Discover 7 essential reasons why financial planning beyond assets is crucial for true wealth building. Learn how to master risk management, taxes, and more to secure your financial future and avoid costly mistakes in personal finance. #Financial planning beyond assets, #Holistic financial planning benefits, #Why financial planning matters, #Comprehensive wealth planning tips, #Elements of financial planning, #Why wealth is more than assets, #How to plan finances holistically, #Importance of full financial planning

Introduction

Many people seek riches in today’s fast-paced world by concentrating only on accumulating things like stocks, real estate, or investments. But what if I told you that true financial security lies in financial planning beyond assets? This method acknowledges that having money involves more than just what you own; it also involves safeguarding, maximising, and maintaining it throughout your life. Imagine spending years building wealth just to lose it all because of an unanticipated illness or failure to pay taxes. Devastating, huh? However, you can turn potential hazards into significant chances for long-term success by adopting financial planning that goes beyond assets.

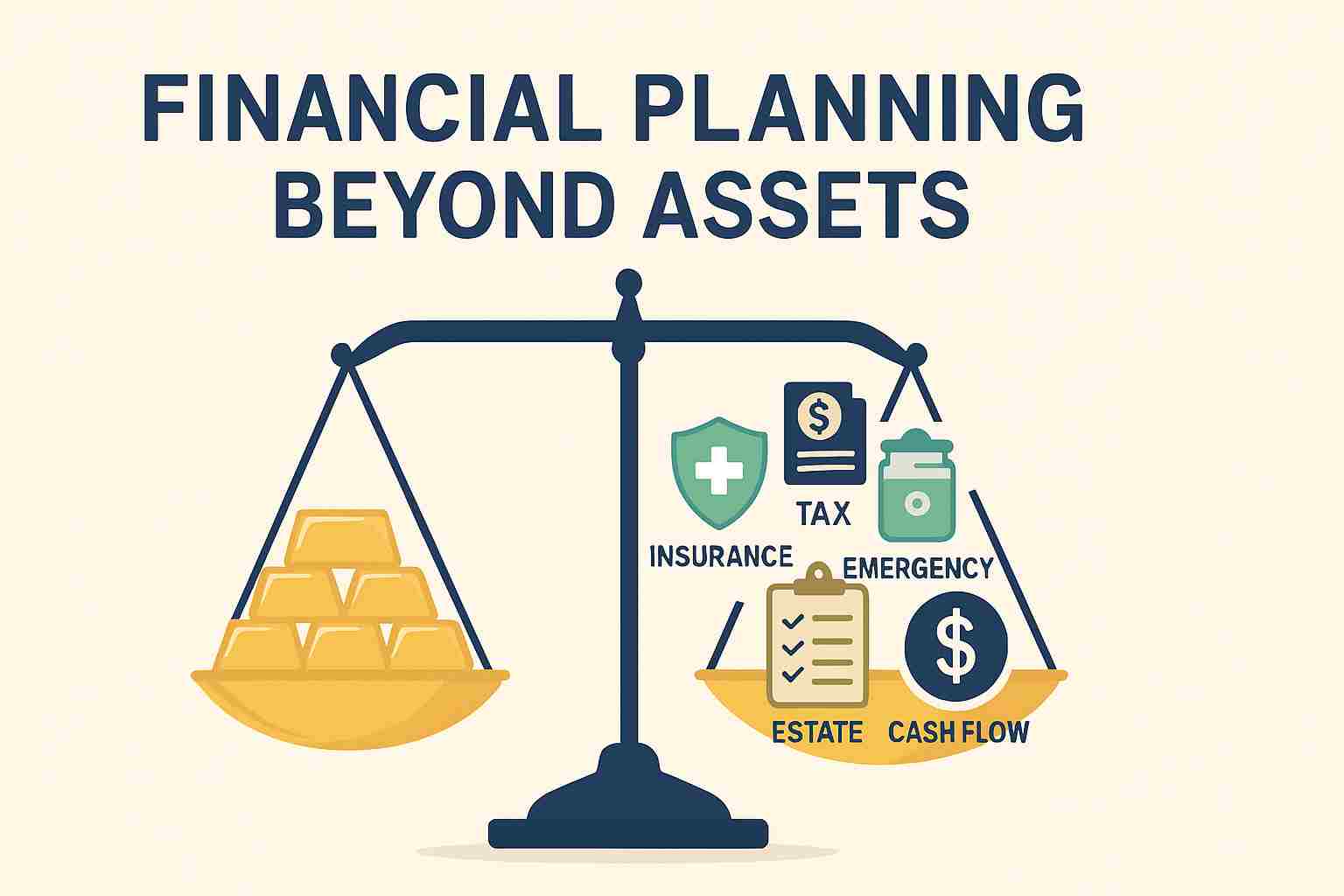

Financial planning beyond assets encompasses a holistic strategy that includes goal setting, risk mitigation, tax efficiency, estate preparation, and behavioural discipline. It distinguishes robust wealth from fragile wealth. In the same way that a chain is only as strong as its weakest link, ignoring any component can jeopardise your efforts, according to thorough personal finance insights. In this in-depth guide, we’ll explore 7 powerful reasons why financial planning beyond assets matters, backed by practical tips to help you avoid common mistakes. Regardless of your degree of investment experience, cultivating this mindset can lead to financial independence and peace of mind. Let’s begin by learning the secrets of generating unstoppable wealth.

Understanding the Core of Financial Planning Beyond Assets

Financial planning beyond assets shifts the focus from mere accumulation to a comprehensive framework that safeguards your future. Insurance, emergency reserves, taxes, and estate plans serve as the pillars that hold everything together, while assets serve as the foundation. Without them, pressure can cause even a strong portfolio to collapse.

Think about this: Years of gain may be erased if you are forced to sell investments at a loss due to an unexpected job loss or health condition. Financial planning beyond assets prevents such scenarios by integrating protective measures. It’s important to manage riches rather than hoard it. True wealth management, according to experts, is matching your financial objectives with your life goals and making sure every choice you make promotes stability and progress.

Also Read: Personal Finance Tasks 2025: 10 Essential Steps to Secure Your Financial Future

Reason 1: Aligning with Life Goals – The Foundation of True Wealth

One of the most compelling reasons for financial planning beyond assets is its emphasis on goals and objectives.Success requires that your assets support your goals, such as paying for your school, purchasing a home, or living well in retirement.

Determine your short- and long-term objectives first. For example, if your goal is financial independence, financial planning beyond assets include setting aside money for growth while budgeting for necessities. Without enough planning, unforeseen circumstances, such medical crises, can cause these to go awry. By establishing specific goals, you develop a plan that transforms idealistic aspirations into attainable realities.

Practical Tip: Track your progress using tools like goal-tracking applications. Keep in mind that financial planning that goes beyond assets guarantees that your wealth benefits your life rather than the other way around. Ignoring this can result in bad choices, but accepting it encourages good things to happen.

Also Read: Smart Personal Finance Habits for Financial Freedom

Reason 2: Mastering Risk Management Through Insurance – Shield Against the Unexpected

Risk management is a cornerstone of financial planning beyond assets, and insurance plays a starring role. Even the wealthiest people can become bankrupt from a single sickness if they do not have proper insurance, underscoring the unfavourable perception of vulnerability in unprepared finances.

Select health insurance that offers advantages like restoration benefits, a sizable sum promised, and covering for everyday costs like bed charges. In times of crisis, this avoids the need to liquidate assets or take on debt. For instance, people with strong insurance remained stable amid world catastrophes like pandemics, while others had difficulties.

Financial planning beyond assets transforms this risk into security. By purchasing comprehensive insurance, you shield your money from catastrophic losses and promote resilience and a healthy sense of control.

Also Read: Why Insurance Is a Smart Financial Decision: 5 Ultimate Reasons

Reason 3: Building Emergency Funds – Your Safety Net for Turbulent Times

No discussion on financial planning beyond assets is complete without emergency funds. Without affecting your primary investments, these liquid reserves cover unforeseen costs like repairs or job loss.

Aim to have three to six months’ worth of living costs in readily accessible accounts, like liquid cash or savings. This protects the value of your assets by preventing distressed sales during market downturns. Examples from the real world demonstrate how pandemics revealed the dangers of insufficient funding, resulting in forced liquidations at a loss.

Negative financial spirals are avoided and peace of mind is gained by including emergency funds in financial planning beyond assets. It’s a strong barrier that transforms possible catastrophes into surmountable obstacles.

Also Read: Why wealth isn’t just about assets—every element of financial planning matters

Reason 4: Achieving Tax Efficiency – Maximize Gains, Minimize Losses

Taxes can erode your wealth if ignored, making tax planning a vital element of financial planning beyond assets. To prevent fines and outflows, it is crucial to comprehend slabs and instrument treatments under dynamic tax regulations.

Calculate taxes every three months using your income and gains. Bank deposits are a better option for lower categories; arbitrage funds are a better option for higher brackets. Interest fees and last-minute hurries are avoided with early filings.

Financial planning beyond assets turns tax burdens into opportunities. You may increase your wealth retention, accelerate growth, and avoid the detrimental effects of inefficiencies by optimising deductions and tactics.

Also Read: Investopedia – Tax Efficiency Strategies

Reason 5: Estate Planning – Ensuring Legacy and Smooth Transitions

Estate planning extends financial planning beyond assets to protect your loved ones. Wills and nominations are essential, particularly when dealing with complex families or liabilities.

Assign investment beneficiaries and make sure that plans are communicated clearly. This makes transfers easier and prevents disagreements or delays in unfavourable situations.

Financial planning that puts an emphasis on estate plans above and beyond assets leaves a great legacy that lasts a lifetime, protecting dependents from adversity and protecting your hard-earned money.

Reason 6: Embracing Behavioural Finance and Savings Habits – The Discipline Driver

Behavioral aspects influence financial planning beyond assets profoundly. Savings is the foundation of wealth, yet bad habits like impulsive spending can impede advancement.

Observe the 50:30:20 rule: set aside 50% for necessities, 30% for indulgences, and 20% or more for savings. To optimise the benefits of compounding, keep EMIs below 50% of income.

Beyond assets, financial planning fosters discipline and transforms bad habits into strong development drivers. Over time, exponential wealth is the result of consistent saving practices.

Also Read: Wealth Growth Tips for 2025

Reason 7: Integrating Debt Management and Retirement Strategies – Long-Term Sustainability

To round out financial planning beyond assets, address debt and retirement. Prioritise paying off high-interest debts while accumulating retirement assets like IRAs or pensions because they might deplete resources.

To fight inflation, diversify your retirement investments beyond assets. This all-encompassing perspective fosters positive financial freedom and avoids the negative perception of retirement deficits.

Beyond assets, financial planning makes sure that debts don’t impede progress, opening the door to a safe future.

Additional Insights: Diversification and Ongoing Review

Beyond the core reasons, financial planning beyond assets involves diversifying across asset classes and regularly reviewing your plan. As the market changes, you must adapt to keep your plan strong.

Add expert guidance for specialised insights that will increase the benefits of your work.

Conclusion

Financial planning beyond assets is the ultimate game-changer for wealth building. You can avoid disastrous traps and unleash transformational potential by addressing goals, risks, taxes, estates, behaviours, debts, and more. Adopt this comprehensive strategy for long-term financial freedom rather than letting a limited focus on assets limit your achievement. Start now: Examine your strategy, accumulate emergency funds, and seek advice from professionals. Your future self will be grateful that you put financial preparation ahead of assets.

FAQs

Q1: What does financial planning beyond assets mean?

It refers to an all-encompassing approach that goes beyond asset building to guarantee long-term wealth stability, encompassing risk management, taxation, estate planning, and saving practices.

Q2: Beyond assets, why is insurance crucial to financial planning?

Insurance acts as a safety net, preventing financial disaster by guarding against medical or other situations that can necessitate asset sales.

Q3: How can I make my financial planning more tax-efficient?

To minimise penalties and optimise retained wealth, submit advances, select tax-efficient investments according to your bracket, and estimate taxes on a quarterly basis.

Q4: What role does an emergency fund play in financial planning beyond assets?

It preserves liquidity and prevents losses in times of crisis by covering unforeseen costs without taking money out of assets.

Q5: How do I start estate planning as part of financial planning beyond assets?

To guarantee a seamless transfer of money to dependents, make sure to connect with family, prepare a will, and add nominations to investments.

Disclaimer

This article does not represent expert financial advice; rather, it is meant to be informative only. For situation-specific advice, speak with a registered financial planner. Risks are associated with investments, and past performance does not guarantee future outcomes.