Learn what does home insurance cover, including dwelling, contents, liability, and more. Discover key coverages, exclusions, and tips to secure your home in 2025. #what does home insurance cover, #home insurance coverage, #homeowners insurance explained, #home insurance policy terms, #types of home insurance coverage, #home insurance exclusions, #home insurance for beginners, #home insurance costs, #dwelling coverage explained, #liability insurance for homeowners

Introduction: Why Understanding What Does Home Insurance Cover Is Crucial

Imagine a burglar stealing your goods or a sudden fire destroying your house. Do you know what these circumstances are covered by home insurance? In 2025, with rising property values and unpredictable weather, understanding what does home insurance cover is a vital step toward safeguarding your most valuable asset. The seven key elements of home insurance are examined in this thorough handbook, which also clarifies policy terminology and outlines what is and is not covered. Whether you’re a first-time homeowner or reviewing your policy, this article will give you the information you need to safeguard your house against unforeseen catastrophes.

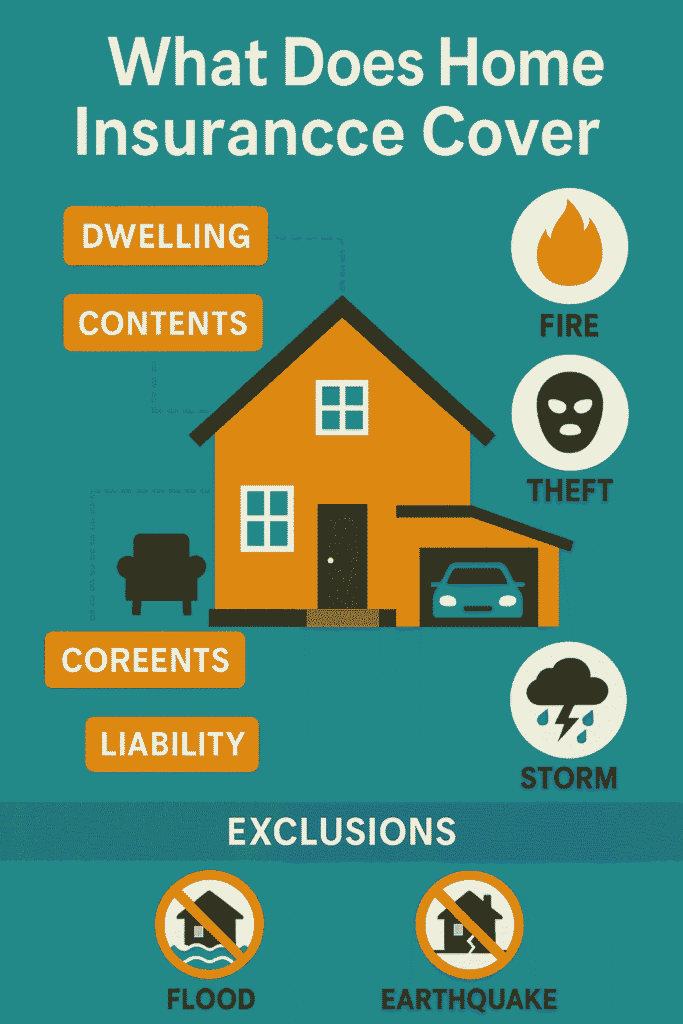

What Does Home Insurance Cover? The 7 Essential Components

The purpose of home insurance, also known as homeowners insurance, is to shield your house, possessions, and money against a range of dangers. In order to make sure you’re ready for life’s unforeseen events, we’ve broken down what house insurance covers below using its seven main components.

Dwelling Coverage: Your Home’s Structure

One of the main components of home insurance is dwelling coverage, which safeguards your home’s walls, roof, foundation, and built-in appliances. Depending on the policy amount, this coverage pays for repairs or rebuilding if your property is damaged by a fire, windstorm, or vandalism.

- Covered Perils: Lightning, windstorms, hail, vandalism, fire, and unexpected water damage (such as burst pipes) are among the hazards covered.

- Typical Limit: Usually between $200,000 and $600,000 in 2025, this amount corresponds to the cost of replacing your house.

- Example: Your dwelling coverage may pay for repairs to your roof after a storm, less your deductible.

- Pro tip: To account for growing building expenses, update your coverage once a year.

Contents Insurance: Your Personal Belongings

What does home insurance cover for your personal items? Your possessions, including clothing, gadgets, furniture, and more, are covered by contents insurance in the event of theft or damage. This coverage helps replace things like your laptop in the event of a theft or a fire that destroys your sofa.

- Covered Perils: Theft, fire, smoke, vandalism, and some types of water damage are covered hazards.

- Coverage Limit: Usually between 50 and 70 percent of dwelling coverage (e.g., $100,000 to 420,000 for a home worth $600,000).

- Tip: To make claims easier, make a home inventory that includes receipts and pictures.

- Example: If your TV is destroyed by a burst pipe, your contents insurance may pay for a replacement.

Personal Liability Protection: Shielding Against Lawsuits

Personal liability insurance is an essential component of home insurance, protecting you in the event that someone is hurt on your property or that you inadvertently cause damage to someone else’s property. This coverage can assist with medical and legal expenses, for example, if a visitor slips on your icy porch and files a lawsuit.

- Standard Limit: $100,000 to $500,000 is the typical limit, with the possibility of raising it.

- What’s Covered: What is covered includes damages in the event that you are held liable, medical costs, and legal fees.

- Scenario: Liability insurance might pay for a visitor’s medical expenses if your dog bites them.

- Pro Tip: If you have a lot of assets, think about getting an umbrella policy for additional protection.

Additional Living Expenses (ALE): Temporary Relocation Costs

If a covered event, like a fire, renders your home uninhabitable, additional living expenses (ALE) coverage is a key aspect of what does home insurance cover. While your house is being repaired, it covers short-term living expenses including rent, meals, and hotel stays.

- Coverage Limit: The coverage limit is usually between 20 and 30 percent of the home coverage.

- What’s Covered: Covered expenses include meals at restaurants, hotel bills, and other reasonable costs.

- Example: ALE may pay for a month’s hotel accommodation following a house fire.

- Tip: To guarantee seamless reimbursement, keep track of all your receipts.

Other Structures Coverage: Detached Buildings

What does home insurance cover beyond your main house? If covered perils cause damage to detached structures like garages, sheds, or fences, other structures coverage will protect them.

- Coverage Limit: Typically, between 10% and 20% of the dwelling coverage.

- Example: This coverage pays for repairs if your garden shed is destroyed by a storm.

- Pro Tip: To prevent coverage gaps, it is advisable to include a list of any detached structures in your insurance.

Optional Add-Ons: Customizing What Does Home Insurance Cover

Standard policies have limitations, but you can enhance what does home insurance cover with endorsements:

- Flood insurance: Provides coverage for flood damage; frequently needed in high-risk locations. Visit the FEMA National Flood Insurance Program to find out more.

- Earthquake Insurance: In places like California, earthquake insurance is essential for protecting against damage from earthquakes. Visit the USGS Earthquake Insurance Information page.

- Scheduled Personal Property: Expensive goods that beyond normal restrictions, such as jewellery or artwork.

- Tip: Determine what extras are required by evaluating the location and value of your house.

Coverage for Specific Perils: Understanding Policy Limits

What does home insurance cover in terms of specific risks? The majority of plans cover “named perils” such as theft, vandalism, windstorms, and fire. However, the scope is determined by the terms of your policy, so carefully read them.

- Common Perils: Common dangers include theft, lightning, hail, fire, and several types of water damage.

- Policy Tip: For a list of covered dangers, consult the declarations page of your policy.

- Example: Your policy should pay for repairs if lightning starts a fire, but make sure to check the exclusions.

What Does Home Insurance Not Cover? 5 Critical Exclusions

Understanding what does home insurance cover also means knowing its limitations. Here are five key exclusions to be aware of:

- Flood Damage: Flood damage caused by rivers or severe rain is not covered by standard policies. Get individual flood insurance from FEMA.

- Earthquakes: Damage from earthquakes necessitates a different endorsement or policy. For possibilities, contact the California Earthquake Authority.

- Wear & Tear: Poor maintenance or neglect-related damage (such as a leaky roof) is not covered.

- High-Value things: Jewellery and other high-value things are typically capped at $1,000 to $2,000 per item under standard plans.

- Some Natural Disasters: You could need extra coverage for storms, sinkholes, or mudslides.

Pro Tip: To prevent claim denials, ask your insurance for a complete list of exclusions.

Tips for Choosing the Right Home Insurance Policy

Knowing what does home insurance cover is only the first step—selecting the right policy is critical. Here are practical tips to ensure comprehensive protection:

- Compare Coverage Limits: Verify that contents coverage reflects the worth of your possessions and housing coverage equals the cost of replacing your home.

- Evaluate Deductibles: While a greater deductible (e.g., $1,000 vs. $500) may result in reduced premiums, it also raises the amount of money that must be paid out of pocket when filing a claim.

- Review Exclusions: To prevent surprises, be sure you know what your house insurance covers and doesn’t cover.

- Bundle Policies: According to the Insurance Information Institute, combining vehicle and house insurance can result in premium savings of 5–15%.

- Shop Around: To discover the greatest coverage and pricing, compare quotes from several insurance providers.

Conclusion: Secure Your Home with Confidence in 2025

Understanding what does home insurance cover is a powerful tool for protecting your home, belongings, and financial future. A regular policy provides strong protection against numerous common risks, ranging from liability and additional living expenses to dwelling and contents coverage. But exclusions like earthquakes and floods highlight the necessity of tailoring your policy with endorsements. In 2025, with rising costs and climate risks, knowing what does home insurance cover is more important than ever. Take control now by going over your policy, looking into add-ons, and making sure your house is prepared for anything.

FAQs About What Does Home Insurance Cover

Q1: What does home insurance cover for water damage?

Floods and slow leaks are not covered by home insurance, but unexpected water damage, such as burst pipes, is. FEMA also offers separate flood insurance.

Q2: Is theft of personal property covered by home insurance?

Yes, up to the maximum amount specified in your policy, contents insurance covers the theft of objects like jewellery or electronics. High-value products sometimes require a recommendation.

Q3: What does home insurance cover for natural disasters?

Floods, earthquakes, and hurricanes frequently need for separate coverage, but it includes hazards like fire, windstorms, and hail.

Q4: In 2025, how much will home insurance cost?

The average annual cost ranges from $1,500 to $2,500, depending on area, property value, and coverage. To find the best prices, compare quotations.

Q5: Can my liability coverage be increased?

Yes, you can add an umbrella coverage or raise the limits. For more information, speak with your insurance.

Disclaimer

This post is not intended to be financial or insurance advice; rather, it is merely informational. Each policy and insurer has different exclusions, fees, and coverage. Consult a licensed insurance professional to understand what does home insurance cover for your specific needs and to select the appropriate policy. For information on exclusions, limits, and coverage, always consult your policy documentation.

Also Read:

- 7 Costly Mistakes Investors Make with Insurance You Must Avoid

- Health Insurance Fine Print Checklist: 15 Essential Items to Avoid Costly Surprises

- Why Insurance Is a Smart Financial Decision: 5 Ultimate Reasons

- Home Insurance: What it covers, how much it costs — All you need to know

- Insurance Information Institute (III) – Homeowners Insurance Basics

- Insurance Information Institute: Home Coverage Guide