Understand the complete insurance complaint timeline in India, including insurer response time, IRDAI role, ombudsman deadlines, escalation rules, and delays that can hurt your claim. insurance complaint timeline in India, insurance grievance response time, IRDAI complaint response time, insurance ombudsman timeline, insurer grievance redressal India.

Introduction — Why Insurance Complaint Timeline Matter More Than Claim Rejection

Most insurance disputes in India do not fail because policyholders are wrong. They fail because timelines are misunderstood, escalation is premature, or silence is misread as inaction. When a claim is delayed or rejected, panic pushes consumers to escalate immediately, often weakening their own case.

The Indian insurance grievance system is procedural, layered, and time-bound. Each authority — the insurer, the regulator, and the ombudsman — has a clearly defined role and response window. Missing or misusing these timelines can permanently damage your legal position, even when your complaint is genuine.

This article explains the insurance complaint timeline in India step by step, focusing not on emotions but on what actually works, when escalation helps, and when delays silently hurt you.

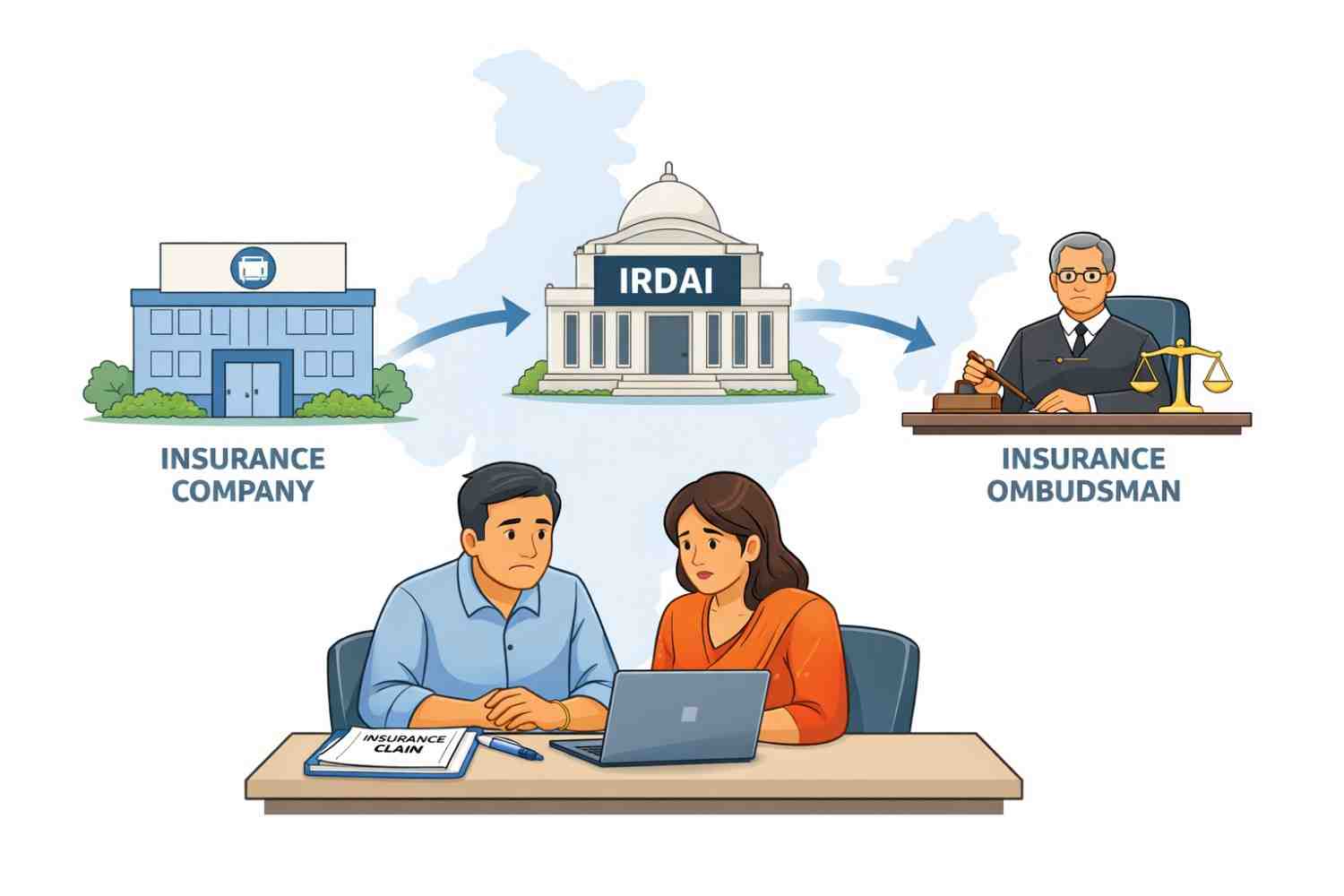

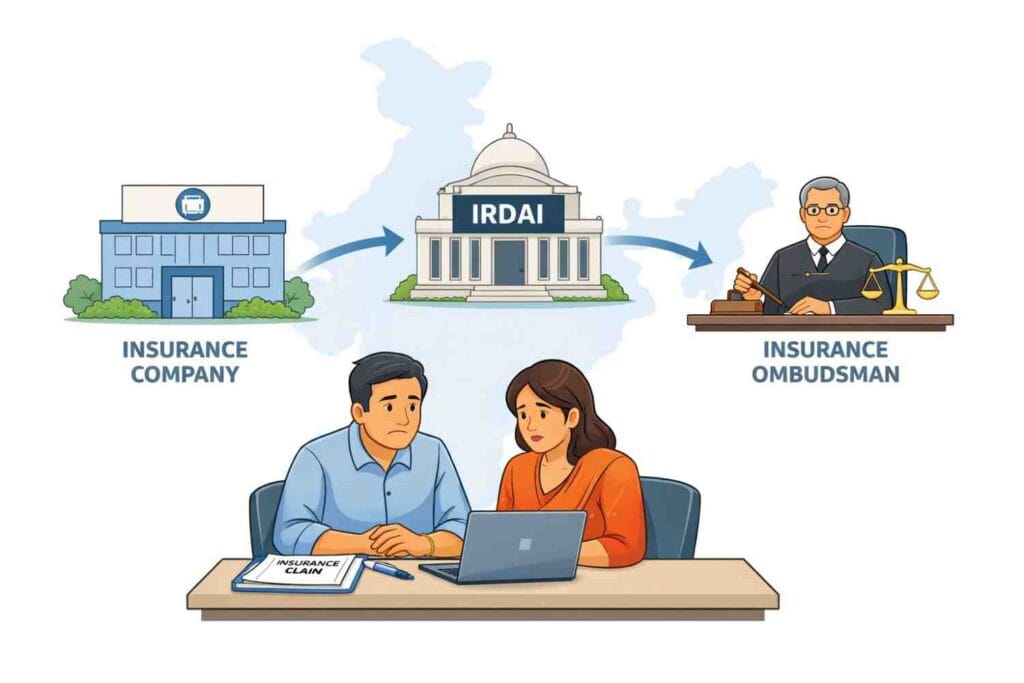

How the Insurance Complaint Framework Works in India

India does not follow a single-authority grievance system for insurance. Instead, complaints move through three structured layers, each governed by different rules and expectations.

The first and most important layer is the insurance company itself. Every insurer licensed in India is legally required to maintain an internal grievance redressal mechanism. This is not optional, and regulators expect policyholders to exhaust this channel first.

The second layer is IRDAI, which acts as a procedural watchdog. IRDAI does not judge whether your claim should be paid. Instead, it checks whether the insurer followed rules, timelines, and grievance procedures.

The third layer is the Insurance Ombudsman, an independent authority empowered to examine fairness, evidence, and service deficiency. This is the first forum where merits of the complaint are actually reviewed.

Only after these layers can a policyholder approach consumer courts, which operate under a completely different legal framework and timeline.

Understanding this structure is essential because skipping steps or escalating too early often leads to rejection — not resolution.

1. Timeline to File an Insurance Complaint After a Dispute

There is no fixed statutory deadline under IRDAI regulations that forces a policyholder to file a complaint immediately after a claim dispute. However, insurers and ombudsman offices evaluate complaints based on reasonableness of delay.

Practically speaking, complaints should ideally be filed within 30 days of a claim rejection, partial settlement, or unexplained delay. In many cases, the problem does not start at the claim stage itself but much earlier, due to mistakes or omissions made while buying the policy — something commonly seen in term insurance claim rejection reasons in India. Filing early helps preserve medical records, surveyor reports, communication trails, and payment histories.

When complaints are filed after several months or years without explanation, insurers often argue that the delay has prejudiced investigation. While this does not automatically invalidate a grievance, it weakens credibility at later stages.

2. Insurer Acknowledgement Timeline (Immediate to 3 Working Days)

Once a complaint is lodged through email, portal, branch office, or call centre, insurers are expected to acknowledge receipt quickly.

In digital systems, acknowledgement is often instant. In manual or branch-based complaints, it may take up to three working days. This acknowledgement confirms registration, not resolution.

If no acknowledgement is received within this period, it usually indicates a process failure, not a claim weakness. Policyholders should preserve screenshots, emails, or complaint reference numbers because these become crucial during escalation.

Silence at this stage is an early warning sign that should not be ignored.

3. Insurer Resolution Timeline — The 15 to 30 Day Rule

This is the single most important timeline in the entire insurance grievance process.

Under IRDAI norms, insurers are expected to resolve grievances within 15 days of receipt. In complex cases involving investigations, medical verification, or third-party reports, this period may extend up to 30 days, but reasons must be documented.

During this window, insurers may legitimately request additional documents or clarifications. However, repeated requests for the same information or vague queries without explanation may constitute unfair delay.

Policyholders often weaken their case by escalating before this timeline expires. Regulators expect insurers to be given a fair opportunity to respond within this window.

4. What “Insurer Responded” Status Actually Means

One of the most misunderstood stages in the insurance complaint timeline in India is the “Insurer Responded” status.

This status only means that the insurer has submitted some form of response to the grievance. Many policyholders assume this means the regulator is now reviewing the case, but that is not how the system works — the actual meaning of each update is better understood by knowing what different IRDAI complaint status labels signify. It does not mean the response is correct, fair, or legally sound. It also does not mean IRDAI has reviewed or approved the reply.

Many consumers assume that once this status appears, the regulator is actively evaluating their case. In reality, it only confirms that the insurer has fulfilled a procedural obligation.

Understanding this prevents false expectations and unnecessary frustration.

5. When to Escalate to IRDAI — And When Not To

Escalation to IRDAI should occur only after one of two conditions is met:

either the insurer has failed to respond within 30 days, or the response clearly violates documented procedure.

Such complaints are formally routed through the IRDAI Integrated Grievance Management System (IGMS), which acts as the official channel for tracking insurer compliance.

IRDAI’s role is limited to checking whether the grievance redressal framework has been followed. It does not decide claim eligibility, policy interpretation, or settlement amounts.

Escalating prematurely often results in the complaint being routed back to the insurer without substantive review.

6. IRDAI Handling Timeline — 15 to 45 Days Explained

Once a complaint is escalated, IRDAI usually forwards it back to the insurer, asking for clarification or compliance confirmation.

The regulator typically monitors the process for 15 to 45 days, depending on the nature of the grievance. If the insurer submits a response within this period, IRDAI often closes the grievance from its end.

This closure is procedural, not merit-based. Many policyholders misinterpret this as rejection, when in fact it simply reflects IRDAI’s limited mandate.

7. Insurance Ombudsman Timeline — Where Merits Are Examined

The Insurance Ombudsman is the first authority that evaluates fairness and deficiency of service.

Complaints that reach this stage can be filed directly with the Insurance Ombudsman of India, once the insurer has issued a final response or remained silent beyond the prescribed period.

A complaint can be filed with the ombudsman if the insurer has rejected the grievance or failed to respond within 30 days. Importantly, this must be done within one year of the insurer’s final response.

Once admitted, cases usually move through document review, hearings, and final award within three to six months. Ombudsman awards are binding on insurers within prescribed monetary limits.

8. Consumer Court Timelines — The Long Route

When regulatory remedies fail, consumer courts become relevant. These courts examine evidence, expert opinions, and legal arguments in detail.

However, timelines here are significantly longer. District commissions may take a year or more, while appeals can stretch into several years. This route should be chosen carefully, especially in smaller disputes.

9. When Delays Hurt You Legally

Delays are not neutral. They can quietly damage your case.

When complaints are delayed excessively, insurers may argue that evidence has gone stale or that the policyholder acquiesced to the decision. Limitation periods may also expire, particularly for ombudsman and court remedies.

Knowing timelines protects not just patience, but legal rights.

Common Mistakes That Break Insurance Complaint Timelines

Many valid complaints fail because of avoidable mistakes. Policyholders often escalate directly to IRDAI without approaching the insurer, submit incomplete documents repeatedly, or miss ombudsman filing deadlines.

Another frequent mistake is treating automated acknowledgements as resolution. Others assume regulators review claim merits, which leads to misplaced expectations.

Most importantly, many consumers wait too long, believing silence will force action. In reality, silence often weakens a case.

Conclusion — Timelines Are More Powerful Than Arguments

Insurance disputes in India are resolved through process discipline, not emotional escalation. Knowing when insurers must respond, when regulators intervene, and when silence works against you is critical. The same principle applies beyond insurance as well, and readers dealing with delays in other financial matters may recognise similar patterns in the bank account grievance escalation process. The insurance complaint timeline in India is designed to protect both consumers and insurers. Those who understand and respect it stand a far stronger chance of resolution than those who rush or wait blindly.

FAQs

Q1: How long should I wait before escalating an insurance complaint?

You should wait at least 30 days from the date of lodging the complaint with the insurer, unless there is a clear procedural violation earlier. Premature escalation often leads to referral back without resolution.

Q2: Does IRDAI decide whether my insurance claim should be paid?

No. IRDAI does not adjudicate claim merits. It only checks whether insurers followed grievance procedures and response timelines.

Q3: Can insurers keep asking for documents to delay complaints?

Insurers can request documents, but repeated or unjustified requests may amount to unfair delay and strengthen your case during escalation.

Q4: Is the Insurance Ombudsman faster than consumer courts?

Yes. Ombudsman proceedings typically conclude within a few months, whereas consumer courts may take years depending on the level of appeal.

Q5: What happens if I miss the ombudsman filing deadline?

If the one-year deadline is missed, the ombudsman may refuse to entertain the complaint, leaving consumer courts as the only remaining option.

Disclaimer

This article is for informational and educational purposes only. It does not constitute legal, insurance, or financial advice. Complaint timelines, regulatory procedures, and insurer practices may vary based on policy terms and case specifics. Readers should consult official guidelines or qualified professionals before taking action.