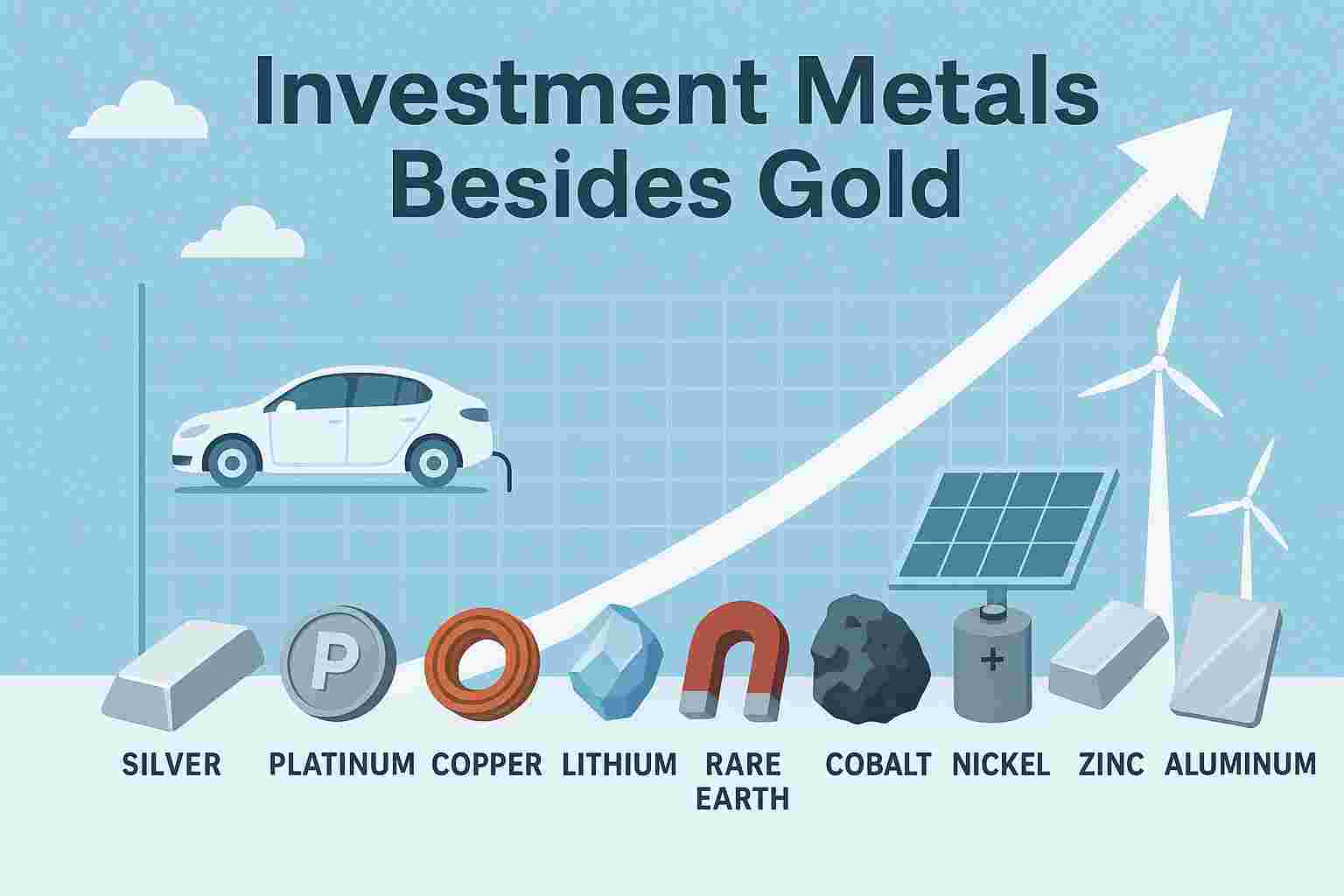

Explore 9 investment metals besides gold, from silver to aluminium, surging in 2025 due to EV demand and supply challenges. Learn how to boost your portfolio with these dynamic metals for massive returns. #investment metals besides gold, #rare earth elements investing, #precious metals beyond gold, #metal investment trends, #alternative to gold.

Introduction

For many years, gold has been the best safe-haven investment because it shines through economic turbulence. But as we step into 2025 , investment metals besides gold are stealing the show, poised to deliver explosive returns. Electric vehicles (EVs), renewable energy systems, and advanced technology are powered by these nine powerhouses: silver, platinum, copper, lithium, rare earth elements, cobalt, nickel, zinc, and aluminium. Geopolitical tensions are rising, green tech is flourishing, and supply chains are getting tighter, investment metals besides gold offer a thrilling blend of stability and growth potential.

Why focus on investment metals besides gold? These metals—from aluminium in lightweight EVs to silver in solar panels—drive the future, while gold protects wealth. These metals are in high demand due to the green revolution—millions of electric vehicles on the road and wind turbines spinning—and price increases are caused by limitations in supply. This guide explores the nine investment metals that are expected to dominate, other from gold. From physical bullion to exchange-traded funds (ETFs), we will examine their potential, hazards, and investment techniques. Are you prepared to diversify and make huge profits? Let’s find these innovators.

Silver: The Versatile Star

Silver shines as a top pick among investment metals besides gold, blending industrial demand with the appeal of a safe refuge. With green technology fuelling unrelenting demand, it’s essential for solar panels, EVs, and 5G networks. Markets are tight due to supply issues in key producers like Mexico and Peru, which drives up prices. Investors can tap investment metals besides gold like silver through physical bars (via dealers like JM Bullion), ETFs (iShares Silver Trust, SLV), or mining stocks (Pan American Silver). Silver’s dual function provides it a dynamic alternative to gold as an investment metal for growth-oriented 2025 portfolios, despite its higher volatility.

Platinum: The Comeback King

Platinum is staging a bold comeback among investment metals besides gold, driven by the rising demand for sustainable energy from hydrogen fuel cells and jewellery, particularly in China and India. A positive prognosis is produced by supply restrictions from South Africa’s faltering mines. You can obtain platinum through miners like Anglo American Platinum, physical bullion, or exchange-traded funds (ETFs) like Aberdeen Physical Platinum Shares (PPLT). Apart from gold, platinum stands out among investment metals because to its scarcity and green tech tilt, notwithstanding the dangers associated with changes in the auto industry.

Also Read: Precious Metals Blended Investment Strategy

Copper: The Electrification Giant

Copper powers the green revolution as a cornerstone of investment metals besides gold, power grids, renewable energy systems, and electric vehicles (which require a lot more than gas-powered vehicles). A tight market is fuelled by supply bottlenecks brought on by deteriorating ore grade and postponed projects. Invest in stocks (Freeport-McMoRan), COMEX futures, or ETFs (Global X Copper Miners, COPX). Risks come from China’s economic slowdowns, but copper’s demand for electrification makes it a must-have investment commodity in addition to gold.

Lithium: The Battery Powerhouse

Lithium fuels the EV boom among investment metals besides gold, fuelling grid storage and electric car batteries as sales increase. Slow mining development causes supply constraints, which maintain high pricing. Lithium can be obtained from junior miners (Piedmont Lithium) or ETFs (Global X Lithium & Battery Tech, LIT). Although worries about oversupply persist, lithium’s vital role in EVs guarantees its position as one of the investment metals alongside gold.

Also Read: Precious Metals in Multi-Asset Funds Benefits

Rare Earth Elements: The Tech Titans

Rare earth elements (REEs) like neodymium and dysprosium are hidden giants among investment metals besides gold, vital for defence technologies, wind turbines, and EV magnets. China’s hegemony in processing reduces supply, while global diversification initiatives open up new possibilities. Invest in miners (Lynas) or ETFs (VanEck Rare Earth/Strategic Metals, REMX). Although export concerns increase volatility, REEs are a high-reward investment metal in addition to gold because of their strategic significance.

Cobalt: The Battery Stabilizer

Cobalt, vital for EV battery stability, is a volatile star among investment metals besides gold, with the DRC being a major source of supply. Markets are driven by growing EV demand as well as new markets like India. Access through stocks (Glencore) or battery ETFs. Although there are hazards associated with ethical mining, cobalt’s necessity guarantees its place among investment metals alongside gold.

Also Read: The Ultimate Precious Metals Investment Guide

Nickel: The Energy-Dense Ally

Nickel enhances EV battery performance, making it a rising force among investment metals besides gold, with the largest supply coming from Indonesia. Markets are tight due to demand from stainless steel and EVs. Invest in miners (Vale) or ETFs. Nickel’s EV-driven demand keeps it a dominant investment commodity in addition to gold, but export limits increase the hazards.

Zinc: The Construction Shield

With smelter closures reducing available supplies, zinc, which protects steel in construction, is an unsung champion among investment metals outside gold. The expansion of China’s infrastructure drives demand. Invest in commodities ETFs or stocks (Teck Resources). Zinc’s consistent role makes it a dependable choice among investment metals aside from gold, although energy cost increases cause volatility.

Aluminium: The Lightweight Leader

Aluminium rounds out investment metals besides gold, flourishing in green infrastructure, EVs, and aircraft because of its lightweight and recyclable qualities. Prices are driven by supply restrictions resulting from energy-intensive production. Access through ETFs or equities (Alcoa). Risks include energy prices and economic downturns, but aluminium’s advantage in sustainability makes it a competitive alternative to gold as an investment metal.

Also Read: Beyond Gold: The Metals Poised to Be Tomorrow’s Investment Champions

Conclusion

Gold’s shine is dimming—investment metals besides gold like The explosive future of 2025 includes rare earth elements, cobalt, nickel, zinc, aluminium, platinum, copper, lithium, and silver. Driven by supply constraints and green technology, these nine metals hold enormous potential for growth. Combine equities, physicals, and ETFs (SLV, PPLT, and COPX) to create diverse firepower. You run the danger of missing the wealth wave if you ignore investment metals other than gold; embrace them to take control of the future.

FAQs

Q1: Why are investment metals besides gold outperforming gold in 2025?

In addition to gold, investment metals offer a safe haven value and robust industrial demand from renewable energy sources and electric vehicles. These metals stimulate the evolution of green technology, in contrast to gold’s emphasis on wealth preservation. Prices are further raised by their supply limitations.

Q2: In addition to gold, how can I begin investing in silver as an investment metal?

For tangibility, start with actual silver bars or coins from vendors like JM Bullion. While mining equities offer a higher risk-reward ratio, exchange-traded funds (ETFs) such as iShares Silver Trust (SLV) facilitate trading. Before you jump in, learn about market and storage trends.

Q3: Apart from gold, are rare earth elements too dangerous as investment metals?

China’s supply restrictions and export risks cause volatility in rare earths. Their vital role in defence technology and EV magnets, however, comes with significant benefits. For safer exposure, ETFs such as REMX help spread risk.

Q4: Will copper prices keep rising among investment metals besides gold?

Strong EV and grid demand exceeding supply is driving up copper prices. Although China’s economic slowdowns may result in dips, long-term trends point to development. Keep an eye on infrastructure spending worldwide for indicators.

Q5: What prospects does lithium have as an alternative to gold as an investment metal?

The rising demand for EV batteries is driving lithium’s promising future. Although there are some oversupply problems, its use in green technology guarantees long-term value. ETFs such as LIT provide a well-rounded approach to investing.

Disclaimer

This material is only informative and does not offer investment, financial, or legal advice. Investing in investment metals besides gold carries risks, involving possible financial loss as a result of legislative changes, market volatility, and geopolitical events. Markets fluctuate quickly, so before making an investment, speak with a financial expert and do your research.