Explore 7 powerful locality growth indicators for real estate to identify high-potential areas. Avoid costly mistakes and boost your property investment success with these expert tips. #locality growth indicators for real estate, #evaluate neighbourhood growth potential, #real estate investment tips, #high-growth areas property investment, #assess city growth real estate, #up-and-coming neighbourhoods, #factors for property investment location

Introduction: The Power of Locality Growth Indicators for Real Estate

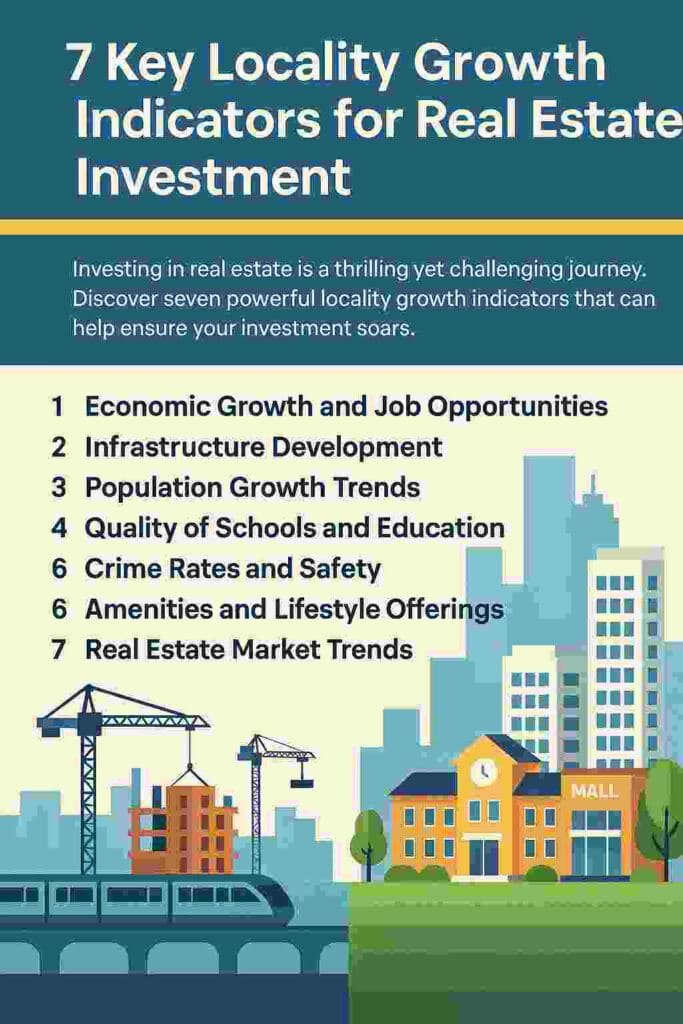

Investing in real estate can improve your life, but choosing the wrong place can backfire. The secret to unlocking massive returns lies in understanding locality growth indicators for real estate. These crucial indicators let you know if a city or neighbourhood is poised for rapid expansion, which will guarantee the success of your investment. Selecting a high-potential location is now essential, as the United Nations projects that 68% of the world’s population will live in cities by 2050.

In order to give you useful information, this article delves into seven locality growth indicators for real estate that have been shown to be effective. These signs will assist you in identifying emerging markets and avoiding stagnant ones, regardless of your level of experience as an investor. Let’s examine how locality growth indicators for real estate might change your investing strategy, taking into account anything from infrastructure booms to economic trends.

7 Essential Locality Growth Indicators for Real Estate

1. Economic Growth and Job Creation

One of the main components of locality growth indicators for real estate is a thriving economy. Strong job markets draw people to an area, which increases demand for housing. According to the U.S. Bureau of Labour Statistics, property values frequently increase by 10–15% in areas where unemployment is less than 4%.

How to Evaluate:

- Utilise Indeed to investigate growing sectors such as technology or healthcare.

- Seek out new business hubs or corporate relocations, as they are important locality growth indicators for real estate.

- Examine local economic reports to find patterns in employment growth.

Example: Real estate locale growth indicators are fuelled by economic vibrancy, as seen by cities such as Raleigh, North Carolina, which had a 3.5% job growth rate in 2024.

2. Infrastructure Development

When it comes to locality growth indicators for real estate, new infrastructure is revolutionary. Accessibility and attraction are increased via roads, bridges, and transit hubs. According to a 2023 Urban Institute study, property values increased by 12–15% in neighbourhoods close to new transit lines.

How to Evaluate:

- For information on upcoming projects, visit the Federal Highway Administration or city planning websites.

- Keep an eye out for commercial developments or metro expansions, which are important locality growth indicators for real estate.

- Evaluate the new commercial districts’ closeness.

Pro Tip: Investors utilising locality growth indicators for real estate are particularly interested in a neighbourhood close to a projected transit hub.

3. Population Growth Trends

One of the main characteristics of locality growth indicators for real estate is growing populations. According to the U.S. Census Bureau, the need for housing will rise as suburbs expand by 1.5% a year until 2030.

How to Evaluate:

- For information on population increase, use Zillow Research.

- Keep tabs on family or young professional migration, which is a crucial locality growth indicator for real estate.

- For long-term demand, keep an eye on population changes.

Why It Matters: great locality growth indicators for real estate indicate great investment possibilities, such as a population growth rate of 2% or more each year.

4. Quality of Schools and Education

Because they draw families, top schools are a vital sign of local real estate growth. Properties close to prestigious schools are 10% more expensive, according to a 2024 National Association of Realtors survey.

Ways to Evaluate:

- Look up school ratings on GreatSchools.org; a score of 8/10+ is ideal.

- Investigate recent school construction, which is a sign of favourable local real estate expansion.

- Find community colleges or universities in your area.

Example: New STEM schools sometimes attract a large number of purchasers to the suburbs, supporting area growth indicators for real estate.

5. Crime Rates and Safety

One non-negotiable measure of locality growth for real estate is safety. While excessive crime might impede growth, low crime rates draw long-term residents. According to a 2023 FBI Crime Data report, home values in safe neighbourhoods increased by 12%.

How to Evaluate:

- Check out the crime statistics on NeighborhoodScout.

- Seek out patterns of decreasing crime, which is a reliable sign of local real estate growth.

- To evaluate community safety, visit the area.

Why It Matters: One important locality growth indicator for real estate is stable demand, which is ensured by safe neighbourhoods.

6. Amenities and Lifestyle Appeal

Convenience is a top priority for modern buyers, therefore facilities are a crucial locality growth indicator for real estate. According to a Redfin survey from 2024, properties close to pedestrian amenities sold 8% quicker.

How to Evaluate:

- Google Maps can be used to map amenities.

- Keep an eye out for new retail or recreational developments, as these are important markers of local real estate progress.

- Visit Walk Score to view walkability scores (70+ is ideal).

Pro Tip: Locality growth indicators for real estate are more active in areas with planned community centres.

7. Real Estate Market Trends

One of the most effective locale growth indicators for real estate is the local market itself. Low supplies and rising prices indicate strong demand. Markets with less than three months’ worth of inventory are ideal for investors, according to Realtor.com.

How to Evaluate:

- Use Redfin or Zillow to monitor price trends.

- Examine rental yields, a crucial locality growth measure for real estate, and strive for 6%+.

- Keep an eye on days on market; a low DOM suggests high demand.

Example: A locality with a 5% yearly price growth rate is a definite sign of real estate growth.

Maximizing ROI with Locality Growth Indicators for Real Estate

To harness locality growth indicators for real estate, follow these steps:

- Create a Checklist: Based on the data, assign a score to each indicator (1–10).

- Focus on High-Impact Indicators: Give infrastructure and employment, two important locality growth indicators for real estate, top priority.

- Visit the Location: Verify information with first-hand knowledge.

- Consult with Experts: Local real estate brokers are able to verify locality growth trends.

- Track Trends: To stay ahead, reevaluate every six to twelve months.

You may find high-potential locations for the highest returns by combining these locality growth indicators for real estate with careful investigation.

Conclusion: Skyrocket Your Investments with Locality Growth Indicators

Gaining an understanding of localised growth indicators for real estate is essential to making more intelligent decisions. You may identify areas with blockbuster potential by assessing factors like infrastructure, demographic trends, schools, safety, amenities, and market dynamics. These indications are your safeguard against bad decisions and your means to gaining riches in 2025, when urbanisation is on the rise.

Use these location growth indicators for real estate to begin investigating one promising area right now. Profitable judgements may be made with the correct data, regardless matter whether the area is a thriving metropolis or a developing suburb. Take immediate action to transform real estate locality growth indicators into your superpower for investing!

FAQs

Q1: What are the top locality growth indicators for real estate?

Important location growth indicators for real estate that influence demand and value are population trends, infrastructure development, and economic expansion.

Q2: How can I locate trustworthy information about real estate locality growth indicators?

For market, school, and demographic insights, consult Zillow, GreatSchools.org, and the U.S. Census Bureau.

Q3: Are there reliable locality growth metrics for real estate in high-crime areas?

Yes, provided that crime is on the decline and other local growth indicators, such as employment, are robust. However, safety is still of utmost importance.

Q4: How frequently should I review locality growth metrics related to real estate?

Each and every 6–12 months, since changes in the infrastructure or the economy may cause locality growth metrics for real estate to change.

Q5: In terms of locality growth indicators for real estate in 2025, are suburbs superior to cities?

Because they are more affordable, suburbs frequently have higher locality growth indicators for real estate; yet, cities with expanding employment are also appealing.

Disclaimer

This article is not intended to be financial or investment advice; rather, it is merely informational. Risks associated with real estate investments include fluctuations in the market and changes in the economy. Before making an investment, always get advice from a licensed financial counsellor or real estate agent. To assess locality growth indicators for real estate and make sure they fit with your investment objectives, do extensive due investigation.

Also Read:

- 10 Proven Strategies to Save Tax After Property Sale and Avoid Costly Mistakes

- How to Invest in Real Estate in India 2025: 7 Proven Strategies for Massive Wealth Creation

- Property Demolition Due Diligence Checklist to Avoid Devastating Losses

- Rent vs Buy Decision in 2025: Making the Right Choice at the Right Time

- Real Estate Investment Tips – How to Evaluate a Locality’s Growth Potential