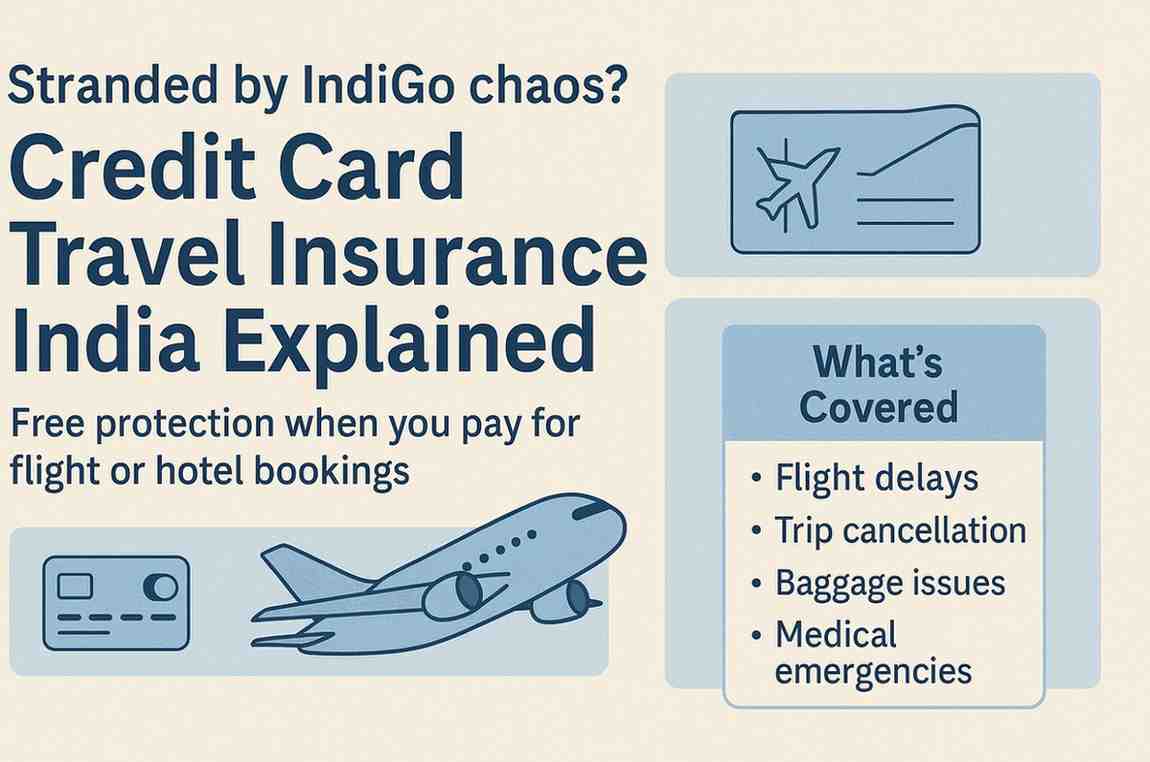

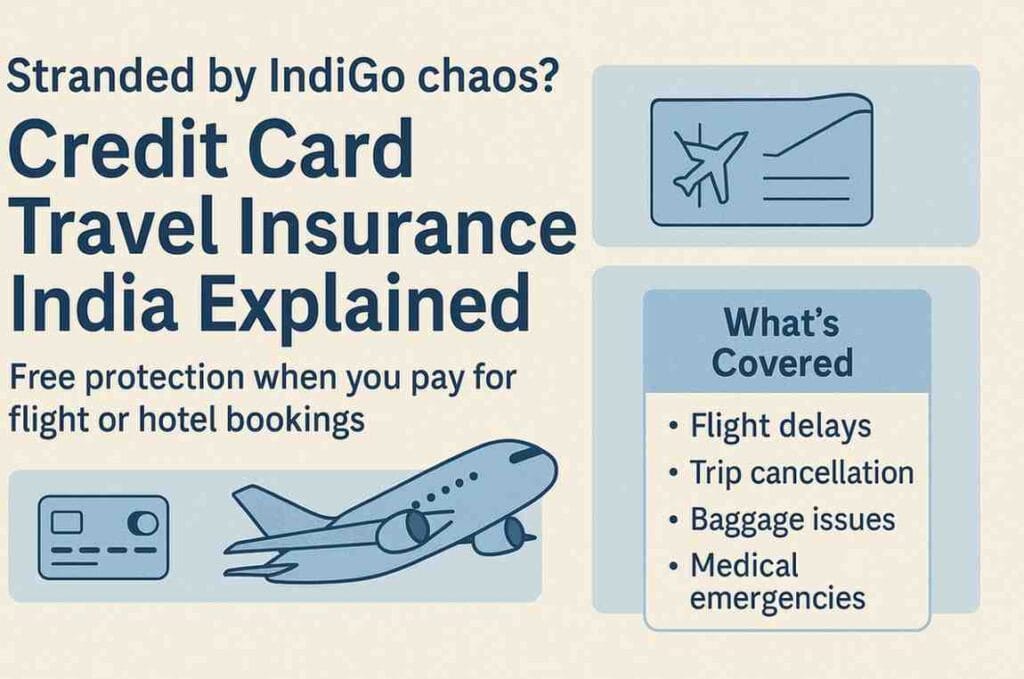

Understand credit card travel insurance India explained clearly. Discover free protection against IndiGo delays, cancellations, baggage issues, and medical emergencies — without paying extra. #Credit Card Travel Insurance India Explained, #flight delay insurance India, #travel cover by Indian credit cards, #Indigo flight cancellation compensation, #domestic travel insurance credit card benefit, #baggage loss reimbursement India, #hidden credit card perks India explained, #claim procedure for travel insurance India.

Introduction — Why This Matters for Indian Travelers

Indian skies are busier than ever, yet carriers such as IndiGo manage huge crowds daily. Due to packed timetables, weak airport setups, along with sudden storms, late or scrapped flights now happen often. Once plans fall apart, travelers face stress – on top of cash strain. Sudden stays, new tickets, lost trips, extra rides around town, even buying clothes when bags don’t show up – all these pile up fast.

Many people from India think getting travel insurance on their own is the only way to stay protected. However, many people already have access to a lesser-known but extremely valuable benefit: credit card travel insurance India explained.

When people reserve plane tickets with a qualifying credit card, protection kicks in automatically – no additional cost at all. Yet most don’t realize this safeguard is there, so heaps of money vanish yearly in missed perks.

In order to help Indian travellers, whether frequent flyers or infrequent vacationers, travel more wisely, recover expenses with confidence, and avoid avoidable financial stress, this article provides a straightforward, factual, and fiscally responsible explanation of credit card travel insurance India.

Also Read: Does Short Trip Need Travel Insurance? 10 Compelling Reasons to Protect Your Getaway

What Is Credit Card Travel Insurance India Explained?

Credit card travel cover in India? It’s a free perk on some local cards. Use the right card to book flights or stays – protection kicks in straight away. Instead of paying extra, you get safeguards just by swiping. Booking trips this way means help if things go sideways.

- No separate premium.

- No need to complete a form when you book. Instead, just pick your option – skip the paperwork hassle.

- No need to send an activation note.

The coverage comes with your card membership – usually ignored because things like airport lounges or cashback get more attention. But in a real emergency, credit card travel insurance India explained often proves far more financially valuable.

What Is Typically Included in This Coverage?

While coverage differs depending on the card issuer and variation, the majority of offers under credit card travel insurance India explained include:

Missed flights if held up way past set limits – like three hours or six. Longer waits mean changes kick in

- Coverage kicks in when trips can’t happen because of protected issues

- Travel plans changing mid-way through a journey

- Get paid back for must-have stuff if your bag’s late

- Payment if your luggage is gone for good

- Aid for sudden health issues while on a trip

- Protection if your passport goes missing or gets damaged while traveling

- Air crash coverage for serious travel mishaps but only when flying’s involved or during boarding

These safeguards turn significant travel-related stress into controllable situations. Rather than suffering financial losses due to the airline’s inability to operate on schedule, credit card travel insurance India explained ensures your finances remain safeguarded.

Also Read: Does Insurance Cover Terrorist Attacks? 8 Critical Facts Every Indian Must Know

Realistic Examples of the Financial Effects of Airline Disruptions

Passengers’ costs increase quickly when IndiGo or any domestic airline experiences an operational outage. Think about the following situations that apply to regular travel in India:

Example 1:

Eight-hour flight delay, unforeseen meals, a nearby hotel, and an airport taxi

Costs: ₹6,500

₹5,000 in reimbursement

Avoided loss: 77%

Example 2:

24-hour baggage delay Essentials (clothes, toiletries): ₹3,200

Payment: ₹3,000

94% of the loss was avoided.

Example 3:

Overseas medical emergency

Hospital stay: ₹55,000

₹40,000 reimbursed by card benefits

Avoided loss: 72%

These actual incidents demonstrate that credit card travel insurance India explained is much more than just a catchphrase; when travel mayhem strikes, it guards against significant, agonizing losses.

Does Credit Card Travel Insurance India Apply to OTA Reservations?

Yep – provided you pay with a qualifying credit card instead.

Bookings via MakeMyTrip, also Cleartrip, or GoIbibo, even Yatra – any OTA works since the perk links to how you pay, not where you book.

UPI transactions won’t trigger protection. Most wallets also fail to start safeguards.

Using the card directly is the golden rule for credit card travel insurance India explained to work.

When There Is Enough Coverage

Credit card travel insurance India explained becomes the perfect protective layer in:

- Short international or domestic travel

- • Frequent or professional flying

- • Itineraries with little danger

- • Young, healthy tourists

- • Low-cost travel with a small number of non-refundable reservations

Because protection is free in certain situations, the cost-benefit ratio is extraordinary.

Where It May Not Be Enough

In situations like these, credit card travel insurance India explained cannot completely replace a dedicated travel insurance policy despite its high worth.

- Costly long-haul travel

- A trip to Europe or the States – places with steep health care prices

- Thrill-seeking activities or travel that involves serious danger

- Senior citizen travel

- Folks traveling together but just the main account user gets protection

The best course of action is to use credit card travel insurance. India added a stand-alone policy for high-value risks and described it as the first line of defense.

How to File a Claim — Without Stress

If claims are not properly filed, even a robust insurance benefit is meaningless. The process for credit card travel insurance India explained is straightforward:

- Step 1: Check if you qualify – make sure the reservation was made with the right credit card

- Step 2: Hold on to your papers – like boarding passes, receipts, or any booking slips

- Step 3: Grab the paperwork you need – like a note from the airline when your flight’s late or canceled

- Step 4: Send it online – fill out the insurance form along with your evidence

- Step 5: Keep an eye on how things are going – if more papers pop up, let them know right away

A little sorting saves big money – just a quick fix avoids huge losses. Small steps now prevent costly messes later, so tidy up fast.

A Financial Example of Savings Demonstration

Trip price – flights plus stay – hits around ₹25,000

Flying plans messed up:

Extra costs along with missed benefits add up to ₹20,000

Card insurance covers up to ₹20,000 when you file a claim

Your real loss is ₹5,000 – just one-fifth of the full money hit

Savings = 80%

Understanding credit card travel insurance India explained transforms airline crisis into a brief hold-up rather than a financial catastrophe.

Why Most Indians Miss This Free Safety Net

The main problem isn’t denied claims – it’s poor understanding. Typical errors involve:

- Paying through UPI rather than using a credit card

- Getting rid of receipts or flight tickets too soon

- No need to ask the airline for evidence

- Expecting the insurance company might say no to pay outs.

- Believing OTA bookings are excluded

These avoidable mistakes make travellers miss out on cash they’d otherwise get back without hassle.

Who Benefits the Most?

Folks who fly at home often, younger workers, people traveling alone, or folks with high-end credit cards benefit most. Trips stay easier on the wallet – especially when unexpected issues pop up.

Folks with kids, older adults, or anyone crossing continents get perks – yet might still require a separate coverage plan.

It is all about understanding credit card travel insurance India explained and using it intelligently.

Conclusion

Airline interruptions are frequent. There is no need for financial losses. Credit card travel insurance India discreetly protects you in the event that your travel plans fall through by using your qualifying card to purchase flights rather using UPI or wallets. Examine your card’s perks before your next trip, and make more informed travel plans.

Be confident while you travel. Be careful when you travel.

Your money shouldn’t vanish due to an airline’s operational difficulties.

FAQs

Q1: Does travel insurance come with all Indian credit cards?

No, only a few cards—typically premium or travel-oriented ones—offer insurance coverage. Before depending on coverage, you should verify your eligibility using your card’s official benefit guide or net-banking dashboard.

Q2: Does IndiGo flight delay qualify for credit card travel insurance India explained?

Yes, provided that the ticket was bought with an acceptable credit card and the delay beyond the minimum hours specified in your card’s policy. The airline must provide you with written documentation of the disruption.

Q3: Are credit card travel insurance policies in India activated by MakeMyTrip or other online travel agencies?

Actually. The payment method, not the booking location, determines the coverage. The bonus is activated as long as you pay with an approved credit card (not UPI).

Q4: Will medical emergencies abroad be covered under credit card travel insurance India explained?

While most cards provide medical emergency coverage when traveling abroad, their limits are frequently less than those of standalone insurance. It’s advisable to check restrictions while visiting nations with high healthcare costs.

Q5: Are my kids and spouse also covered?

The principal cardholder is typically the only one who is automatically protected. Before traveling, confirm whether dependent family members are eligible for perks from certain premium cards to prevent making assumptions.

Q6: What paperwork is needed to properly submit a claim?

Usually required are boarding cards, trip invoices, airline documentation of delays or cancellations, and receipts for necessities. To prevent rejection, claims must be filed within the insurer’s time frame.

Disclaimer

This article on credit card travel insurance India explained gives basic info for learning purposes. Because each card company works differently, check your provider for exact perks. Not meant as financial guidance or insurance details. Since claims need proof, they’re approved only after review.