Learn how to choose the right investment plan by age in India. Simple age-wise strategies from your 20s to 60s to grow wealth safely and confidently. investment plan by age, long-term investment strategy, age wise investment strategy, best investment options in India, investment planning by age, retirement investment planning.

Introduction

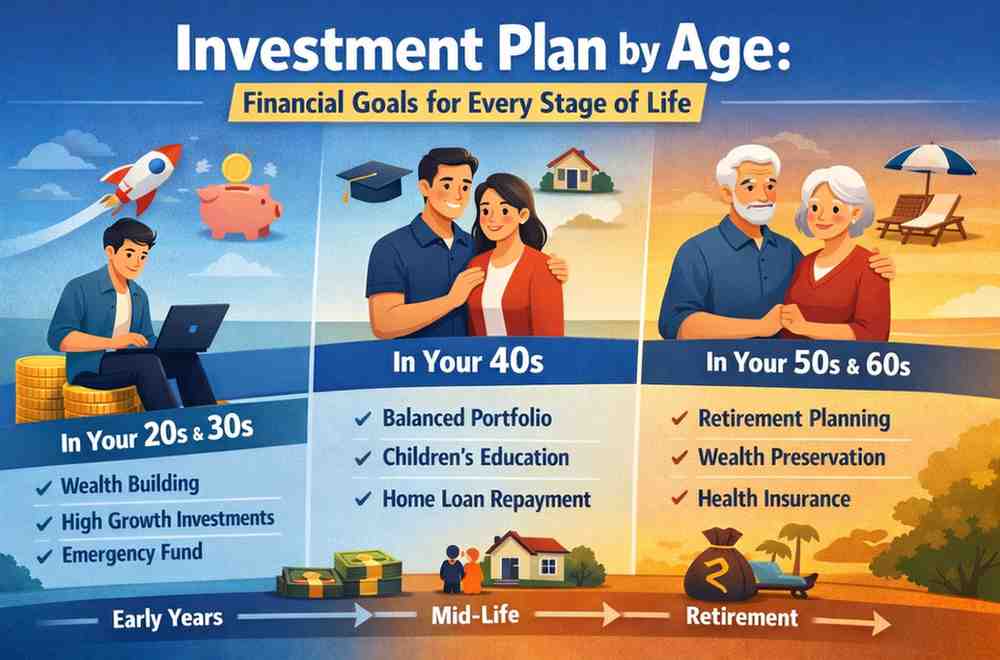

Choosing the right investment plan by age is one of the most important yet misunderstood aspects of financial planning. Many people invest without considering whether a product or strategy actually fits their current life stage. As a result, they either take too much risk or remain overly conservative, both of which can hurt long-term wealth creation.

Your income, responsibilities, goals, and risk tolerance change as you grow older. A smart investment approach evolves along with these changes. When your investments align with your age and life stage, you can grow wealth steadily, protect your savings, and reduce financial stress. This guide explains how to choose the right investment plan at every stage of life in a simple and practical way.

Why Age Matters in Investment Planning

Age plays a central role in determining how much risk you can afford and how long your money can stay invested. Younger investors usually have more time to recover from market downturns, while older investors need stability and predictable income.

Many people struggle because they invest randomly or chase returns without a clear structure. This often leads to confusion and poor outcomes. A planned, age-based investment strategy helps you stay focused, disciplined, and aligned with long-term goals.

As highlighted by SEBI’s investor education resources, investors should always align their investment choices with their risk appetite, time horizon, and financial goals rather than chasing short-term returns.

Investment Strategy in Your 20s: Build the Growth Foundation

Your 20s are the best years to begin investing because time is your biggest advantage. Even small, regular investments can grow significantly due to compounding if started early.

At this stage, your goal should be learning, building habits, and staying consistent rather than trying to maximize short-term returns.

What to focus on in your 20s:

- Start investing as early as possible: The earlier you begin, the longer your money gets to grow. Starting early reduces pressure later in life.

- Build an emergency fund first: Keeping 6–12 months of expenses aside prevents you from breaking long-term investments during emergencies.

- Accept short-term volatility: Market ups and downs are normal. With time on your side, temporary declines should not cause panic.

- Learn investment basics: Understanding concepts like risk, return, and diversification helps avoid emotional decisions later.

- Control lifestyle inflation: As income rises, avoid increasing expenses at the same pace. Direct extra income toward investments.

If you are just starting out, this guide on how to invest your first salary explains beginner-friendly steps clearly.

Investment Strategy in Your 30s: Balance Growth With Stability

In your 30s, income usually improves, but responsibilities also increase — marriage, children, EMIs, and long-term commitments. This stage requires balance between growth and stability.

You should continue investing aggressively but in a more structured and goal-oriented way.

Key priorities in your 30s:

- Increase investments as income grows: Gradually step up your investments whenever your salary increases instead of upgrading lifestyle expenses.

- Adopt goal-based investing: Assign specific investments to specific goals such as education, home purchase, or long-term wealth.

- Improve diversification: Avoid concentrating all money in one asset type; diversification reduces overall risk.

- Review investments annually: Annual reviews help ensure your portfolio still matches your goals and responsibilities.

A structured approach like goal-based investing strategies can help bring clarity and discipline at this stage.

Investment Strategy in Your 40s: Protect and Optimize

Your 40s are often peak earning years, but mistakes during this phase can be costly because recovery time becomes limited. The focus now should shift from aggressive growth to controlled and balanced investing.

According to AMFI’s investor awareness guidance, asset allocation should gradually change with age so that risk reduces as financial responsibilities and retirement approach.

You should aim to protect what you have built while still allowing moderate growth.

Key focus areas in your 40s:

- Reduce high-risk exposure gradually: Avoid speculative or highly volatile investments that can destabilize your portfolio.

- Rebalance your portfolio regularly: Asset allocation drifts over time; rebalancing restores balance and controls risk.

- Strengthen retirement planning: Start estimating retirement needs and aligning savings accordingly.

- Maintain diversification: A diversified portfolio helps manage uncertainty and smooth long-term returns.

To understand how diversification works at this stage, refer to portfolio diversification at 40 in India.

Investment Strategy in Your 50s: Shift Toward Stability

In your 50s, retirement planning becomes urgent. You now need to focus more on protecting accumulated wealth and ensuring stable income rather than chasing high returns.

At this stage, mistakes can be difficult to recover from, so caution becomes essential.

Key priorities in your 50s:

- Preserve accumulated wealth: Protect what you have built over decades by reducing unnecessary risk.

- Lower portfolio volatility: Shift gradually toward safer and more predictable investments.

- Prepare a realistic retirement plan: Estimate expenses and savings needs to avoid shortfalls later.

- Avoid last-minute risky decisions: High-risk bets close to retirement often cause more harm than benefit.

To estimate your future retirement needs more accurately, you can refer to this detailed guide on how to calculate retirement corpus in India, which explains the process step by step.

Investment Strategy After 60: Income, Safety & Liquidity

After retirement, investment goals change completely. Growth becomes secondary, while income stability and capital safety take priority.

Your investments should support daily expenses without creating stress or uncertainty.

Post-retirement priorities:

- Stable and predictable income: Choose options that provide regular cash flow.

- High liquidity: Funds should be easy to access during medical or personal emergencies.

- Low volatility exposure: Reducing market swings helps preserve capital.

- Protection against inflation: A small growth component helps maintain purchasing power over time.

Many retirees use systematic withdrawal approaches to manage income efficiently. Learn more from how to use SWP for retirement planning.

Suggested Age-Wise Asset Allocation (Indicative)

| Age Group | Equity | Debt & Safer Assets |

| 20–30 | 70–80% | 20–30% |

| 30–40 | 60–70% | 30–40% |

| 40–50 | 45–55% | 45–55% |

| 50–60 | 30–40% | 60–70% |

| 60+ | 20–30% | 70–80% |

Actual allocation depends on income stability, goals, and personal risk tolerance.

Common Investment Mistakes at Every Age

Many investors unknowingly repeat the same mistakes throughout life:

- Starting too late and missing compounding benefits

- Chasing high returns without understanding risks

- Ignoring diversification

- Making emotional decisions during market volatility

- Failing to review investments periodically

Avoiding these mistakes can significantly improve long-term financial outcomes.

How Often Should You Rebalance Your Portfolio?

Rebalancing ensures your investments stay aligned with your age, goals, and risk capacity.

You should rebalance:

- At least once every year

- After major life events like marriage or job change

- When market movements distort asset allocation

- As retirement approaches

Regular rebalancing brings discipline and stability to your investment strategy.

Who Should Choose Aggressive vs Conservative Strategies?

Aggressive strategies are suitable for:

- Younger investors with long time horizons

- Individuals with stable income

- Those comfortable with short-term volatility

- Investors focused on long-term wealth creation

Conservative strategies are suitable for:

- People nearing or already in retirement

- Those dependent on investment income

- Investors with low risk tolerance

- Individuals with short-term financial goals

Choosing the right approach helps reduce stress and improve consistency.

Conclusion

Choosing the right investment plan by age is about aligning your money with your life stage. Each phase—from your 20s to retirement—comes with different priorities, risks, and opportunities. When your investment strategy evolves with your responsibilities, you gain better control, stability, and confidence in your financial future.

A thoughtful, age-based approach helps you grow wealth gradually, protect what you’ve built, and move toward long-term financial independence with clarity.

FAQs

Q1: What is the best investment plan by age?

There is no single best investment plan by age. The right choice depends on income, goals, time horizon, and risk tolerance. Younger investors usually focus on growth, while older investors prioritize safety and income.

Q2: Why should investment strategy change with age?

As responsibilities increase and retirement approaches, the ability to take risks decreases. Updating your strategy ensures better balance between growth and protection.

Q3: Is it too late to start investing after 40?

No. With disciplined investing and realistic planning, even late starters can build meaningful wealth over time.

Q4: How often should investments be reviewed?

Investments should be reviewed at least once a year or whenever there is a major life change such as marriage, job change, or retirement planning.

Q5: Can one investment strategy work for a lifetime?

No. Financial needs, income levels, and risk tolerance change over time, so your investment approach must evolve accordingly.

Disclaimer

This article is for educational and informational purposes only and should not be considered financial or investment advice. Investment decisions depend on individual goals, risk tolerance, and financial circumstances. Readers should consult a qualified financial advisor before making investment decisions.