Learn how many mutual funds to hold to create a diversified, high-performing portfolio. Discover expert strategies, avoid costly pitfalls, and optimize your investments for long-term wealth growth. #how many mutual funds to hold, #ideal number of mutual funds, #mutual fund diversification, #how many mutual funds for beginners, #best number of mutual funds, #mutual fund portfolio size, #diversify mutual funds, #mutual funds for small investors

Introduction: Why Knowing How Many Mutual Funds to Hold? Is a Game-Changer

Mutual funds, which provide professional management and diversification, are an effective tool for building wealth. However, one query frequently baffles investors: How many mutual funds to hold? The performance, risk profile, and manageability of your portfolio can all be influenced by this choice. While having too many funds might result in increased fees, overlap, and complexity, having too few funds could expose you to market instability. In this in-depth guide, we’ll answer How many mutual funds to hold? with nine tried-and-true methods, practical examples, and doable advice to help you, whether you’re a novice or an experienced investor, maximise your investments for long-term success.

The Importance of Deciding How Many Mutual Funds to Hold?

Choosing How many mutual funds to hold? is a strategic decision that impacts your portfolio’s success. Diversification, cost reduction, and alignment with your financial objectives are all guaranteed by a well-calculated figure. Let’s look at nine tried-and-true methods for figuring out how many mutual funds to own. in order to generate the most wealth possible.

Achieve Optimal Diversification

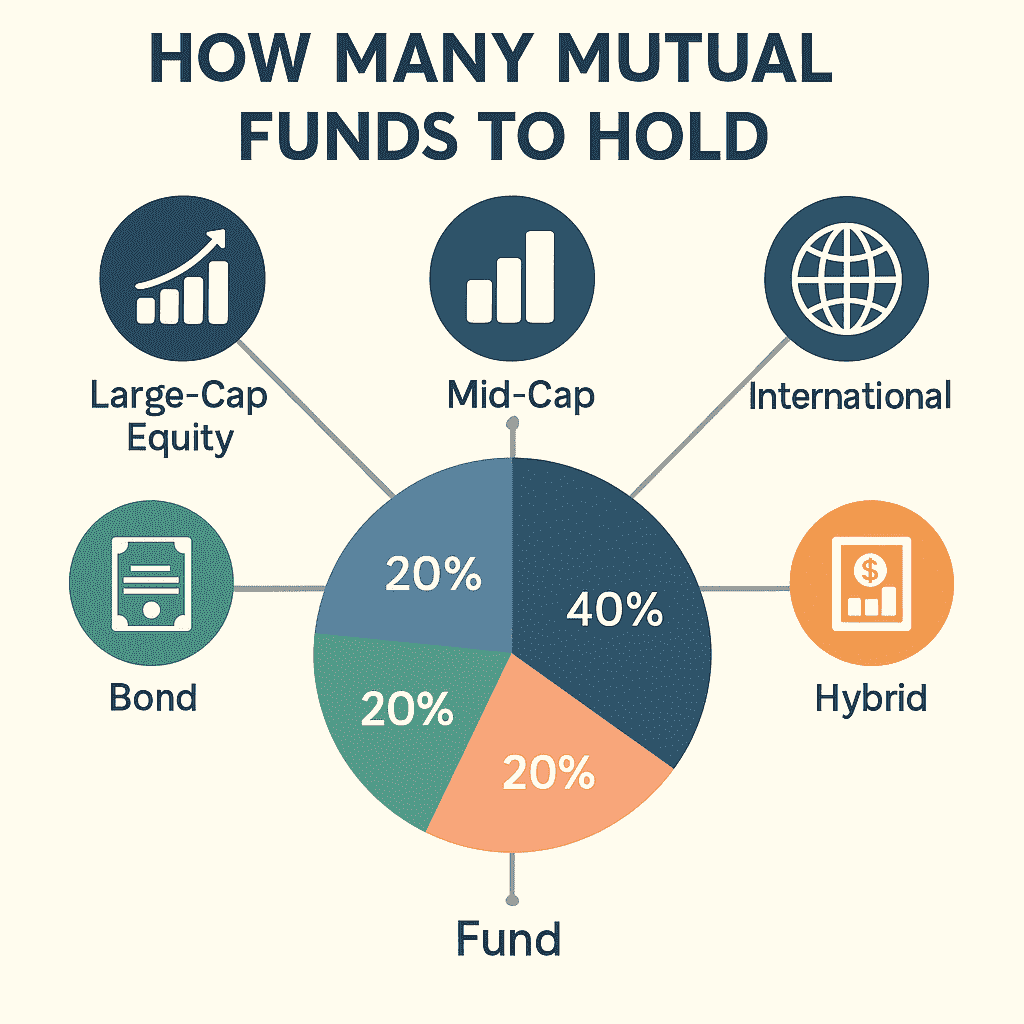

Diversification is the bedrock of a resilient portfolio, and deciding How many mutual funds to hold? is key to achieving it. To diversify assets across sectors (large-, mid-, and small-cap) and asset classes (equity, debt, and hybrid), experts advise using four to eight mutual funds. The impact of a single fund’s poor performance is lessened by this range. For instance, a Vanguard study on diversity found that a portfolio of one large-cap equity fund, one mid-cap fund, one corporate bond fund, and one hybrid fund can reduce volatility by as much as 20%. By carefully answering How many mutual funds to hold?, you protect your wealth while pursuing growth.

Think about a novice who wants to invest $15,000. Broad exposure without complexity can be achieved by allocating 40% to a large-cap fund, 25% to a bond fund, 20% to a hybrid fund, and 15% to an international fund. This approach to How many mutual funds to hold? ensures robust diversification.

Avoid Over-Diversification Pitfalls

Diversification lowers risk, but too much mutual fund holding can result in over-diversification, which lowers returns and raises expenses. When considering How many mutual funds to hold?, exceeding 10-12 funds often results in overlapping holdings, mimicking an index fund but with higher fees. For example, there is no special advantage in having many large-cap funds with comparable equities (like Apple and Amazon). Effective diversification is ensured by a portfolio of four to eight funds that are chosen to avoid overlap. By focusing on How many mutual funds to hold?, you maintain a lean, high-performing portfolio.

Simplify Portfolio Management

Overly large portfolios are difficult to manage and prone to mistakes. Selecting the right number of mutual funds to hold—ideally 4–8—makes tracking, rebalancing, and market adjustments easier. For instance, you may rapidly determine whether your stock funds are outperforming your debt funds if your portfolio is small. According to a 2023 Morningstar survey, investor satisfaction was better in portfolios with fewer, carefully selected funds since they were easier to administer. You may maintain control and save time by optimising How many mutual funds should hold?

An investor with a $50,000 portfolio, for example, can more readily keep an eye on five funds (large-cap, mid-cap, bond, hybrid, and foreign) than fifteen. With this knowledge, how many mutual funds should I own? a crucial choice for effectiveness.

Minimize Costs for Higher Returns

Long-term returns may be eroded by the expense ratios that mutual funds charge, which are normally between 0.5 and 2% per year. These expenses rise with excessive fund holdings, particularly if they overlap. By determining How many mutual funds to hold? (4-8 is ideal), you minimize fees while maintaining diversification. With expense ratios frequently less than 0.5%, selecting inexpensive index funds or exchange-traded funds (ETFs) can result in decades of savings. Fidelity’s guide to mutual fund fees states that a 1% yearly cost reduction can increase returns by 20% or more. When deciding How many mutual funds to hold?, prioritize low-cost funds to keep more of your wealth.

A $100,000 portfolio with an average expenditure ratio of 1.5%, for instance, pays $1,500 in fees every year. Cutting to 0.5% results in an annual savings of $1,000, which increases dramatically over time. This emphasises how crucial it is to know how many mutual funds to own.

Align with Your Risk Tolerance

One important consideration while responding is your risk tolerance. What number of mutual funds should I own? Conservative investors who value stability can like three to five products that emphasise debt or hybrid funds. In search of growth, aggressive investors may select 6–8 funds with a greater proportion of equity. Young investors preparing for retirement, for instance, might allocate 70% of their money to large-, mid-, and small-cap equity funds and 30% to bond and hybrid funds, for a total of six funds. A retiree may choose to invest in four funds, 60% of which would be debt and hybrid funds. Your comfort level and objectives will be met by a portfolio that is tailored to your risk tolerance.

Focus on Quality for Superior Returns

Knowing How many mutual funds to hold? allows you to concentrate on high-quality funds with strong track records. Choose the best performers in each area rather than distributing your assets too widely. For example, a portfolio comprising corporate bond funds, mid-cap funds, large-cap equity funds (which track the S&P 500), and hybrid funds can all produce strong returns without overlapping. According to a Schwab study, portfolios with four to eight carefully selected funds performed 1% better annually than those with twelve or more funds. By carefully choosing how many mutual funds to own, you can increase the potential return on your portfolio.

A 10-year annualised return of 10% for a large-cap fund, 12% for a mid-cap fund, 5% for a bond fund, and 7% for a hybrid fund might be selected by an investor. This focused approach to How many mutual funds to hold? maximizes returns.

Adapt to Market Dynamics

Your portfolio should be dynamic, just like the markets are. Do you know how many mutual funds you should own? The best range is 4–8, which allows you to adjust allocations in response to market conditions. For instance, you could reallocate from bond funds to enhance your exposure to equity during a bull market. You could switch to debt funds for steadiness in a bad market. You can change course without feeling overburdened if you have a reasonable amount of money. By optimizing How many mutual funds to hold?, you position yourself to capitalize on opportunities and mitigate risks.

Account for Investment Horizon

When choosing how many mutual funds to keep, your investment horizon—the length of time you intend to remain invested—plays a big part. Investors with 10+ years of experience can manage 6–8 funds with greater growth exposure to equity. Investors with short time horizons (three to five years) might favour three to five funds, emphasising debt or hybrid funds for stability. A 30-year-old who is investing for retirement, for instance, may own seven funds, which include international equity funds, large-cap, mid-cap, and small-cap funds. A 50-year-old who is saving for a house might select four funds with a focus on bonds. Aligning How many mutual funds to hold? with your time horizon optimizes your portfolio’s growth potential.

Incorporate Tax Efficiency

Choosing how many mutual funds to keep might help you manage your tax liability, as taxes can have a big impact on your returns. High turnover funds, or those that acquire and sell holdings frequently, may be subject to capital gains taxes, which will lower your net returns. You can choose tax-efficient funds, including index funds or exchange-traded funds (ETFs), which generally have lower turnover, by keeping the number of mutual funds you can hold to 4–8. According to a Bogleheads guide to tax-efficient investing, tax-efficient funds can reduce taxes by 0.5 to 1% a year. To optimise your after-tax profits, take tax implications into account when deciding how many mutual funds to own.

An investor in a high tax band, for instance, would select a large-cap index fund that is tax-efficient over an actively managed fund that has a high turnover rate. This approach to How many mutual funds to hold? enhances long-term wealth.

How to Determine How Many Mutual Funds to Hold?: A Step-by-Step Guide

To find the ideal number of mutual funds to hold, follow this detailed process:

- Define Your Goals: Determine if your savings are for a vacation (short-term), a house (medium-term), or retirement (long-term). While short-term goals prefer 3-5 finances, long-term goals could need 6-8.

- Assess Portfolio Size: In order to avoid excessive costs, smaller portfolios ($5,000–$10,000) could require three to five funds. For greater diversification, larger portfolios ($50,000+) can accommodate 6–8 funds.

- Evaluate Risk Tolerance: While aggressive investors can handle 6–8, conservative investors should aim for 3-5 funds.

- Consider Time Commitment: Time constraints? It is simpler to keep an eye on a portfolio with four to five funds.

- Check for Overlap: To make sure each fund contributes something special, use resources like Morningstar’s Portfolio X-Ray.

- Review Tax Efficiency: To reduce capital gains taxes, pick funds with low turnover.

Common Mistakes to Avoid When Deciding How Many Mutual Funds to Hold?

- Overlapping Holdings: Diversification is diminished by investing in several funds that contain comparable stocks. To look for overlap, use tools.

- Ignoring Fees: Over time, high expense ratios (2% vs. 0.5%) might result in hundreds of dollars in losses. When choosing how many mutual funds to hold, compare fees.

- Chasing Past Performance: The past performance of a fund does not ensure future outcomes. Prioritise consistency and goal alignment.

- Neglecting Rebalancing: Make sure your portfolio represents the amount of mutual funds you intended by reviewing it every six to twelve months.

- Overlooking Tax Implications: Funds with a high turnover rate may be subject to taxes. When planning, select funds that are tax-efficient. What number of mutual funds should I own?

Conclusion: Master Your Portfolio with How Many Mutual Funds to Hold?

Deciding How many mutual funds to hold? is a pivotal step toward building a successful investment portfolio. The ideal ratio of manageability, cost effectiveness, and diversity is achieved by aiming for 4–8 funds. You may optimise your wealth-building potential by steering clear of traps like over-diversification, concentrating on high-quality funds, and matching your time horizon, goals, and risk tolerance. Assessing how many mutual funds to own will help you take charge of your financial destiny today. and developing a plan that promotes sustained expansion. Get started now, and see how your portfolio grows!

FAQs

Q1: How many mutual funds to hold? as a beginner?

In order to achieve diversification and maintain a simple portfolio, beginners should own three to five mutual funds. Depending on risk tolerance, a combination of debt, equity, and hybrid funds is the best option.

Q2: Can holding too many mutual funds hurt my portfolio?

Indeed, having more than eight or ten funds can result in over-diversification, increased costs, and complexity, all of which could reduce returns.

Q3: Should I include sector-specific funds when deciding How many mutual funds to hold?

Although they are riskier, sector-specific funds increase diversity. To prevent overexposure, keep them to no more than 1-2 funds in a 6–8 portfolio.

Q4: How frequently ought I to review? How much should I own in mutual funds?

To make sure your portfolio fits your objectives and risk tolerance, review it every six to twelve months or following notable market movements.

Q5: When choosing how many mutual funds to own, are index funds a wise option?

Yes, index funds are perfect for a diversified portfolio because they are affordable and offer wide market exposure.

Disclaimer

One risk associated with mutual fund investing is the possibility of principal loss. This article is not financial advice; rather, it is merely informational. Prior to making any investing decisions, seek advice from a licensed financial advisor. Mutual fund success in the past does not guarantee future outcomes. Make sure the investments you make fit your risk tolerance and financial objectives.

Also Read:

- 7 Dangerous Risks of Chasing High-Performing Funds: Avoid Costly Mistakes

- How to Use Step-Up SIP with the 50-30-20 Rule to Build Life-Changing Wealth

- 7 Proven Two-Minute Investment Rules to Skyrocket Your Financial Success

- Is Speculating the Same as Investing?

- How Many Mutual Funds Should You Invest in?

- AMFI Investor Education Portal