Explore essential first time education loan tips India for beginners—learn how to apply smartly, choose low-interest options, and repay easily to fund your dreams without stress. #first time education loan tips India, #education loan for beginners India, #how to apply for first education loan in India, #common mistakes first time education loan borrowers India, #documents for first education loan India

Introduction

It’s a thrilling experience to begin your higher education journey, whether in India or overseas, but for newcomers, figuring out the financing might be stressful. That’s where first time education loan tips India come into play, assisting you in confidently navigating the process. These loans can pay for tuition and living expenses, allowing you to concentrate on your studies rather than your problems, regardless of your goals—engineering, medical, or an overseas degree.

Knowing the fundamentals as a first-time borrower is essential to avoiding needless obstacles. First time education loan tips India emphasize starting early, making informed decisions and preparing in advance. Government programs provide additional assistance, while platforms such as Vidya Lakshmi facilitate communication with banks. This guide will explore ten powerful first time education loan tips India to make your borrowing process successful and seamless. These tips, which range from repayment tricks to application tactics, can help you get funding and create a solid financial future. It’s all about making wise decisions from the beginning. Picture using these first time education loan tips India and watching your goals take off without financial constraints preventing you. With the correct first-time college loan advice from India, you can focus on what really matters—your education and personal development—and transform any possible tension into smooth success.

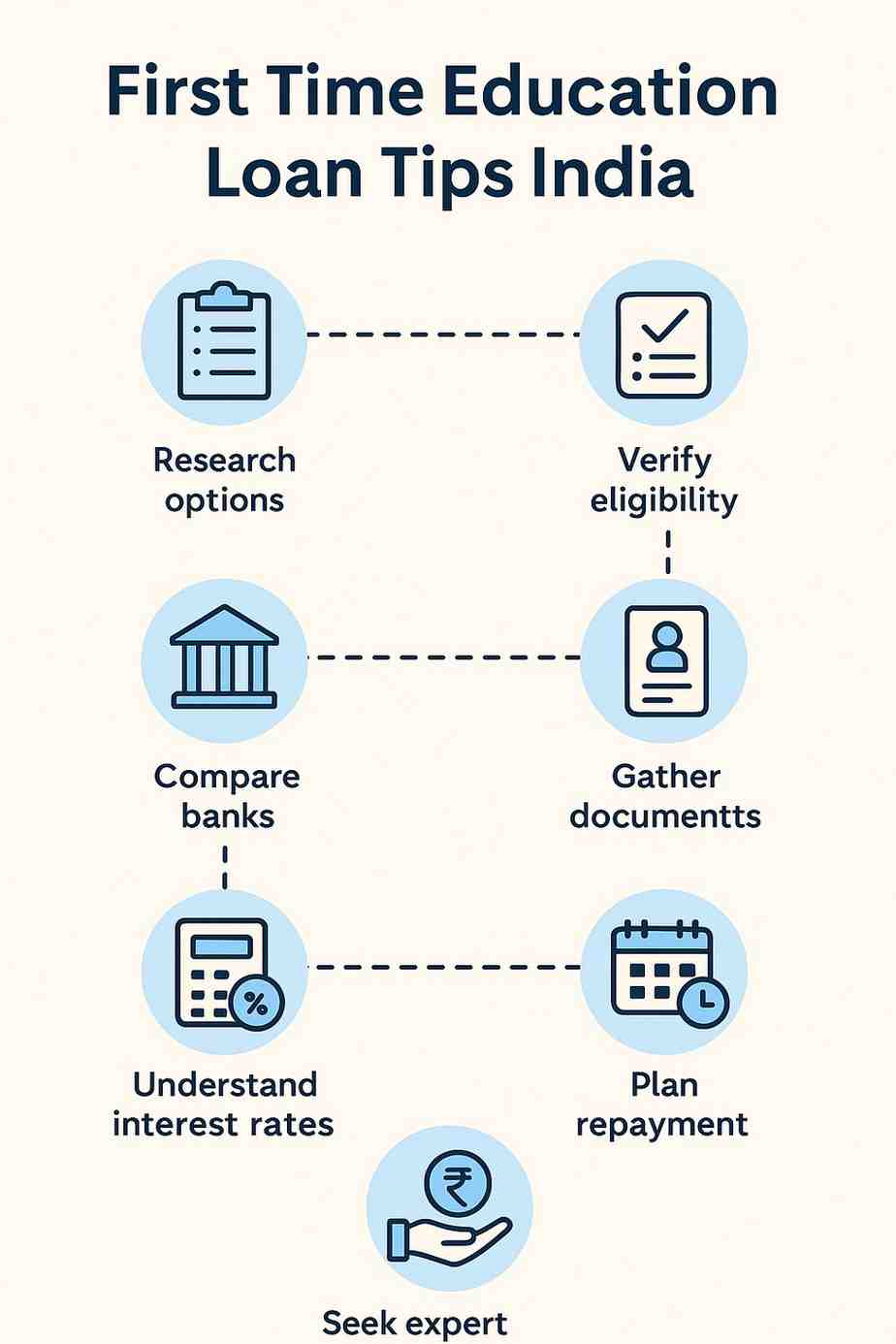

10 Essential First Time Education Loan Tips India

Start with Thorough Research: Empower Your Decisions

One of the top first time education loan tips India is to research options before diving in. Take your time; investigate institutions, plans, and rates to determine what best suits your need. While private banks offer quicker processing for overseas study, public banks frequently have lower rates. To view variations in processing fees and tenure possibilities, for instance, use comparison websites or portals.

To compare, use online portals. This step in first time education loan tips India helps you avoid regrets in the future by ensuring that the loan you choose fits your budget and course. Speak with former students or counsellors who have taken out loans; their experiences demonstrate how neglecting this results in increased expenses while doing it correctly offers comfort. Applying first time education loan tips India identifies the best offer for novices like you by comparing at least three institutions.

Verify Eligibility Criteria Upfront: Prevent Rejections

One of the most important first-time college loan advice in India is to examine your eligibility as soon as possible to avoid the disappointment of denials. You must reside in India and have been admitted to an accredited institution. Co-borrower information and academic results are also important; for example, most require at least 50% on prior tests.

Discounts for girls and specific groups make it even easier to acquire first-time school loan advice in India. Verify these details to increase the likelihood that you will be approved. Gaps, such as missing income proofs, can be found with a rapid self-audit using bank checklists, enabling corrections before to submission. Time and frustration are saved by this proactive approach to first-time college loan advice in India.

Also Read: Essential Marriage Loan Eligibility Criteria You Must Know to Fund Your Dream Wedding

Compare Public vs. Private Banks: Unlock Better Deals

Choosing the right lender is among the best first time education loan tips India. For domestic courses, public banks like as SBI or Canara offer longer moratoriums and reasonable rates. Private alternatives, which frequently approve in a matter of days with extra services like forex assistance, are ideal for urgent demands when travelling abroad.

Weigh pros and cons in these first time education loan tips India to secure terms that ease your repayment journey. Think about your schedule; even if private lessons are a little more expensive, they can be your best option if school abroad begin soon. Astute comparison using advice for first-time student loans Over the course of the loan, India can result in huge savings.

Gather Documents Efficiently: Speed Up Approval

Messy paperwork can delay everything, so organize early as per first time education loan tips India. For your co-borrower, gather admission letters, identification documents such as Aadhaar and PAN, fee schedules, and income records. Include cost estimates and documents of visas for overseas study.

Digital tools, such as uploading through applications, facilitate faster submission. By following these first-time college loan tips in India, you can expedite the funding process and reduce waiting times. To make a potential nightmare into a breeze, organise your files on your computer or phone into folders. Here, efficiency is at the heart of useful first-time college loan advice from India.

Understand Interest Rates Deeply: Minimize Costs

Grasping rates is a game-changer in first time education loan tips India. For flexibility, choose floating rates that are based on market fluctuations; these rates may decrease if the economy improves. Look for discounts offered to excellent performers or to particular groups, such as women’s 0.5% off.

This information from India’s first-time college loan advice keeps your total load light and controllable. Create scenarios with bank calculators; what if interest rates increase? With first-time college loan advice India, preparing for it increases resilience and guarantees you can borrow money at a reasonable rate.

Also Read: How to Reduce Personal Loan Interest Rate: A Step-by-Step Guide

Plan Repayment from the Start: Ensure Smooth Payback

Thinking about repayment early is smart in first time education loan tips India. The moratorium allows time to study and look for a career, but after that, get ready for EMIs. Select terms that correspond with your professional development; for example, if your initial pay is low, consider extending to 15 years.

Reduce effective costs by incorporating tax benefits under Section 80E. These first-time college loan suggestions in India also help to ease the burden of loan settlement. Set up partial prepay reminders, which reduce interest without penalties after the first few months and are ideal for beginners looking for first-time university loan advice in India.

Leverage Government Schemes: Gain Extra Benefits

As said in first-time college loan suggestions India, take advantage of subsidies and portals such as Vidya Lakshmi for benefits. Interest during studies is covered by programs for low-income families or members of under-represented groups, greatly reducing the burden.

These options in first time education loan tips India can make borrowing more affordable and supportive. Applying through the portal gives you one-stop access to several banks, streamlining what may otherwise be a disorganised search and increasing the usefulness of India’s first-time education loan advice.

Also Read: Unlock Extra Funds: 7 Must-Know Personal Loan Top-Up Eligibility Criteria for Fast Approval

Steer Clear of Common Mistakes: Dodge Pitfalls

Ignoring fine print leads to surprises—avoid this with first time education loan tips India. Don’t take out more loans than you need or neglect to check your co-borrowers’ credit. To identify hidden costs like processing or insurance add-ons, carefully read the conditions of fees and prepayments.

You can avoid unforeseen fees and regrets by paying attention to these cautions in the first-time education loan advice India. Learn from others’ mistakes: taking out too much debt for pleasures might lead to unsustainable debt, but you can avoid this by adhering to first-time education loan advice India.

Also Read: Disadvantages of Personal Loans You Need to Avoid

Consider Insurance Coverage: Add Security Layer

Loan insurance safeguards against uncertainties, a protective step in first time education loan tips India. It gives you and your family peace of mind without adding to your family’s load by covering outstanding sums in difficult circumstances like accidents.

For total protection, include this in your first-time education loan tips India plan. For risk-averse newcomers using first-time college loan recommendations India, it’s typically required or inexpensive, adding a modest charge but a massive safety net.

Seek Expert Guidance Regularly: Stay Informed

Consult bank advisors or online resources for personalized advice, rounding out first time education loan tips India. Use applications to track the status of your loan and refinance if better rates become available later.

This continuous strategy for first-time college loan advice in India keeps you flexible and ahead of the game. Join student forums to get practical advice on how to maximise your first-time education loan application in India and transform solo navigation into community-supported success.

Also Read: Tips for first-time education loan borrowers in India

Conclusion

Applying these 10 first time education loan tips India prepares you for a successful borrowing experience. You now have the means to pay for your education without taking on excessive debt thanks to diligent payback and astute study. Take advantage of first-time education loan advice in India to transform goals into reality; put it into practice now for a better, debt-free future. You’re investing in an empowered future full of options when you have these first-time education loan advice India in your toolbox, rather than merely taking out a loan. Act now to see how these first-time education loan suggestions from India might turn your academic journey into a successful tale.

FAQs

Q1: How do I begin applying using first time education loan tips India?

To complete online forms, go to the bank’s website or the Vidya Lakshmi Portal. Obtain the necessary paperwork, such as IDs and admittance letters, and submit it with the co-borrower’s details. For a quicker approval time (usually 7–15 days), these first-time college loan suggestions from India advise determining eligibility first.

Q2: How does a co-borrower function in India’s first-time education loan guidelines?

Co-borrowers, who are frequently parents, share repayment responsibilities and increase acceptance by providing proof of income. Rates are influenced by their credit score; first-time college loan advice India advises choosing a reliable applicant to access unsecured and reduced interest options.

Q3: Can I use these first-time education loan tips in India to pay off my debt early?

Yes, most permit penalty-free floating rates after six to twelve months. According to first-time education loan recommendations India, it lowers overall interest. To reduce tenure and improve credit, employ job bonuses.

Q4: Are there concessions for girls in first time education loan tips India?

Indeed, a lot of banks provide rate cuts of between 0.5 and 1%. India’s first-time education loan advice suggests looking at girl-specific programs, such as those offered by SBI, to reduce expenses and advance equality.

Q5: How can first-time Indian students who are studying abroad manage their education loans?

Give breakdowns of expenses, passports, and visas. Select foreign-focused lenders and get advice on first-time student loans. To reduce foreign exchange risks and pay for living expenses, travel, and education, India prefers rupee loans.

Q6: What if I face repayment issues per first time education loan tips India?

For EMI restructuring or grace extensions, get in touch with your bank. India’s first-time education loan advice emphasises on tax benefits to manage the flow without defaults and setting up a buffer reserve during the moratorium.

Disclaimer

This article on first time education loan tips India is intended solely for informative purposes and does not represent expert financial, legal, or investment advice. Regulations, individual profiles, and lenders all affect loan terms, rates, and eligibility. For specific advice, always check with banks, certified experts, or government agencies. Any choices, losses, or results resulting from this content are not the responsibility of the author or publisher.