Discover how debt consolidation for EMI relief in India works, its benefits, risks, eligibility, and the exact process. Learn how combining multiple loans into one structured repayment plan can reduce stress, optimize cash flow, and improve financial discipline. #debt consolidation for EMI relief in India, #EMI relief solutions India, #simplify loan repayments India, #consolidate multiple EMIs, #single EMI repayment plan, #manage loan burden India, #reduce EMI stress.

Introduction

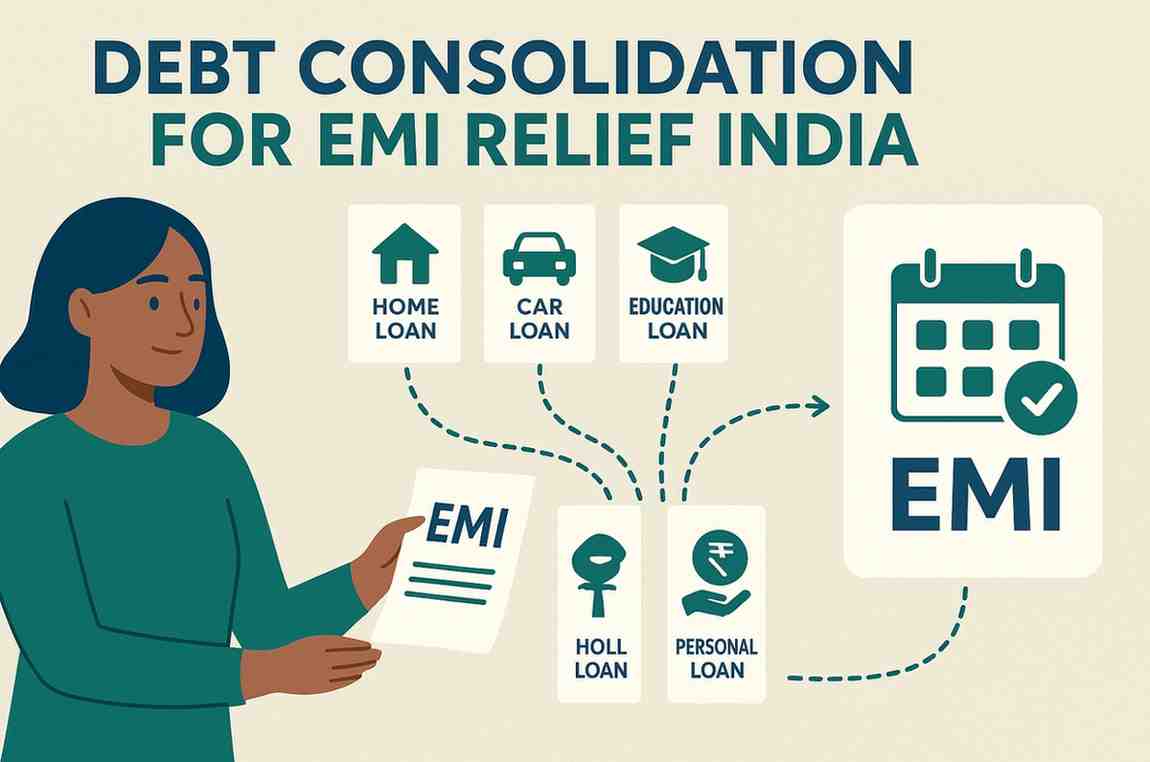

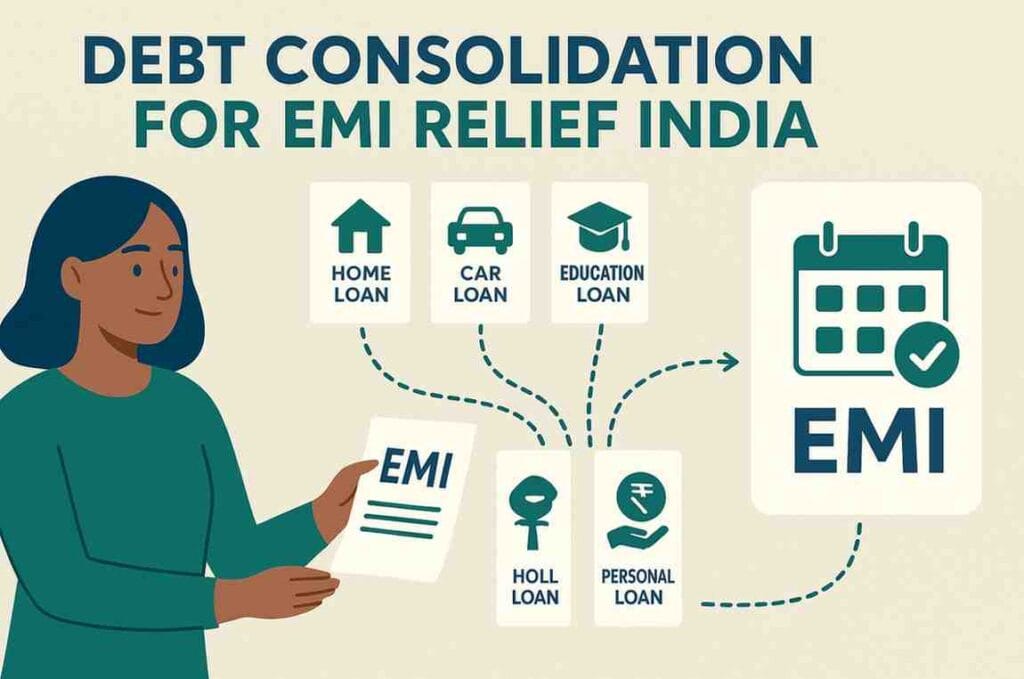

Handling several EMIs at once is normal these days across India, thanks to folks using credit cards along with personal loans or home financing. When payment deadlines start piling up while interest keeps adding, stress around money usually follows. This is where debt consolidation for EMI relief in India has evolved as a successful financial technique that helps debtors to bundle all outstanding dues into a single, structured loan with predictable payback conditions.

The idea’s picked up speed since it helps people juggle lots of loan payments at once – bringing order, ease, and structure. Instead of chasing different due dates, folks combine various debts into a single plan, which makes budgeting easier while easing stress from scattered EMIs. Lenders across the nation now roll out specific packages aimed at working employees, freelancers, and everyday customers looking for simpler payback terms.

This article covers the benefits and downsides of debt consolidation for EMI relief in India, here’s how it goes – who qualifies, what the payback plan looks like, plus key steps you need to take so this actually helps your money situation. Stuff pulled from real banking reports, official updates, and trusted finance sources.

Also Read: 7 Shocking Hidden Charges in Personal Loans You Must Avoid

Understanding Debt Consolidation in India

Debt consolidation combines what you owe – like credit cards, personal loans, store financing, or added borrowing – into just one loan. Rather than juggling several payments each month with varying rates and deadlines, you handle only one payment on a regular basis. The fundamental goal of debt consolidation for EMI relief in India is to give borrowers with predictable repayment conditions and alleviate the tension of managing several commitments.

Banks look at how much you owe on different loans, then add it up into one single debt. This new loan often comes with a set repayment period along with a steadier interest charge instead of changing rates. Since everything’s rolled into just one monthly payment, planning your spending gets simpler. With fewer bills to track each month, staying in control of money feels less overwhelming.

Why Debt Consolidation Works for EMI Relief

The biggest advantage of debt consolidation for EMI relief in India is the clarity it introduces. A single payment clears up the mess of juggling due dates or shifting rates. When expensive card bills turn into one steady instalment, people drowning in debt finally catch a break.

Most people who borrow money struggle less with earning enough – more with timing payments around several monthly dues. With debt consolidation for EMI relief in India, unorganized debt changes into a streamlined framework, eliminating financial concern and protecting credit scores.

Also Read: Personal Loan Terms Explained for Beginners in India: 10 Key Concepts to Master and Save Big

Working Mechanism of Debt Consolidation Loans

Banks start by looking at the overall amount owed. After approval, cash are instantly delivered to lenders instead of transferring money to the borrower. This ensures that every responsibility is closed properly. After this, the borrower obtains a new EMI cycle under debt consolidation for EMI relief in India with specified dates and terms. The system helps borrowers maintain consistency and lowers the likelihood of missing payments.

Once the consolidated loan activates, borrowers track only a single EMI, making it easier to budget without confusion.

Benefits Explained in Descriptive Detail

The biggest perk of merging debts for EMI ease in India? It eases both stress and cash strain. Juggling multiple payments wears you out – having just one payment lightens the mental weight right away.

Borrowers get steady money coming in each month. Since every payment’s bundled into a single schedule via debt consolidation for EMI relief in India, late fees drop sharply when due dates are missed.

Borrowers gain from steady rates that last over time. Because handling EMIs in India is about easing payments, lenders provide flexible payback periods – these align with how money comes in each month.

On top of that, stretched payback terms from merging debts to cut EMIs in India give breathing room when cash is tight – though you might end up paying a bit more in interest. While it’s not perfect, this setup helps folks manage short-term money problems without snapping under pressure. Even so, the extra time can mean higher overall costs down the road, yet still brings some ease now.

Risks and Awareness Factors

Though helpful, people borrowing money should know about some downsides. A longer repayment period when combining debts for lower EMIs in India can ease payments each month – yet lead to paying more interest overall.

Banks often add extra charges when adjusting loans. Before agreeing, people should see if the savings beat the price.

Long-term debt is another issue. Borrowers must remain disciplined and refrain from taking out new loans, even under debt consolidation for EMI relief in India.

Borrowers can employ consolidation responsibly if they are aware of these hazards.

Also Read: 8 Alarming Missed Personal Loan EMI Consequences You Need to Understand Now

Eligibility Criteria in India

Banks that provide debt consolidation for EMI relief in India evaluate credit ratings, employment status, and income stability. A score above 700 raises approval prospects greatly.

Lenders look at how well you’ve paid back loans before. A bunch of missed payments or resolved debts? That makes approval less likely. You need current debt – this option’s meant for combining what you owe right now.

How the Repayment Model Works

After approval, debt consolidation for EMI relief in India sends money straight to creditors. From there, borrowers get a single, clear payment plan. Payments happen smoothly through automatic bank deductions.

Thanks to debt consolidation offering EMI relief in India, people skip juggling multiple due dates – this means fewer late payments or hits to their credit scores.

Key Points Borrowers Must Verify

Borrowers need to confirm each loan’s shutdown when bundling debts for EMI relief in India – so grab fresh payoff slips from every lender involved. That way, nothing gets missed or mixed up later on.

Borrowers should check that the new payment fits their month-to-month cash flow. When installments are way too small, it could lead to a stretched-out loan term – racking up more interest over time.

Checking interest rates matters just as much. Though combining debts eases monthly payments in India, people should weigh what it costs over time.

Repayment Schedules Explained

Repayment plans change if the loan’s backed by collateral or not. When merging debts to lower EMIs in India, lenders set payback periods, charges, and monthly amounts using how steady your earnings are plus past borrowing habits.

Borrowers who earn steady money usually land nicer deals – on the flip side, freelancers might snag longer repayment windows.

A Real-Life Scenario Based on Industry Patterns

A person managing four separate loans might feel overwhelmed. Choosing debt consolidation for EMI relief in India lets the bank combine everything into one total. It pays off each lender right away on their behalf. Now, they only handle one clear monthly payment rather than several random ones.

This change cuts down tension, stops unexpected holdups – while making your monthly spending easier to follow.

Also Read: Managing too many EMIs? Here’s how debt consolidation schemes can simplify your repayment

The Smart Way to Use Debt Consolidation

Borrowers using debt consolidation for EMI relief in India do best when they stay responsible. The aim? To regain solid finances – without grabbing new loans right away. Keeping control during the entire period leads to steady money improvements over time.

Borrowers need to stay steady – skip fresh loans while knocking out their merged payment smoothly. They shouldn’t waver, take on more debt, yet keep pushing toward finishing what’s owed. Staying sharp matters since slipping up could slow progress down fast.

Conclusion

Debt consolidation for EMI relief in India can be an effective instrument for a financial reset when handled properly. It simplifies complicated repayment cycles into a single, manageable EMI, lowers stress, and enhances repayment discipline. Borrowers can restore financial clarity, increase creditworthiness and focus on long-term stability with debt consolidation for EMI relief in India as a structured assistance system.

FAQs

Q1: Is debt consolidation safe?

Indeed, since banks pay lenders directly, debt consolidation for EMI reduction in India is secure. A predictable repayment schedule is advantageous to borrowers.

Q2: Does interest decrease with consolidation?

It varies. Debt consolidation for EMI relief India reduces the burden of EMIs, but if the tenure is lengthy, total interest may increase.

Q3: Will my credit score improve?

Yes, you can greatly improve your credit score by making regular EMI payments under debt consolidation for EMI relief India.

Q4: Can anyone apply?

Applicants need consistent income, active liabilities and a reasonable credit score to qualify for debt consolidation for EMI relief India.

Q5: Are interest rates higher?

Some unsecured consolidation loans may have higher rates. Borrowers must check costs before choosing debt consolidation for EMI relief India.

Disclaimer

This article on debt consolidation for EMI relief India is meant to inform – not to give financial guidance. Since loan approval, rates, or conditions differ depending on the lender, your background, or how markets shift, it’s smart to talk with an approved advisor or directly contact your bank prior to deciding anything money-related.