Longevity risk in India is rising as life expectancy improves. Learn why retiring at 60 may require funding 30–35 years without salary and how to protect your retirement corpus from long-term depletion. longevity risk in India, retirement longevity risk, retirement planning India, life expectancy India retirement, retirement corpus sustainability, medical inflation India, retirement income risk India.

Introduction: The Retirement Risk Most People Ignore

Longevity risk in India is one of the least discussed but most dangerous threats to financial independence. What if the real issue isn’t just saving enough? People spend time guessing returns, calculating totals, checking if numbers add up. Yet almost nobody stops to wonder – how many years should that money stretch? That silence speaks louder than spreadsheets ever could.

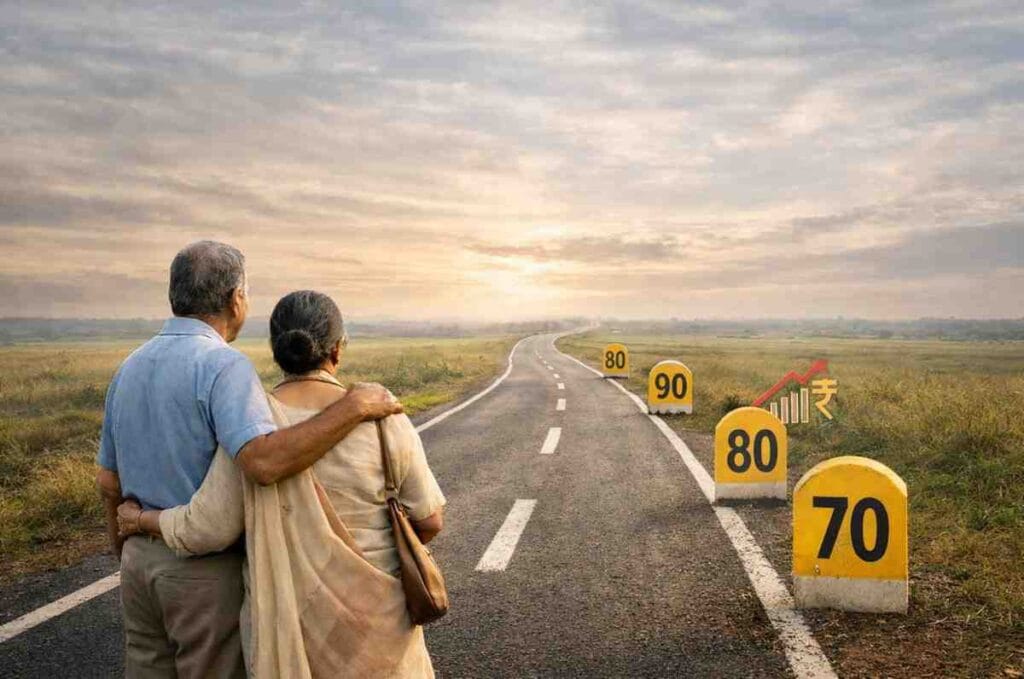

Three decades of living after work isn’t rare – it’s likely. Picture stepping away at sixty, then needing money for thirty-five years straight. Math shifts when paychecks stop but bills keep coming. Rising prices tug harder on savings stretched thin over time. Indian families now face longer lives as fact, not guesswork. What once seemed distant now shapes how money must last.

Longevity Risk in India: The Demographic Shift

Decades of gradual gains have lifted how long people live across India. Medical care reaching more folks plays a big role here. New tools spotting illnesses early add to the shift slowly taking hold. Handling ongoing health issues got smarter along the way too. Numbers straight from the World Bank back this steady climb year after year. What we see is not random swings but deeper changes rooted in systems built over time.

Yet most pension strategies cling to old estimates. Some halt projections by eighty-five. If people live into their nineties, that last stretch often lacks support. In India, living longer pulls reality further from standard forecasts.

Outliving the average person isn’t rare in cities where families can afford private clinics. When income climbs, so does the chance of spending more years retired – simply because people stay alive longer.

Why Retiring at 60 Now Means 30–35 Years Without Salary

Half a century ago, sixty marked the quiet years ahead. Now, that age could begin decades of living on saved funds alone. Three full decades without paychecks brings layered risks – money changes value, investments sway unpredictably, medical needs grow, relationships shift under pressure.

One way to look at it: ₹12 lakh spent each year when you retire could grow fast with 6% inflation. Twenty-five years later, that yearly cost might go beyond ₹50 lakh. Cost peaks often show up near the end, not right away. Expensive times wait until later, catching many off guard. Many investors confidently model their targets, but realistic survival assumptions can significantly alter how you calculate retirement corpus in India.

Longevity risk in India increases not just duration but cumulative exposure to financial variables.

The Medical Inflation Multiplier

Healthcare prices climb faster than everyday living costs, making longer lives more expensive in India. With age comes more doctor trips, tests, ongoing treatments, plus regular expert visits – these add up slowly but surely. Insurance might pay big hospital bills, yet extra charges like medicine, private rooms, shared fees, helpers at home still need cash. Year after year, such spending grows without notice. Stretch that across three decades of retirement, and the total becomes hard to ignore. Health costs keep rising, a trend the Reserve Bank of India has pointed out through regular updates on money trends and industry figures. Though services like medical care show steady price increases, many retirement plans fail to account for this gap. Because of that, estimates often miss how long people might need funds, particularly during later years. Medical bills tend to climb sharply near the end of life, making underestimations more dangerous. Without realistic assumptions, financial gaps grow just when support is needed most.

Why Retirement Sufficiency Calculations Often Fail

Retirement sufficiency models frequently focus on present numbers rather than time risk. Many investors use tools or frameworks that help them know if retirement savings are enough, but these tools often stress-test only up to age 80 or 85.

It’s not about how you calculate. The real issue sits in assuming too much time. Pushing forecasts out to 95 years old blows up the needed savings fast. Then there’s the belief that markets grow steadily. Truth? Gains jump around – bunched into streaks, not spread evenly. More retirement years mean more chances to hit rough patches in the market.

A single percent shift in returns or inflation feels tiny at first – yet stretches wide when time drags it forward. In India, living longer means models face more pressure, where slight miscalculations balloon without notice. What seems negligible over a decade reveals weight by year thirty-five.

The Compounding Effect of Early Decisions

Early retirement decisions have disproportionate impact when longevity extends the timeline. For example, withdrawing a significant portion of EPF before retirement may appear manageable in short-term projections. However, analysing the EPF withdrawal impact on retirement reveals that reduced compounding years shrink long-term sustainability.

Thirty years of relying only on low-interest savings after age sixty cuts swings in value – though inflation slowly chips away at buying power. Withdrawal plans become clearer once retirees learn SWP fits their long-term needs. Lasting three to three-and-a-half decades means timing matters just as much as the amount taken out.

What happens early sticks around longer when people live longer in India. Mistakes in how money gets split up show up clearer over decades, not months. Time stretches out every choice made at the start. Living longer means small missteps grow without notice. The future weighs heavier where lifespans stretch further. Wrong moves gain strength when given years to breathe. How things begin shapes what they become, especially when life lasts.

Psychological Blind Spots

Most people in India overlook how long they might actually live. Because of habits in thinking, guesses about life span tend to lean too short. Parents’ lifetimes become a mental marker – yet hospitals now do more than before. When someone has ongoing health issues, hope shrinks even if treatment works better today. Serious diagnosis does not always mean fewer years, but many act as though it does.

Hope colors how people see retirement. Lower savings goals seem easier to reach, so they pick them, though bigger numbers might be safer. Living until 95 sounds like too much, even when data says otherwise. Relying on kids for help is common, yet fewer families can afford that now, with younger adults facing tighter budgets. The future rarely matches today’s assumptions.

Comfort in feeling safe beats cold numbers every time. When emotions win, later years grow shaky.

Real-Life Examples of Longevity Risk in India

Example 1: The Underestimated Horizon

Retirement came for Mr. Kulkarni at sixty, carrying three crores in savings. Until eighty-five, his costs were mapped out by the advisor. On paper, it seemed to hold up just fine. Comfortable figures filled the spreadsheet, nothing more. Yet he made it to ninety one. Those last half dozen years pulled money faster while stocks sagged. Even though spending stayed steady, living longer chipped away at peace of mind. It wasn’t bad math. Just blind spots in time planning.

Example 2: The Conservative Allocation Trap

Right off the bat, Mrs. Thomas moved almost all her retirement savings into fixed deposits when she stopped working – wanted to dodge market swings. At first glance, things looked steady for a solid decade; checks arrived like clockwork. Over time though, creeping inflation started chipping away at what those returns could actually buy. Even into her eighties, actual purchasing power fell fast although numbers on paper stayed stable. Staying too safe for too long revealed flaws when lifespans stretched out across India.

Example 3: Medical Cost Acceleration

Though once predictable, their budget faced strain after frequent health issues arose. By the late eighties, doctor visits plus round-the-clock aid added up fast. Coverage handled big bills yet left gaps in daily support costs. Living longer meant more years of care needs piling on. Still, savings held firm thanks to earlier frugality and extra reserves set aside.

Example 4: Early Withdrawal Regret

At 58, Mr. Singh left work sooner than planned, pulling out some savings to fix up his house. That choice didn’t feel heavy back then. By age 88, though, the cost of taking money too soon had grown quietly larger. Living longer in India turned an old financial move into a present-day strain. Three decades later, one early step still shaped how far his funds could stretch.

Structural Strategies to Manage Longevity Risk in India

Even when it seems cautious, pushing estimates toward ages 90 to 95 tackles the challenge of outliving savings. Growth assets stay useful over decades, especially when mixed thoughtfully to offset rising prices. Instead of relying on one type of investment, combining pensions, planned drawdowns, and backup funds spreads the load. A wider safety net emerges by weaving different income types together.

Now imagine checking things again after a few years, say between three and up close to five. Health shifts, prices climb differently, money grows at new speeds – each shapes what comes next. Lives stretch longer in India now, always changing pace. Plans for later years need to bend like reeds, never lock into stone.

Conclusion: Longevity Is a Success, But It Must Be Financed

Aging longer in India shows how far society has come. Better health care, higher living conditions, because of medical progress – lives stretch further now. Still, money plans need to shift just as much. Funding three decades without pay could start at age sixty. During that stretch, prices climb steadily while health surprises wait around corners. Markets wobble unpredictably, layering pressure on choices made too early. Overlooking how long life might stretch builds hidden weakness underneath calm surfaces. Honouring that span shapes a steadier kind of freedom. How long retirement lasts matters just as much as the amount saved. What once focused on savings size now shifts toward time span.

FAQs

Q1: What exactly is longevity risk in India?

Life spans are stretching in India, making it more likely someone could exhaust their retirement funds. Because folks stay alive longer now, the years after work stretch further than old estimates predicted. This shift pushes harder on how long money needs to last. Running out becomes a real concern when golden years grow without matching savings.

Q2: At what age should retirement projections ideally end?

Lifespans tend to surprise people – aiming forecasts at 90, maybe 95, makes sense. Stopping the math at 80 could leave someone short when they need it most. Running out becomes more than a worry if numbers don’t stretch far enough.

Q3: Does higher life expectancy mean everyone will live past 90?

No, but retirement planning must account for probability, not certainty. Even if average life expectancy is lower, planning conservatively protects against the financial consequences of living longer.

Q4: How does medical inflation affect longevity risk?

Medical inflation often rises faster than general inflation. Over 30 years, healthcare costs can significantly increase withdrawal pressure, especially in the final decade of life.

Q5: Can conservative investments eliminate longevity risk?

No. While too much caution may shield against volatility, it also accelerates the loss of inflation over extended periods of time. Allocation must be balanced in order to control growth and stability.

Q6: Is longevity risk more serious than market risk?

They are related to each other. The longer retirement age, the more detrimental market volatility gets. Exposure to unfavorable return cycles grows with a longer time horizon.

Disclaimer

This piece aims to inform and educate. Not meant as financial, investing, or tax guidance. Decisions around retirement need thought – personal risks, health status, money goals matter just as much. Speaking with a certified financial expert first brings clarity nearly every time.