lien

- Loan EMI Defaults: When loan EMIs remain unpaid beyond reminder stages, banks secure recovery by marking a lien on linked savings accounts. This is common when the loan and savings account are with the same bank.

- Credit Card Outstanding Dues: Credit card agreements often allow banks to recover dues from savings accounts held with them. Persistent non-payment can trigger lien marking instead of immediate legal action.

- Overdraft or Cash Credit Irregularities: Failure to service overdraft interest, renew documentation, or regularise excess usage may result in lien marking on connected accounts to protect bank exposure.

- Income Tax or GST Recovery: Tax authorities have statutory powers to instruct banks to lien funds for unpaid taxes, penalties, or interest. Such liens usually appear without prior consent.

- Court Attachments and Legal Disputes: Civil disputes, recovery proceedings, or enforcement orders can mandate lien marking. Banks must comply strictly and cannot override court directions.

- Negative Balance Recovery Due to Charges: In many cases, unnoticed penalties such as minimum balance fees or SMS alert charges silently push accounts into negative balance, which may later trigger recovery actions like lien marking — a risk explained in detail in our guide on Hidden Bank Charges in India.

- Employer or Institutional Claims: Salary advances or benefit recoveries backed by written employment agreements may result in temporary lien marking until dues are settled.

- Failed Contractual Auto-Debit Mandates: Some institutional mandates (not OTT subscriptions) permit lien enforcement if repeated failures occur under signed contracts.

- Regulatory or Compliance Actions: In rare cases, regulatory or investigative authorities may instruct banks to secure funds temporarily during compliance reviews.

Lien Marked vs Account Frozen — A Crucial Difference

| Aspect | Lien Marked | Account Frozen |

| Funds blocked | Partial | Entire balance |

| Transactions | Allowed beyond lien | Not allowed |

| Typical trigger | Dues / recovery | KYC / compliance |

| Severity | Medium | High |

Some account holders confuse lien-related restrictions with inactivity-based limitations, but the resolution process is very different, as explained in our step-by-step guide on How to Reactivate an Inactive Bank Account.

How to Remove Lien from Bank Account

Removing a lien from a bank account is not automatic, even after you clear the dues. This is where most people get stuck. Banks treat lien removal as a manual, compliance-driven process, and unless you follow each step carefully, the lien can remain for weeks or even months.

Below is the correct, ground-level process followed by Indian banks.

Step 1: Identify the Exact Authority That Ordered the Lien (Critical Step)

Before paying anything, you must confirm who ordered the lien. Do not rely on assumptions.

Ask the bank (preferably in writing or at the branch):

- Is the lien bank-originated (loan, credit card, overdraft)?

- Is it due to a tax authority (Income Tax / GST)?

- Is it due to a court or legal order?

You should also ask for:

- Exact lien amount

- Date of lien marking

- Reference number or department name

Why this matters:

Paying the wrong party or clearing only part of the obligation will not remove the lien.

Step 2: Clear the Underlying Obligation in FULL (Partial Payment Is Not Enough)

Banks rarely remove liens on partial settlement unless explicitly approved.

Depending on the cause:

- Loan / Credit Card Lien: Clear all pending EMIs, interest, late fees, and penalties.

- Tax Lien: Pay the full demand using the official challan and keep the payment receipt.

- Court-Ordered Lien: Comply strictly with the court direction or settlement terms.

Important: Even small unpaid charges (minimum balance penalties, SMS alert fees) can block lien removal. This is why understanding hidden bank charges is important.

Step 3: Submit a Written Request for Lien Removal (Payment Alone Is NOT Enough)

This is the step most people miss.

After clearing dues, you must submit:

- Proof of payment (receipt / challan / settlement letter)

- A written request for lien removal

- Account number and lien reference (if available)

Submit this:

- At the home branch, or

- Through official bank email / grievance channel

Always ask for:

- Email confirmation, OR

- Stamped acknowledgment copy

Without a written request, banks often do not initiate lien release.

Step 4: Internal Bank Verification & Compliance Review (Why Delays Happen)

Once your request is submitted, the bank does internal verification, which may involve:

- Loan department confirmation

- Credit card or legal cell approval

- Compliance or back-office system updates

This step is manual in many Indian banks, which is why delays are common.

Typical timelines:

- Bank-origin lien: 3–7 working days

- Tax or legal lien: 7–15 working days

If the delay crosses this window, you should escalate formally instead of repeated branch visits.

Step 5: Confirm That the Lien Is Actually Removed (Do Not Assume)

Do not assume the lien is removed just because dues are paid.

You must:

- Check net banking or mobile app (lien amount should disappear)

- Verify available balance equals actual balance

- Ask the bank for written confirmation of lien removal

Only when the “Lien Amount” is zero should you consider the issue resolved.

Step 6: What If the Bank Does Not Remove the Lien Even After Payment?

If the bank delays or refuses without valid reason:

- File a written complaint with the bank’s grievance cell

- Escalate to the bank’s nodal officer

- If unresolved, approach the official complaint system governed by the Reserve Bank of India.

If the bank fails to resolve the issue even after formal escalation, customers can file an official complaint through the RBI’s Centralised Management System (CMS). This is a real, enforceable escalation route. Banks are required to respond within prescribed timelines.

Step 7: Distinguish Lien Issues from Inactive or Frozen Accounts

A lien is a targeted restriction where only a specific amount is blocked to secure recovery of dues, while the remaining balance usually stays usable. However, many users confuse this with other account restrictions:

- Lien: Partial amount blocked due to dues or legal instruction

- Inactive account: Restricted due to long periods of no transactions, not recovery-related

- Frozen account: Complete debit block caused by KYC, legal, or compliance issues

Understanding this difference ensures you take the correct resolution path and avoid unnecessary delays.

Can Banks Mark a Lien Without Informing You?

In some situations, banks can mark a lien marked on bank account without prior notice, but this is not arbitrary and happens under defined circumstances:

- Banks may act immediately if there is a court order or statutory recovery instruction (such as tax dues).

- Prior consent is usually already covered in loan or credit card agreements signed by the customer.

- In urgent recovery or legal cases, intimation may be sent after lien marking.

- However, banks are expected to explain the reason, amount, and authority once the customer asks.

- Lack of explanation or prolonged silence gives the customer the right to escalate formally.

What to Do If a Lien Is Wrongfully Marked

If you believe a lien marked on bank account is incorrect or unjustified, act promptly instead of waiting:

- First, seek written clarification from the bank on why the lien was applied.

- Submit proof if dues were already paid or if the account was wrongly linked.

- File a written complaint at the branch if the explanation is unsatisfactory.

- Escalate to the bank’s grievance officer if the lien is not removed within a reasonable time.

- Keep all documents and communication records, as they are crucial for further escalation.

Conclusion

A lien marked on bank account is a legally backed recovery safeguard, not a technical error. The real danger lies in ignoring it. By identifying the cause, clearing dues properly, and following the correct removal process, most liens can be resolved without long-term damage.

FAQs

Q1: What does lien marked on bank account mean in India?

A lien marked on bank account means a specific amount is legally blocked by the bank to secure recovery of dues or comply with a legal or statutory instruction. The remaining balance usually remains usable.

Q2: Is lien marked on bank account the same as account freeze?

No. A lien blocks only a fixed portion of funds, while an account freeze restricts all debit transactions. The reasons and resolution processes for both are different.

Q3: Can a lien marked on bank account affect salary credits?

Salary credits can still be received, but the lien amount remains blocked. If incoming funds are adjusted against the lien, it depends on the underlying recovery instruction.

Q4: How long does a lien on a bank account remain active?

A lien remains active until the underlying obligation is fully resolved or the authority that ordered it withdraws the instruction. There is no automatic expiry.

Q5: Does a bank account lien affect a person’s credit score?

The lien itself does not affect credit score, but the unpaid loan, credit card dues, or legal action that caused it may negatively impact your credit profile.

Q6: Can liens placed on bank accounts be immediately removed by banks upon payment?

No. Even after clearing dues, customers must submit proof and request lien removal in writing. Banks follow a manual verification process before releasing the funds.

Q7: Can a lien placed on a bank account be applied without the customer’s permission?

Yes, in cases involving court orders, tax recovery, or statutory instructions. For bank-origin liens, consent is usually part of signed loan or credit card agreements.

Q8: When a lien is placed on a bank account, would interest on the funds continue?

In most savings accounts, interest continues to accrue, but the lien-marked amount cannot be withdrawn or used until the lien is removed.

Disclaimer

This article is for informational purposes only and does not constitute legal or financial advice. Banking rules and procedures related to a lien marked on bank account may vary by institution and are subject to regulatory updates. Readers should verify details with their bank or consult a qualified professional before taking action. The publisher is not responsible for decisions made based on this information.