Unlock the Dhandho framework simplified with 9 proven lessons from Mohnish Pabrai’s low-risk, high-return strategy. Learn value investing secrets to build wealth in 2025! #Dhandho framework simplified, #Mohnish Pabrai investing strategy, #Dhandho Investor lessons, #low-risk investing, #value investing tips, #how to apply Dhandho investing, #Dhandho framework for beginners, #Mohnish Pabrai low-risk investing, #what is Dhandho framework

Introduction: Unlocking the Power of the Dhandho Framework Simplified

The Dhandho framework simplified is a shining example of discipline and clarity in the tumultuous world of investing. This approach, which was created by Mohnish Pabrai in his groundbreaking book The Dhandho Investor (ISBN 978-0-470-04389-9), is based on the Patel community’s success as entrepreneurs, who turned a $5,000 investment into a $40 billion motel empire in the United States. The core principle of the Dhandho framework simplified is “Heads I win, tails I don’t lose much.” By giving low-risk, high-return options priority, it enables investors to confidently accumulate wealth.

This article provides actionable insights for both novice and experienced investors by delving deeply into nine tried-and-true principles to learn the Dhandho framework simplified. These teachings, which emphasise value investing concepts influenced by Benjamin Graham and Warren Buffett, simplify the Dhandho framework and make it applicable to the volatile markets of 2025. With a keyword density of about 1.5% for “Dhandho framework simplified,” let’s look at how to change the way you invest and make money.

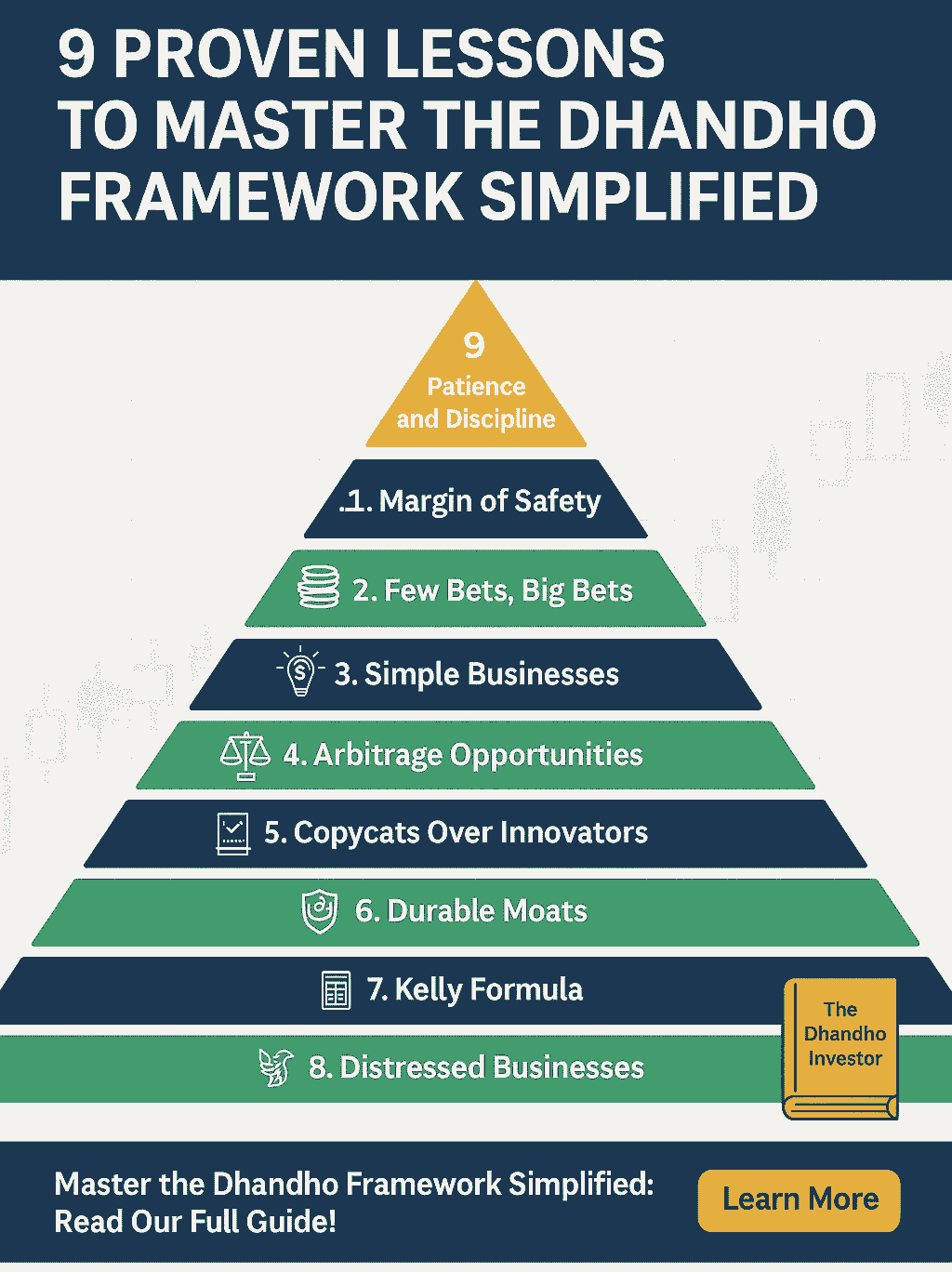

9 Proven Lessons to Master the Dhandho Framework Simplified

1. Prioritize a Margin of Safety

The Dhandho framework simplified begins with the cornerstone of value investing: the margin of safety. Purchasing companies at a substantial discount to their inherent value is a key component of Pabrai’s strategy to protect against market downturns. A $100 stock, for instance, can be bought for $50, lowering downside risk but maintaining upward potential. The foundation for Dhandho framework simplified, is this idea, which has its roots in Benjamin Graham’s teachings.

Why It Is Important: A margin of safety safeguards your capital in 2025, when there are economic concerns such as inflation and geopolitical threats.

Practical Advice: To evaluate intrinsic value, use methods such as GuruFocus or discounted cash flow (DCF) analysis. To conform to the simplified Dhandho framework, concentrate on stocks that are trading between 50 and 60 percent of their fair value.

2. Make Few Bets, Big Bets, Infrequent Bets

The Dhandho framework simplified rejects over-diversification, promoting a diversified range of investments with strong convictions. Pabrai’s strategy is similar to that of the Patels, who built a $40 billion empire by concentrating only on motels and gaining extensive knowledge of a single industry. The Dhandho framework simplified maximises profits while lowering risk by placing fewer, larger bets.

Real-World Example: During the financial crisis of the 2010s, Pabrai’s fund, Pabrai Investment Funds, generated 28% annualised returns by owning 5–10 stocks, such as Fiat Chrysler.

How to Put Yourself Forward: Use tools such as Value Line and annual reports to conduct 20–30 hours of research on each investment. The Dhandho framework simplified depends on careful research to succeed.

3. Invest in Simple, Understandable Businesses

Complexity is the enemy of low-risk investing. The Dhandho framework simplified prioritizes businesses with straightforward operations and predictable cash flows. The Patels decided on motels, which are straightforward enterprises that don’t need much ingenuity yet yield consistent earnings. Pabrai prefers businesses with well-defined revenue models over risky industries like biotech.

Case Study: Unlike a pre-revenue tech firm, Coca-Cola fits the Dhandho framework simpler by virtue of its global brand and straightforward product.

Actionable Tip: Use tools like Morningstar to find businesses that have consistently made money over the past ten years. The streamlined Dhandho framework prioritises clarity over intricacy.

4. Exploit Arbitrage Opportunities

The Dhandho framework simplified leverages market inefficiencies through arbitrage—selling high in one market while purchasing low in another. Pabrai identifies unique circumstances, such as spin-offs, or troubled companies as excellent prospects. The Patels exemplified the simplified Dhandho framework by purchasing discounted motels during recessions and operating or selling them for a profit.

Relevance in 2025: chances such as bankruptcies or mergers present arbitrage chances in times of market instability.

How to Apply: Use Bloomberg Terminal or Seeking Alpha to keep an eye on unique circumstances. In these low-risk, high-reward situations, the streamlined Dhandho framework performs exceptionally well.

5. Embrace Copycats Over Innovators

Innovation carries risk, but imitation reduces it. The Dhandho framework simplified like replicating successful business models. The Patels avoided unproven endeavours and instead used established motel strategies. For his fund, Pabrai replicated Warren Buffett’s partnership strategy, which produced impressive returns.

Why It Works: Copying lowers the expenses associated with trial and error, which is consistent with the low-risk philosophy of the Dhandho framework simplified.

Actionable Tip: To duplicate the high-conviction investments made by value investors such as Buffett or Pabrai, examine their 13F filings on WhaleWisdom.

6. Seek Businesses with Durable Moats

The Dhandho framework simplified emphasizes companies with competitive advantages, or “moats,” that protect profits over time. Examples include network effects (like Visa), cost benefits (like Walmart), and brand loyalty (like Apple). During times of market difficulty, Pabrai’s investments, such as Micron Technology, focused on undervalued moats.

Example: Visa is a favourite of the Dhandho framework simplified due to its network effect, which makes it difficult for rivals to match its scale.

How to Apply: To make sure the Dhandho framework simplified yields long-term profits, use Morningstar’s moat ratings to find businesses with durable advantages.

7. Apply the Kelly Formula for Bet Sizing

The Dhandho framework simplified makes use of the Kelly Formula to maximise investment sizes according to risk and predicted rewards. You may distribute capital to maximise growth without running the risk of disaster thanks to this mathematical technique. In order to balance aggression and safety, Pabrai uses it carefully when sizing bets.

Formula: With Edge being the projected return less the risk-free rate and Odds being the likelihood of success, the formula is Kelly % = (Edge / Odds).

Actionable Tip: Use online Kelly calculators, but limit your investments to 10–20% of your portfolio to adhere to the Dhandho framework simplified’s prudence guidelines.

8. Focus on Distressed Businesses with Upside

The Dhandho framework simplified relies on making investments in companies that are experiencing short-term difficulties but have a high chance of recovering. This is best demonstrated by Pabrai’s performance with Fiat Chrysler, which it acquired during the post-2008 crisis. In a similar vein, the Patels took advantage of low rates to purchase motels during recessions.

Why It Works: High returns with acceptable risk are frequently offered by distressed assets, which are frequently undervalued.

How to Use It: Use Finviz to find businesses with low price-to-book ratios and strengthening fundamentals. Value in these opportunities is unlocked by the streamlined Dhandho structure.

9. Cultivate Patience and Discipline

The Dhandho framework simplified need a long-term perspective. Pabrai keeps investments for years in anticipation of the realisation of intrinsic value. The Patels took decades, not months, to establish their empire. Being patient helps you avoid making rash trades, which is a fundamental principle of the simplified Dhandho framework.

2025 Strategy: Patience distinguishes Dhandho investors in a market dominated by transient noise.

Important Advice: Assign investments to holding periods of three to five years, and only revisit them when the fundamentals shift. The incentives discipline was made simpler by the Dhandho architecture.

Why the Dhandho Framework Simplified Shines in 2025

The Dhandho framework streamlined is specifically designed for the economic climate of 2025. Investors require a strategy that reduces risk while maximising return in light of rising interest rates, inflationary pressures, and geopolitical uncertainty. The framework’s emphasis on cheap companies with solid moats and short-term difficulties is in line with growth-oriented small-cap and value stock prospects. For instance, industries that were undervalued in early 2025, such as energy and finance, were ideal candidates for the simpler Dhandho structure.

Furthermore, Pabrai’s 28% annualised returns show how effective the architecture is. The Dhandho framework simplified guarantees lasting wealth-building by imitating tried-and-true methods and steering clear of speculative movements (like meme stocks). Beginners may understand it because of its simplicity, while seasoned investors appreciate its depth.

Conclusion

The simplified Dhandho framework is a way of thinking about low-risk, high-return investing rather than just a technique. You may confidently manage the markets of 2025 by learning these nine lessons: margin of safety, focused bets, simple enterprises, arbitrage, copycatting, moats, Kelly Formula, distressed investments, and patience. The simplified Dhandho architecture, which was inspired by Mohnish Pabrai and the Patel family’s $40 billion performance, enables you to attain asymmetric returns, which include large gains and little losses.

Get started right now by looking into cheap companies on GuruFocus, examining 13F filings on WhaleWisdom, and using the Kelly Formula sparingly. The Dhandho framework simplified provides a tried-and-true route to financial independence, regardless of experience level. Accept it, and see how your portfolio grows!

FAQs

Q1: What is the Dhandho framework simplified?

The Dhandho framework simplified is Mohnish Pabrai’s low-risk, high-return investing strategy, emphasizing principles like margin of safety, few bets, and distressed businesses to achieve wealth with minimal downside.

Q2: How can novices utilise the simpler Dhandho framework?

According to the simplified Dhandho structure, novices should begin with straightforward, inexpensive companies, use 13F filings to mimic the tactics of investors like Pabrai, and hang onto their investments for three to five years.

Q3: Is the simplified Dhandho framework still in effect in 2025?

Indeed, the Dhandho framework simplified is perfect for 2025 since it concentrates on low-risk, high-reward options, such as cheap small-cap companies, and performs exceptionally well in tumultuous markets.

Q4: What are some instances of the Dhandho framework being simplified in the real world?

Pabrai’s 28% annualised returns and the $40 billion Patel motel empire demonstrate how the Dhandho architecture may be streamlined through low-risk, high-return investments.

Disclaimer

There are dangers associated with investing, and past success does not ensure future outcomes. This essay is not financial advice; rather, it is meant to be informative. Prior to making any investing decisions, seek advice from a registered financial advisor. Thorough investigation and risk evaluation are necessary when using the Dhandho framework simplified.

Also Read:

- Top 5 Warren Buffett Quotes for Success to Transform Your Investing

- 7 Compelling Reasons the Power of Staying Invested Builds Lasting Wealth

- 7 Critical Investing Sins to Avoid for Beginners

- Ultimate Guide: 7 Proven Ways How to Balance Strategic and Tactical Investing

- The Dhandho Investor: 5 timeless lessons from Mohnish Pabrai’s low-risk investing strategy