Room rent limit in health insurance can reduce your claim by 40% or more through proportionate deduction. Understand the risks before buying a policy. room rent limit in health insurance, proportionate deduction in health insurance, health insurance room rent cap, claim reduction in health insurance, sub-limit in health insurance, room category restriction.

Introduction: Room Rent Limit in Health Insurance

People who get health insurance usually look at just one thing – the amount covered. A plan offering five hundred thousand rupees or ten lakh gives them confidence. Big medical bills seem manageable because of that figure alone. When checking options, some consider cost, time before claims start, and which hospitals are included. Yet deep within the document lies a tiny detail most overlook entirely. This small line quietly controls how much cash comes through when treatment happens. It’s called the room rent cap. Health insurance products in India are regulated by the Insurance Regulatory and Development Authority of India (IRDAI), which permits insurers to define sub-limits and room eligibility conditions within policy documents.

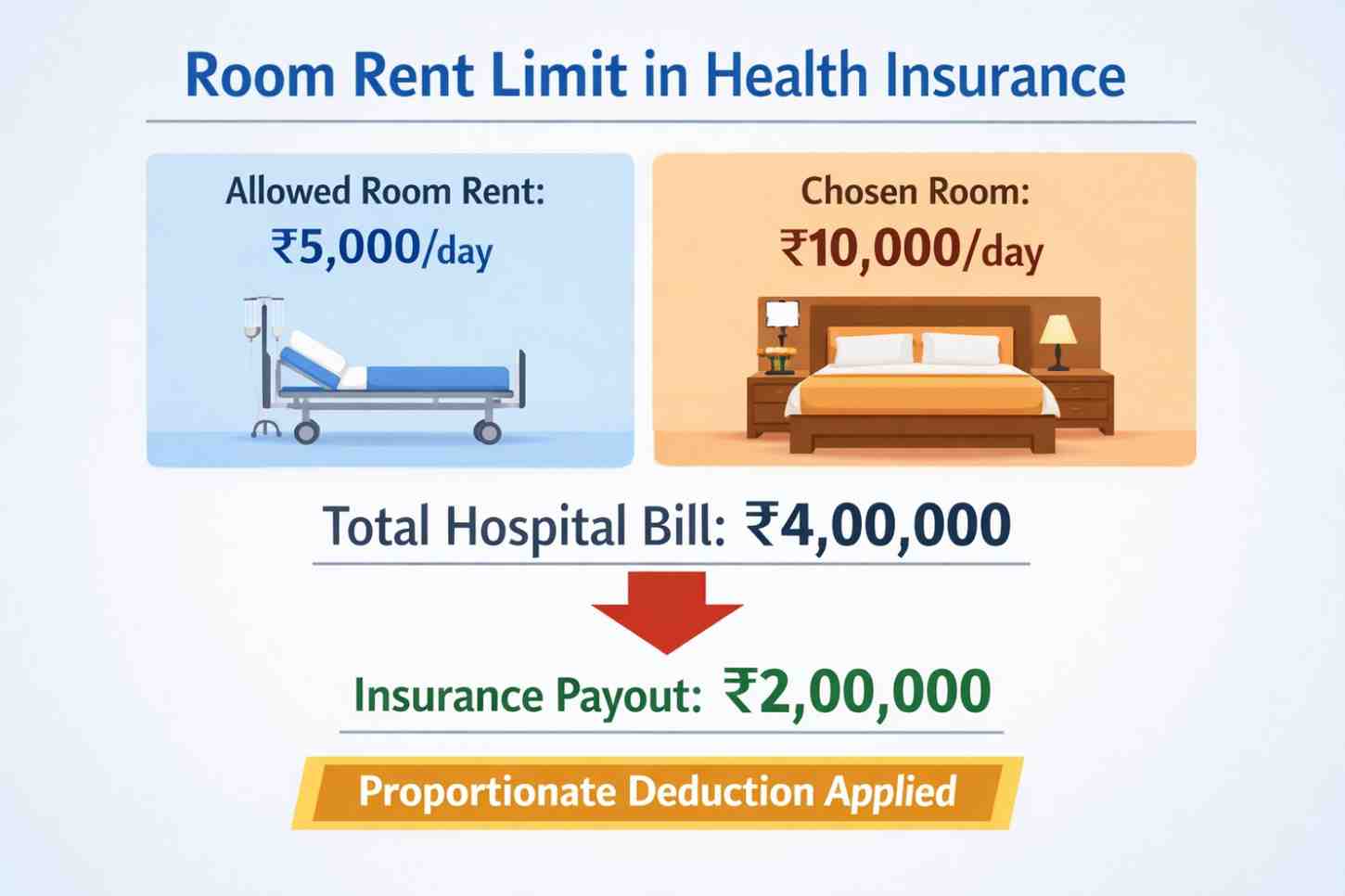

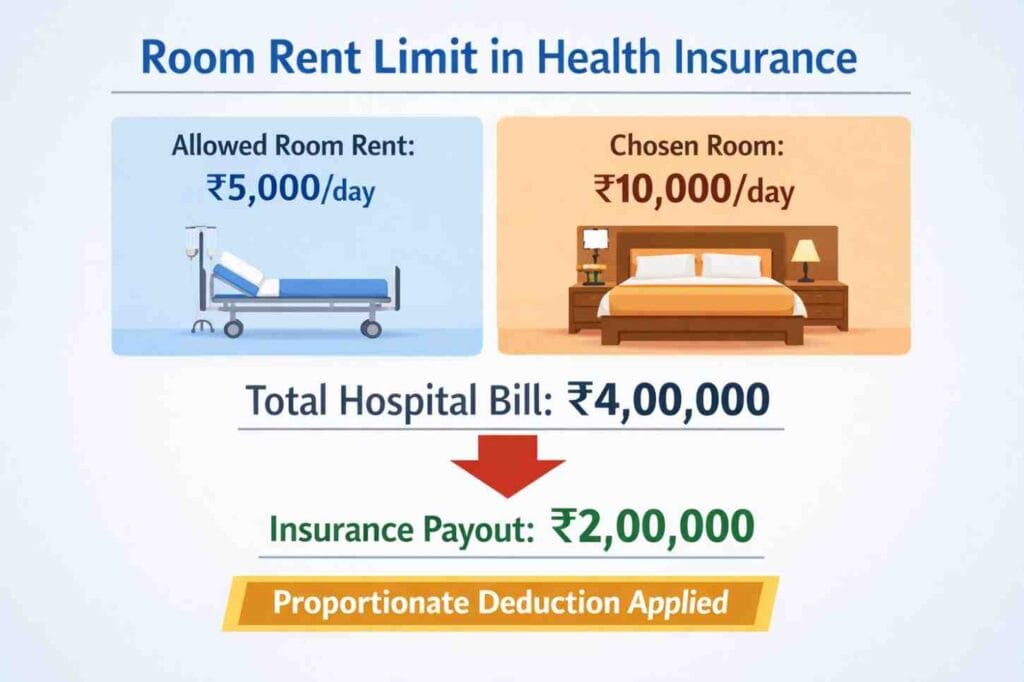

Room rent limit does not simply cap the daily cost of hospital accommodation. A typical policy triggers something known as proportional deduction. Under such cases, the insurance provider doesn’t only adjust the cost linked to room rent. It reshapes several billing elements based on the approved type of room. That’s when a payout may drop sharply – by 30%, maybe 40%, occasionally beyond – even if coverage seemed enough.

When someone ends up in the hospital, money options shrink fast – this rule matters most right then. Paying close attention makes clearer why it hits hardest at that moment.

What Is a Room Rent Limit?

Hospital stays come with daily charges, capped by insurers through set limits. Sometimes it’s a flat rate – five thousand rupees each day, for example. Other times the cap ties directly to how much total coverage you hold. A portion of that sum insured might define what they’ll pay. Or maybe only certain rooms count – like shared wards – not private ones. Rules shift depending on policy terms. Coverage could hinge on type, not just cost. Limits appear different across plans, yet serve one purpose: control expenses.

At first glance, it might seem clear enough. Should someone pick a costlier room, they could expect to cover just the extra amount. Yet that idea usually does not hold up. When certain health plans set limits on room types, going beyond those can pull down coverage for many linked treatments. The payout gets cut – not only for lodging but also consultations, operations, care during recovery, and occasionally test bills too.

It’s not the cap that brings danger. What matters is how the numbers are worked out when settling.

How Proportionate Deduction Actually Works

Room type usually sets how hospitals price care. Because of better rooms, doctor visits and treatments get more expensive. Since insurance rates depend on defined risks and rules, they adjust accordingly. If someone picks a fancier room than allowed, costs shift in their view.

Picture a basic scenario instead.

When your plan covers ₹5,000 daily but you pick a room costing ₹10,000 each day, only half counts toward claims. Suppose the full hospital charge hits ₹4 lakh – insurers might cut every approved expense by that same fifty percent. Rather than getting ₹4 lakh back, expect just ₹2 lakh instead. Even if coverage seems enough on paper, what lands in hand drops fast.

This financial shock feels similar to situations where a cashless request is rejected at admission and the entire hospital bill must be arranged immediately, because in both cases the insured must suddenly mobilise large funds despite believing they are fully covered.

Types of Room Rent Structures

A few plans skip room rent caps entirely. How they’re built makes all the difference. A daily spending limit sets a strict amount, cutting costs if limits are passed. When claims drop sharply, these rules feel the impact first. What seems enough in rural areas might fall short in big city clinics, where prices run much higher.

A different kind of rule changes which room you can have rather than how much is covered. Suppose a policy covers only shared rooms under normal terms. Choosing a private one – for more space or better rest – might lead the insurance to reduce payment by part. The cut reflects the extra cost picked up by the individual.

A few plans let you stay in a private room with no set cost limit. While these often mean steeper payments, they offer more freedom plus cut down on partial claim rejections.

Premium plans toss out room cost caps completely. Though they come at a higher price, these policies wipe away guesswork when you’re admitted, making payout math straightforward.

Beyond structure, what stands out is how certain outcomes feel expected. One type stirs uncertainty when claims arise, the other settles into clear terms by design.

Why Policyholders Miss This Clause

Often it’s human nature that ignores room rental caps, not the difficulty of understanding them. Surprisingly, attention often lands on the total coverage amount right away. Comfort grows when that figure climbs, shaping early opinions. Details tucked below? They fade into the background fast. Conversations zoom ahead without pausing for footnotes.

Now here’s a twist – cost often steers the choice more than anything else. Take one plan priced two thousand rupees lower each year; it might pack stricter caps on certain claims. What slips through the cracks? How much freedom you lose when settling for smaller payments up front.

When crises hit, clear thinking fades. At check-in, relatives focus on care fast, not whether bills match coverage rules. Where patients land depends on what beds are free, how bad things look, or which way a physician leans.

Now imagine wading through thirty pages just to grasp a policy. Details on room rent hide deep inside blocks of fine print, tangled with caps and exceptions. Comprehension takes a hit when paperwork piles up too high.

When reassessment delays settlement beyond expectations, confusion increases, especially when delays extend past the standard processing window and policyholders begin questioning regulatory timelines.

Real-Life Illustration: A Detailed Scenario

That time in Delhi, Anita had bought health cover worth five lakh rupees. Her plan set aside four thousand daily for lodging inside the hospital. She thought it would cover most rooms nearby. Trouble started when her appendix acted up suddenly. The medical team said recovery needed a private space. Only one option came up nine thousand each night. That number floated way above what her insurer promised.

That hospital stay ended up costing ₹3.6 lakh. With a cover of ₹5 lakh, Anita thought nearly all would be paid. But then came the math: 4,000 divided by 9,000, which is about 44 percent. So rather than getting back the full amount, only roughly ₹1.6 lakh showed up in claims.

What stayed behind was two lakh rupees, pulled together slowly – some saved, some borrowed from family. It hit harder emotionally since she thought everything would be covered completely. That shortfall wasn’t due to rejection or missing benefits, just one small line in the policy she’d never really looked at before.

Interaction With Underwriting and Premium

Premium loading and room rent limits operate independently. Premium loading occurs at policy issuance when risk factors are assessed. The long-term financial implications become clearer when examining how smoking and alcohol consumption influence policy terms at issuance, since those factors affect pricing but not claim-stage proportionality.

When room rental caps change, how claims settle shifts instead of cost going up or down. Cheaper plans usually come with stricter rules on pay-outs. Looking at two options means checking price alongside how freely claims get handled.

Urban Cost Dynamics

Big city hospitals often charge over ₹8,000 daily for basic private beds. On top of that, upgraded rooms might cost ₹15,000 or even higher. So when a plan only covers ₹5,000 each day, people could face growing out-of-pocket costs.

Out here, location shapes everything. Where hospitals set lower prices, a rent limit might fit just fine – yet in big-city zones, that same rule could pinch hard.

Conclusion

What you pick for room rent affects how much gets paid later. A wrong choice might cost more than two fifths of your coverage, despite enough total insurance. Saving on price at sign-up could mean paying far more when stuck in a hospital bed.

Start by checking things early. When room types match what hospitals in your area charge, money troubles shrink. Pick a plan that fits how those prices line up. Coverage should clear fog, not bring confusion when bills arrive.

FAQs

Q1: Does room rent limit always trigger proportionate deduction?

It depends. A few plans cover just the gap in lodging costs, leaving extra fees untouched. Still, plenty of limit-based contracts state clearly that cuts apply across all expenses, so checking the details matters more than you might think

Q2: Can proportionate deduction reduce claim by more than 40%?

Right. How much gets cut ties directly to how wide the gap sits between what’s permitted and what’s picked. When numbers stretch too far apart – say ₹4,000 approved against ₹12,000 taken – the drop can blow past 60%. That kind of swing pulls the final amount down hard.

Q3: Is ICU covered under room rent limit?

A stay in intensive care usually comes with its own price tag, separate from regular room charges. Still, how it’s covered can shift based on what the insurance document actually says. Some companies might adjust payments if the patient’s chosen room tier goes beyond approved limits. The fine print decides whether a slice of cost gets shared or fully denied.

Q4: Should I avoid policies with room rent limits?

Not necessarily. Policies that include realistic room prices and aligned caps can work well. The choice should be based on premium affordability, hospital preference, and city of residency.

Q5: Why do insurers include room rent limits?

Limiting room rents enables insurers to set competitive prices and manage claim inflation. For different risk sectors, insurers provide alternative premium possibilities by segmenting policies with different caps.

Disclaimer

This piece shares knowledge, nothing more – never seen as financial or insurance guidance. Different companies offer different rules, each plan holding its own details. Check the actual documents provided by the company every single time prior to choosing a plan. What happens when filing a claim relies on specific agreements plus personal context.