Learn how to file ITR-U online with this step-by-step 2025 guide. Fix income tax errors, understand eligibility, deadlines, and penalties to ensure compliance. Perfect for Indian taxpayers seeking a hassle-free way to update returns! #how to file itr-u online, #itr-u filing guide india 2025, #file updated income tax return online, #itr-u step by step process, #itr-u eligibility and deadlines, #online itr-u filing portal, #benefits of filing itr-u

Introduction

It can be difficult to file an income tax return, particularly if you discover that you made a mistake, such as failing to declare interest income or claiming the wrong deduction. Taxpayers may experience worry as a result of such mistakes since they may result in fines, interest, or even audits. Thankfully, there is a strong way to fix these errors and bring piece of mind: the ITR-U (Updated Income Tax Return). ITR-U, which was introduced under Section 139(8A) of the Income Tax Act, gives Indian taxpayers a substantial amount of time to revise their returns while maintaining compliance and preventing serious penalties.

In this ultimate 2025 guide, we’ll walk you through how to file ITR-U online in 10 easy steps, tailored for salaried individuals, freelancers, and business owners in India. With our practical insights, filing ITR-U online will be a snap, covering everything from qualifying requirements to deadlines and penalties. You will have the self-assurance to correct tax mistakes and steer clear of unfavourable outcomes like penalties or notices by the conclusion. Discover the keys to being an expert at filing ITR-U online by delving into this crucial tutorial!

What is ITR-U? Your Key to Tax Compliance

A revolutionary provision known as ITR-U, or Updated Income Tax Return, permits taxpayers to make changes to their previously filed reports in order to report unreported income or fix errors. ITR-U is a flexible instrument for compliance since it provides a longer window—up to 4 years from the end of the relevant assessment year—than amended returns with strict deadlines. Whether you filed under the incorrect income head, failed to declare rental income, or made incorrect deduction calculations, learning how to file ITR-U online can save you from costly disputes with the Income Tax Department.

By encouraging voluntary compliance, this facility lessens the anxiety associated with possible audits or fines. For example, ITR-U enables you to proactively update your ITR-1 if you claimed an improper exemption or neglected to include bank interest. Every taxpayer hoping to have a spotless tax record has to understand how to file ITR-U online, which has become much easier to do with recent changes to the Finance Act 2025.

Read More: ITR-U explained: A golden window to fix your income tax mistakes

Who Can File ITR-U Online? Eligibility Criteria

Before exploring how to file ITR-U online, confirm your eligibility. ITR-U can be used by any taxpayer who has submitted an original, amended, or belated return to fix errors such as underreported income, inaccurate income headings, or incorrect deductions. ITR-U can be used to report income and pay taxes even if you completely skipped filing, as long as it results in a higher tax obligation.

However, there are restrictions:

- You cannot record losses, claim or raise refunds, or lower your tax due by filing an ITR-U.

- If you are the subject of a tax search, survey, or current assessment proceedings, you are not permitted to do so.

- ITR-U is void if the tax department already possesses information about your unreported income under certain rules.

For salaried employees, how to file ITR-U online is especially useful for correcting Form 16 errors or unreported interest. To make sure your file is legitimate, always check the Income Tax portal for the most recent eligibility requirements.

Also Read: How to Choose ITR Form Based on Income FY25: A Comprehensive Guide

ITR-U Filing Deadlines for 2025: Act Before It’s Too Late

Timing is critical when learning how to file ITR-U online. The ITR-U filing window was extended by the Finance Act 2025 to 48 months (4 years) from the conclusion of the applicable assessment year. Since the assessment year for Assessment Year (AY) 2025–26 (Financial Year 2024–25) ends on March 31, 2026, you have until March 31, 2030, to file your ITR-U. Due to recent developments, the regular ITR deadline for AY 2025–2026 has been extended from July 31 to September 15, 2025. ITR-U is your lifeline if you need to make corrections on a return after this.

The penalty for submitting between 24 and 48 months is 50%, while the penalty for filing within the first 24 months is lower at 25% additional tax. To minimize costs, act early when mastering how to file ITR-U online. Mark these dates on your calendar because missing them could result in usual penalties or notices!

Read More: Key Things to Know About New Tax Regime

Why File ITR-U? Benefits That Boost Confidence

Understanding how to file ITR-U online isn’t just about fixing errors—it’s about reaping powerful benefits:

- Avoid Audits and Penalties: Making voluntary corrections to errors helps you avoid expensive fines and tense scrutiny.

- Clean Tax Record: Your credibility with the tax department is increased if your record is in compliance.

- Peace of Mind: Correcting mistakes removes the concern of upcoming notifications or legal action.

- Flexibility: There is enough time to find and fix mistakes within the four-year period.

Businesses can operate smoothly and avoid tax problems by knowing how to file ITR-U online. For individuals, it’s an opportunity to transform unfavourable tax circumstances into favourable compliance results.

Additional Tax and Penalties: What to Expect

To maintain responsibility, there are extra tax requirements when filing ITR-U online. You pay 25% more in additional tax and interest if you file within 24 months; after 24 months, you pay 50% more. For instance, you would pay ₹1.25 lakh (within 24 months) or ₹1.5 lakh (beyond 24 months) if your amended return revealed an additional ₹1 lakh in tax liability. To precisely calculate this, use the calculators on the e-filing platform.

While this increases cost, it’s significantly better than risking penalties for non-compliance. To prevent surprises, factor in these penalties when preparing your online ITR-U filing.

Also Read: How to Avoid Income Tax Penalties in 2025: A Step-by-Step Guide

Limitations of ITR-U: Know the Boundaries

ITR-U has strict rules to prevent misuse. You cannot use it to:

- Lower your tax obligation or request more rebates.

- Report any losses.

- If the department is already aware of your unreported income or if you are the subject of an inquiry, file.

Understanding these limits ensures your attempt at how to file ITR-U online is successful. Check the Income Tax portal for full restrictions.

How to File ITR-U Online: 10 Simple Steps for 2025

This comprehensive 10-step instruction will help you navigate the Income Tax e-filing portal with ease. It explains how to file ITR-U online:

- Gather Documents: Get your bank statements, proof of additional income (such as Form 26AS), PAN, Aadhaar, and original ITR information. When learning how to file ITR-U online, this guarantees correctness.

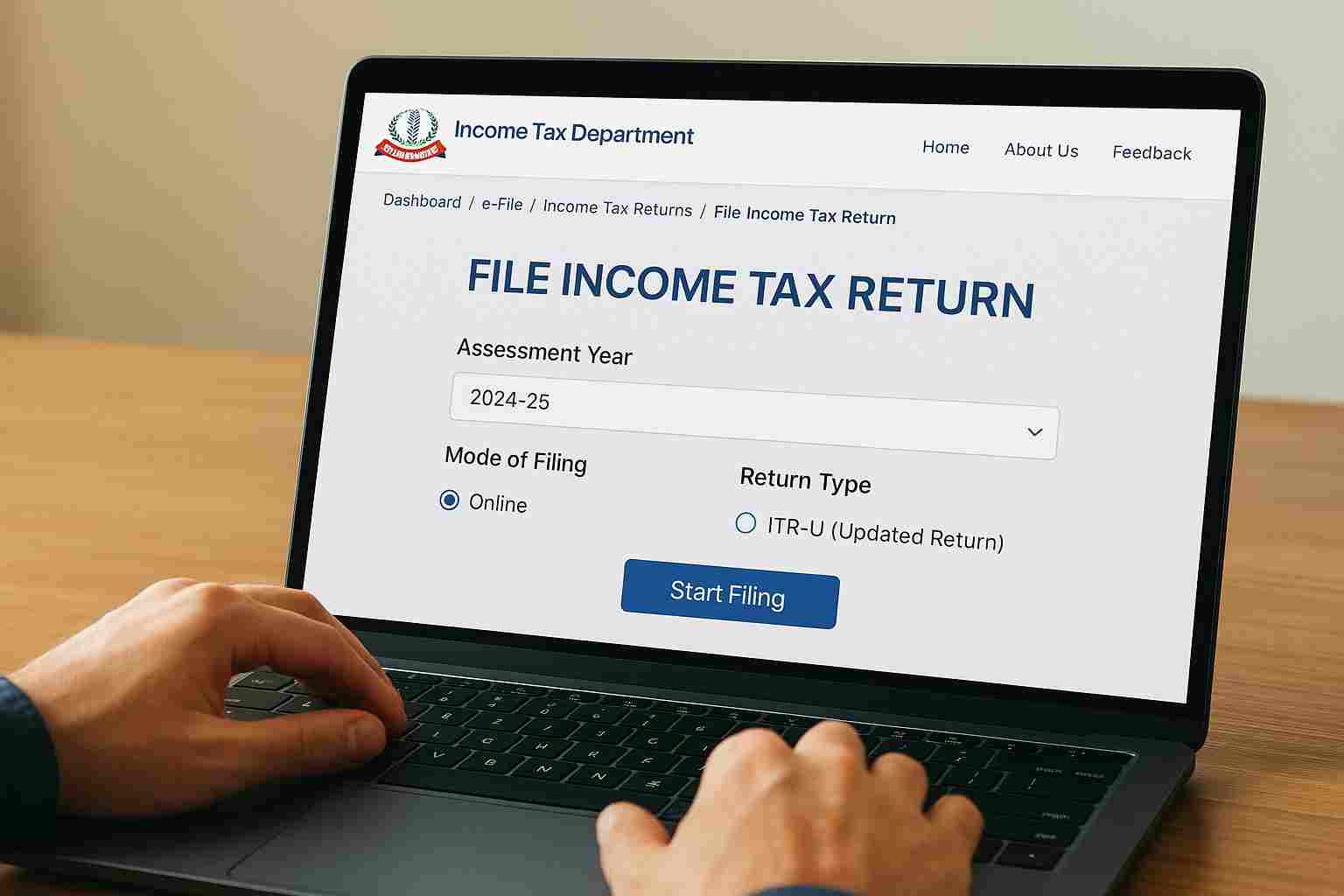

- Open the E-Filing Portal and log in: Go to incometax.gov.in, enter your password, and log in using your PAN as User ID. First, new users need to register.

- Select the ITR-U Form: Select “File Income Tax Forms” under “e-File” > “Income Tax Forms.” After selecting ITR-U, pick the appropriate AY (for example, 2025–26).

- Specify the Update Reason: Explain the reason for the update (e.g., incorrect deduction, under-reported income). This is a crucial step in the online ITR-U filing process.

- Calculate Additional Tax: Use the portal tools to determine the additional tax and penalty (25% or 50%). Check all the numbers to prevent mistakes.

- Make the tax payment: Pay with a challan, debit card, or net banking. For reference, take note of the challan number and BSR code.

- Fill ITR-U Form: Complete the ITR-U form by entering your most recent income, tax information, and deductions. If pre-filled data is available, import it to expedite the online ITR-U filing process.

- Upload JSON or Use Online Mode: Fill out the online form or use the offline tool to create a JSON file. In the ITR-U section, upload it.

- E-Verify the Return: Within 30 days, confirm using a digital signature certificate (DSC), net banking, or an Aadhaar OTP.

- Acknowledgement Download: Save the ITR-V acknowledgement to your files. You’ve mastered the online ITR-U filing process now!

These steps make how to file ITR-U online straightforward. Use portal tutorials for extra guidance if needed.

Also Read: e-Filing Portal – Income Tax Department

Common Pitfalls to Avoid

Steer clear of these errors when learning how to submit an ITR-U online:

- Incorrect Calculations: Verify the amounts of taxes and penalties twice.

- Missing Documents: Verify that all proofs of income are available.

- Ignoring Deadlines: To reduce penalties, file early.

- Invalid Reasons: Only submit modifications that are legitimate (such as a higher tax obligation).

Also Read: Commonly Confused Tax Terms

Conclusion

Mastering how to file ITR-U online in 2025 is your ticket to fixing tax errors and achieving compliance with confidence. From signing into the e-filing site to confirming your return, this 10-step tutorial streamlines the procedure. You can turn tax errors into chances for a fresh start financially by being aware of eligibility, due dates, and penalties. Start learning how to file ITR-U online right now to avoid mistakes and take advantage of the assurance that comes with having a tax record that is in compliance. To take charge of your tax future, visit the Income Tax portal right now!

FAQs

Q1: What does how to file ITR-U online mean?

The process of submitting an Updated Income Tax Return (ITR-U) via the Income Tax e-filing portal (incometax.gov.in) to rectify errors or report unreported income from a previously filed return is known as “how to file ITR-U online.” This process entails indicating the reason for updating, choosing the ITR-U form, computing additional tax, and confirming the submission—all of which are completed digitally for convenience.

Q2: Can I file ITR-U online to claim a refund?

No, you are unable to increase or claim a refund using ITR-U. Correcting errors like underreported income or inaccurate deductions that lead to an increased tax bill is the goal of learning how to file ITR-U online. According to Section 139(8A) limits, rebates or lowering tax obligations are not allowed.

Q3: When is the cut off date for online ITR-U filing for AY 2025–2026?

Due to the 4-year window from the conclusion of the assessment year (March 31, 2026), you have until March 31, 2030, to file your ITR-U for Assessment Year 2025-26 (Financial Year 2024-25). A 25% penalty is applied for submitting by March 31, 2028, which is the first day of the 24-month period; a 50% penalty is applied for subsequent submissions.

Q4: How is the penalty calculated when learning how to file ITR-U online?

You pay an extra 25% (within 24 months) or 50% (between 24 to 48 months) of the excess tax and interest owed when you file your ITR-U. For instance, you would pay ₹1.25 lakh or ₹1.5 lakh, respectively, if your amended return indicated ₹1 lakh in additional tax. The calculators on the e-filing portal help guarantee accuracy when submitting an online ITR-U.

Q5: Is e-verification required in order to submit an online ITR-U?

Yes, in order to validate your ITR-U, e-verification must be completed within 30 days of filing. You can use DSC, net banking, or Aadhaar OTP. When learning how to file ITR-U online, this step is crucial since without verification, the return is deemed invalid.

Q6: Who is not eligible to submit an online ITR-U?

If you are the subject of a tax search, survey, or current assessment proceedings, you are not permitted to file an ITR-U. Additionally, if the update does not raise your tax due or if the tax agency already has information about your unreported income, it is invalid. Before attempting to file ITR-U online, be sure you are eligible by checking the Income Tax portal.

Q7: Can salaried employees benefit from how to file ITR-U online?

Sure! Incorrect deductions, unreported bank interest, and Form 16 anomalies can all be fixed by salaried employees using ITR-U. You can update your return and pay the required tax, avoiding penalties, by learning how to file ITR-U online, for instance, if you neglected to record ₹50,000 in savings account interest.

Q8: What occurs if the ITR-U deadline is missed?

You cannot submit ITR-U if you miss the 4-year deadline (for example, March 31, 2030, for AY 2025–26). You can get notifications for non-compliance, interest under Section 234A/B/C, or regular fines. These problems can be avoided by taking early action on how to file ITR-U online.

Q9: In order to file my ITR-U online, how do I figure out the additional tax?

Add the 25% or 50% penalty, depending on the filing date, to the revised income after deducting the tax paid on the original return. This can be made simpler with the help of the e-filing portal. To successfully learn how to file ITR-U online, precise computations are essential.

Q10: Is there a cost to submit an ITR-U online?

You must pay the additional tax and penalty (25% or 50%) on the revised liability, but there is no special portal cost for filing ITR-U. For instance, depending on the date, it might cost an additional ₹50,000 to ₹1 lakh to fix an underreported income of ₹2 lakh. When deciding how to submit your ITR-U online, account for this.

Disclaimer

This online ITR-U filing guidance is intended solely for informative purposes and should not be construed as expert tax advice. For individualised advice, speak with the Income Tax Department or a licensed tax professional as tax regulations are subject to change. Verify information on incometax.gov.in at all times. Decisions based on this content are not the responsibility of the publisher or author.