If you’re asking how to know if my retirement savings are enough, read these 7 powerful signs, age-based benchmarks, safe withdrawal tests, and practical fixes to secure your future. #how to know if my retirement savings are enough, #retirement savings benchmark, #retirement readiness checklist, #retirement savings by age, #10x salary rule, #retirement calculator, #safe withdrawal rate.

Introduction

Have you ever stopped in the middle of your pay cheque and wondered how to know if my retirement savings are enough, You’re not by yourself. Figuring out retirement mixes money numbers with real-life decisions – how you spend today, how many years you’ll need funds, or what kind of future feels right – all shape if your savings actually last.

This guide breaks down seven straightforward, research-backed signs that show how to respond how to know if my retirement savings are enough — skip the technical terms; focus on what you can do right away. Think of these signals as a list: a few come from numbers and math, yet others grow out of habits and how you prepare. When combined, they show whether you’re truly set.

How to Know If My Retirement Savings Are Enough: 7 Powerful Signs

Here are seven simple indicators you may look for right now to determine whether how to know if my retirement savings are enough ought to be a soothing affirmation or a call to action.

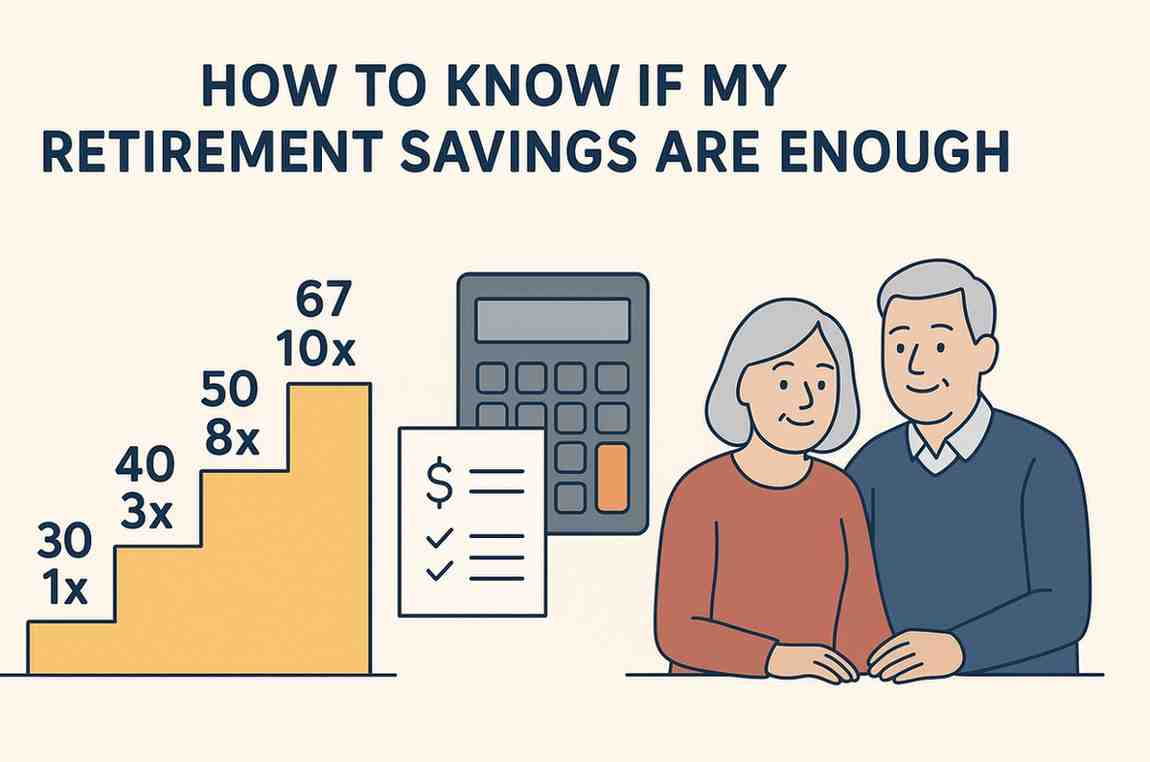

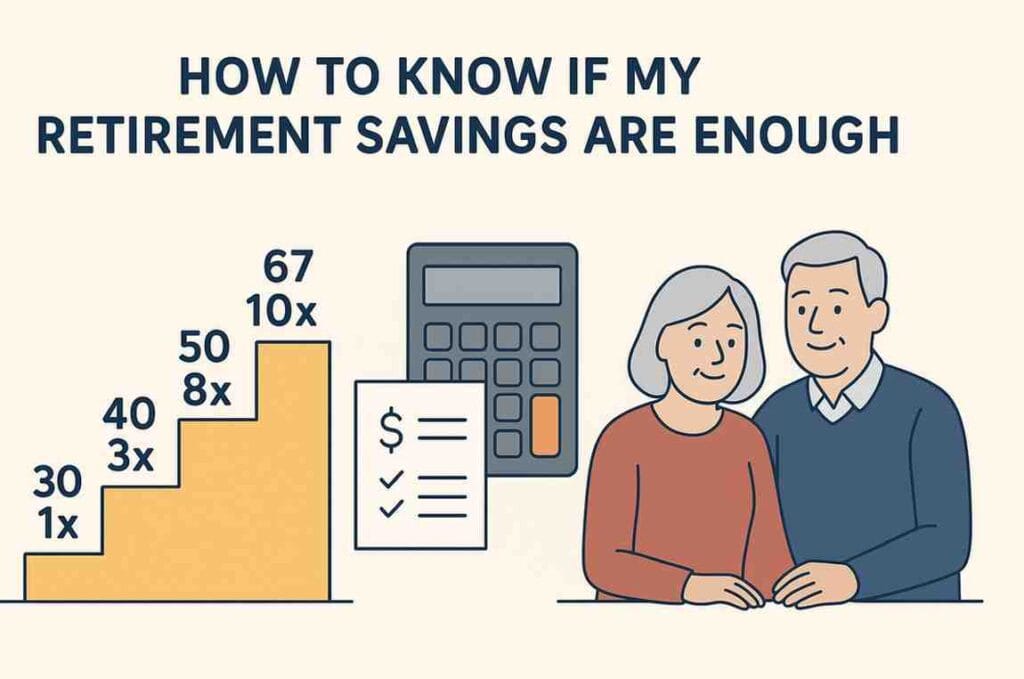

You reach the age-based benchmarks (the 10× rule and associated multiples)

Many planners utilise a commonly recognised benchmark to help answer how to know if my retirement savings are enough: By a particular age, aim for multiples of your pay. One frequently mentioned route is:

- By 30 → ~1× your pay

- By 40 → ~3× your pay

- 50 => ~6× your pay

- By 60 → ~8× your pay

- By 67 → ~10× your pay

These goals represent projected saving rates, portfolio returns, and a planning horizon; they are not magical. Your totals at or above these multiples are an obvious indication of how to know if my retirement savings are enough — You’re probably headed for a retirement that feels familiar. When way under, see these markers as alerts – hinting at what’s missing.

You consistently contribute a high percentage of your income—roughly 15%

A second sign to check when asking how to know if my retirement savings are enough is your annual contribution percentage. Most experts suggest setting aside roughly 15% of your paycheck before taxes – this often includes what your company adds. Here’s why it counts: consistent deposits make use of time plus compound growth.

If you stash away 15% or more, hitting those targets becomes way easier. Saving just 5–10%? Then figure out if your nest egg’s big enough – tweak how much you save, when you retire, or what kind of life you plan to live.

Your score on the retirement calculator is “on track”

Your score from a reliable retirement calculator is a useful indicator of how much money you have saved for retirement. A readiness score is offered by several institutions, usually on a range of 0 to 100. Common interpretations

- < 65 → Important adjustments are required

- 65–80 → Moderate improvements are needed

- 81–95 → mostly on schedule

- 95 → extremely well-prepared

A personal retirement score in the 80s or above provides you with quantitative confidence for how to know if my retirement savings are enough. If not, adjust the inputs and try different solutions, such as increasing savings, delaying retirement, or making more cautious withdrawal plans.

You can easily stick to sustainable withdrawal guidelines

Understanding your withdrawal plan is essential to responding to how to know if my retirement savings are enough. According to the conventional “4% rule,” 4% of the initial portfolio should be withdrawn in the first year of retirement, after which inflation should be taken into account. To estimate a goal corpus, times your expected first-year retirement income by 25. This is a helpful beginning point, but it’s not perfect.

If, under conservative return assumptions, a 4% initial withdrawal is sustained from your expected retirement savings, that’s a major sign that how to know if my retirement savings are enough can be answered positively. You should probably review your plan if the safe withdrawal rate falls below 3% during stress tests.

You’ve taken longevity, inflation, and medical expenses into consideration

A shallow answer to how to know if my retirement savings are enough ignores three big risks: healthcare, longevity, and inflation. When combined, they can significantly raise the amount of savings needed and reduce purchasing power.

- Plan with a conservative real-return assumption because inflation lowers the value of your money.

- Planning till age 90+ lowers the risk of outliving finances because longevity requires the corpus to last longer.

- Healthcare is a significant retirement expense and frequently increases more quickly than overall inflation.

If your plan specifically accounts for increased medical expenses and a longer lifespan while still covering your expenses, it’s a good indicator that your retirement resources are sufficient.

Your anticipated corpus is in line with your ideal retirement lifestyle

In terms of lifestyle, money has significance. To respond how to know if my retirement savings are enough, First, decide what kind of life you want: a luxurious lifestyle, annual vacation, or humble living? After estimating your yearly retirement expenditures using that vision, see if your predicted corpus can sustain it.

For instance, use a withdrawal model or the Rule of 25 (multiply by 25) if you intend to retire with ₹12 lakh annually. The topic of how to determine whether my retirement assets are sufficient becomes a practical confirmation rather than a guess if your corpus comfortably covers that amount.

You have a flexible and realistic catch-up plan

Even if today’s numbers worry you about how to know if my retirement savings are enough, the presence of a workable catch-up plan is encouraging in and of itself. Among the catch-up measures are:

- Gradually increasing savings (increasing SIPs every year)

- utilising any applicable catch-up contribution guidelines (such as age 50+ allowances)

- Postponing retirement for a few years in order to benefit from compound interest and shorten retirement years

- Short-term reduction of discretionary spending

- Increasing part-time earnings or working as a consultant before retirement

If you have a workable strategy to bridge the gap, that tells you how to know if my retirement savings are enough is a scenario that can be handled and is not a binary result.

Useful guide: a brief self-evaluation to address “how to know if my retirement savings are enough”

Create a quick response by following the instructions listed below.

- Work out what you’ve saved using your pay as a base. Then check it against goals for your age – like 1 year’s pay by 30, 3 times by 40. That way, you can quickly tell if your nest egg is on track.

- Look at how much you’re putting in. Over 15%? That’s good – mark it down as a win.

- Try a retirement tool. Plug in real numbers for growth and rising prices – check the result it shows. That number tells you whether your saved money might last.

- Check if pulling out 3–4% each year works when gains are low. Try it with old market data to see what happens.

- Check your plan against health issues or living longer than expected. When it works even then, you’ve got a solid answer to whether your retirement funds are sufficient.

Also Read: How to know if you’re saving enough for retirement

Conclusion: useful actions to take after you have the solution

If your self-audit answers how to know if my retirement savings are enough with “yes,” good job – stay focused, check things each year. When it’s “no” or “not sure,” jump on it right away:

- Boost how much you save – just a little each year adds up fast because small gains grow over time when they pile on top of one another

- Move some funds into varied stocks for future gains – provided you’re okay with the risks involved

- Think about pushing back retirement – maybe just a couple of years

- Safeguard your cash by getting solid health coverage or a reliable life plan

- Team up with an experienced guide to shape your own strategy

Dealing with these steps boosts your numbers while building trust, shifting that worried feeling about whether your retirement funds are sufficient into something you can actually handle.

FAQs

Q1: Is the 10× target the only way to know how to know if my retirement savings are enough?

Nope. The 10× goal isn’t magic – it’s just a rough guide. What really matters? Your future costs, how prices might rise, what kind of earnings you expect, along with when and how much you pull out. Think of the 10× tip as one clue, not the whole answer how to know if my retirement savings are enough.

Q2: How frequently should I ask myself “how to know if my retirement savings are enough”?

At least once a year, or following significant life events such as a change in employment, a pay increase, marriage, having children, or a change in one’s health.

Q3: Can I depend solely on pensions and fixed deposits?

Focusing only on bonds might not keep up with rising prices. Combining different types of investments often helps give a clearer picture over time – especially when wondering if your nest egg will last.

Q4: What happens if I’m fifty years old and behind?

You can take action now – boost your savings fast, tap into catch-up options, think about working longer, or skip unnecessary spending. Doing these things makes it easier to say yes when wondering if you’ve saved enough for retirement.

Q5: To find out “how to know if my retirement savings are enough,” should I hire a financial planner?

If things with money get tricky, sure – go see a pro. One might use number games like Monte Carlo runs or custom what-if scenarios to really show whether your nest egg’s on track.

Disclaimer

This piece shares info but isn’t meant as financial, tax, or legal guidance. Everyone’s situation varies – talk with a qualified advisor before big retirement moves, particularly after learning new details about how to know if my retirement savings are enough.