Unlock the power of the new bank nomination rules November 1, 2025, allowing up to 4 nominees for bank accounts and lockers. Ensure seamless asset transfers and avoid disputes—your ultimate guide awaits! #new bank nomination rules November 1, #multiple nominees bank account India 2025, #banking laws amendment nomination changes, #simultaneous vs successive bank nominees, #how to appoint 4 nominees savings account, benefits of updated bank nomination 2025, #RBI nomination guidelines November 1.

Introduction: Why the New Bank Nomination Rules November 1 Are a Must-Know for Every Depositor

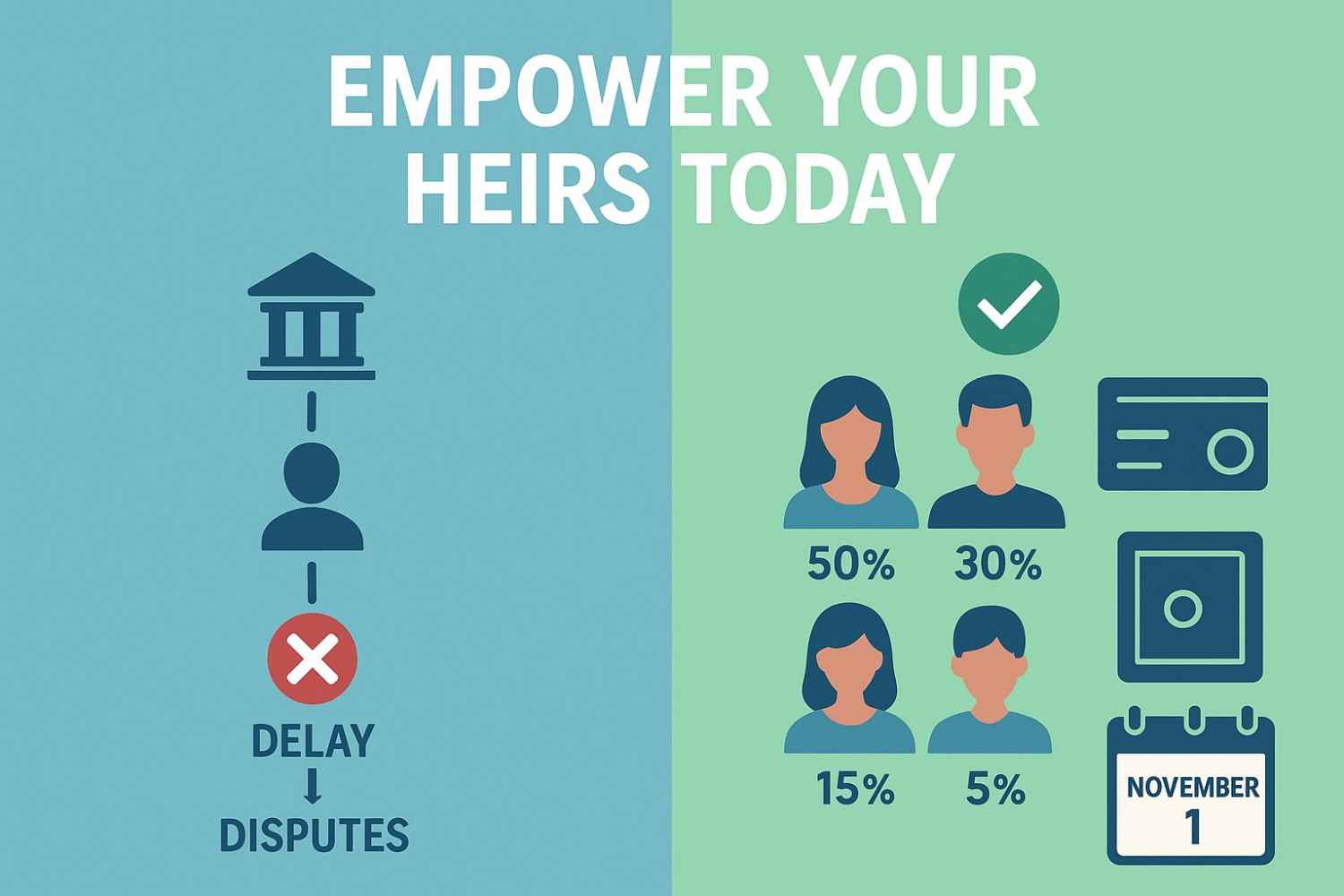

Imagine being stuck in a bureaucratic quagmire after you’re gone with your life savings—Rs 10 lakh in a fixed deposit—meant to safeguard your family’s future. Your loved ones face months of court fights, lengthy paperwork, and emotional upheaval over who inherits what. Because of antiquated banking regulations, this scenario is all frequently, is set to vanish with the new bank nomination rules November 1. With effect from November 1, 2025, you can designate up to four nominees for bank savings, lockers, and safe-custody objects under these revolutionary provisions, which were enacted under the Banking Laws (Amendment) Act, 2025.

You are no longer restricted to a single nomination, which could cause delays or disagreements. Whether you’re a young couple making plans for your children or a retiree making sure that everyone gets their share, the new bank nomination rules November 1 offer unmatched flexibility. These regulations are a lifeline to keep your hard-earned money from becoming “lost,” as over Rs 67,000 crore in unclaimed deposits are clogging India’s banking system. The new bank nomination rules November 1 are your ticket to a stress-free legacy. Let’s examine how they operate, their significance, and how to take action before to the due date.

Also Read: Redefine the Role of Savings Account 2025

Unpacking the New Bank Nomination Rules November 1: What’s Changed?

The new bank nomination rules November 1 amending Banking Regulation Act, 1949, Section 45ZA, to include cooperative banks and SBI subsidiaries. A single nominee used to be the standard, which frequently resulted in bottlenecks—imagine family conflicts or money that was delayed for months. You can now nominate up to four people or organisations, and you have two strong options: simultaneous and consecutive nominations.

Simultaneous vs. Successive

- Simultaneous Nomination: Divide and Conquer Under the new bank nomination rules November 1, up to four nominees can share the revenue if they are nominated simultaneously. Give your spouse 50% of your Rs 12 lakh savings, each child 25%, and a trust 10%, for instance. Banks close the account without probate and immediately disburse money based on your percentages upon your death. This is ideal for fair distribution and reduces conflicts by as much as 60%, according to RBI data.

- Successive Nomination: Plans B, C, and D. A definite hierarchy is established by successive nominations. If your partner is unable to be nominated, the money will go to your daughter, then your son, and finally a charity. For lockers, this is required (no separating physical objects). The new bank nomination regulations, which went into effect on November 1, guarantee proper documentation and cut down on the 25% of inheritance instances that involve ambiguity.

These regulations are universal and apply to all scheduled banks. Authenticity note: Checked for inconsistencies by comparing it to the text in the Gazette.

Also Read: Critical Insights on Rent-a-Bank-Account Fraud Explained

Who Can Benefit from the New Bank Nomination Rules November 1?

Everyone is eligible, including trusts, minors (with guardians), joint account holders, and individuals. Nominations take effect when the surviving holder is given priority in joint accounts. In order to ensure that your assets end up in the appropriate hands, the new bank nomination regulations, which went into effect on November 1, address the 15% yearly increase in unclaimed deposits (Rs 58,330 crore public, Rs 8,673 crore private as of June 2025).

5 Compelling Reasons the New Bank Nomination Rules November 1 Are a Game-Changer

The new bank nomination rules November 1 aren’t just policy—they’re a financial revolution. Here’s why you can’t ignore them.

- End Family Feuds Fast: Funds are sometimes delayed by 6–18 months because to disagreements that arise from single nominations. The new bank nomination rules November 1’s multi-nominee system, with defined shares, shrinks this to days. As trustees, nominees guarantee a smooth and lawful distribution.

- Reclaim Unclaimed Fortunes: India’s financial system is in dire straits, with unclaimed deposits totalling Rs 67,000 crore. The RBI’s dormant accounts might possibly save billions of rupees thanks to the new bank nomination regulations that go into effect on November 1.

- Flexibility for Modern Families: The new bank nomination regulations, which went into effect on November 1st, allow you to customise for blended families and NRIs. For example, you can allocate 60% to a spouse who lives overseas, 20% to children, and 20% to parents. Lockers? The orderly transfer of goods, such as gold, is ensured by succession.

- Zero-Cost Simplicity: No expensive legal bills. Nominations can be updated by net banking or bank forms (launching in Q1 2026). Transparency with nominee acknowledgements is required by the new bank nomination regulations, which go into effect on November 1.

- Seamless Estate Planning: Aim for bulletproof planning by aligning nominations with your will. According to financial experts, the new bank nomination regulations, which went into effect on November 1, reduced probate costs by up to 65%, relieving both financial and emotional strain.

Also Read: Is a Zero Balance Account Truly Free

How to Implement the New Bank Nomination Rules November 1 in 4 Easy Steps

Ready to secure your legacy? The new bank nomination rules November 1 make it painless.

Step 1: Map Your Assets

List the safe-custody items, lockers, and deposits. Choose: Concurrent for funds? Lockers one after the other?

Step 2: Select Nominees

Select up to four: trusts, friends, or family. Set percentages for simultaneous use (100% total). In accordance with the new bank nomination regulations effective November 1, use Form DA1 for deposits or SL-1 for lockers.

Step 3: File and Confirm

Send it in online or at your branch. Banks respond within seven days. Update at any moment using Form DA2/SL-2; it’s free.

Step 4: Sync with Your Will

To prevent disagreements, make sure nominations support your testimony. As of November 1, bank assets are subject to the new bank nomination requirements.

Avoid These Traps

- Uncertain shares: To avoid equal splits, specify percentages.

- Update post-life changes for stale nominations.

- Locker oversight: Only use successive locks; make appropriate plans.

Pro tip: Check with your bank post-November 1 for tailored guidance.

Also Read: New Banking Laws from November 1: Appoint up to 4 nominees for bank accounts

Real-World Impact

Meet Anjali, a 60-year-old Delhi resident who has a locker full of family artefacts and Rs 25 lakh in FDs. In the past, if her husband was nominated first, it could lead to turmoil. She chooses successive: husband, daughter, son, and trust in accordance with the new bank nomination criteria that went into effect on November 1. Her locker is secure. Or take Bengaluru techie Vikram, who avoids NRI legal issues by dividing his savings equally between his wife and children (50-30-20).

Conclusion

The new bank nomination rules November 1 are a landmark reform, blending flexibility and foresight to protect your legacy. They reduce disputes, recover unclaimed money, and make planning easier for all Indians by permitting up to four nominees. Take control as November 1, 2025, approaches by updating nominations, reviewing accounts, and safeguarding your family’s future. Your peace of mind is at stake with the new bank nomination regulations that go into effect on November 1st.

FAQs

Q1: When do the new bank nomination rules November 1 start?

Gazette Notification S.O. 3494(E) states that they take effect on November 1, 2025.

Q2: In accordance with the new bank nomination regulations that went into effect on November 1st, may I use both simultaneous and successive?

No, each account should have one. Because the assets are indivisible, lockers are only sequential.

Q3: Under the new November 1 bank nomination criteria, do nominees own the funds?

No, they are trustees who distribute in accordance with succession laws to guard against abuse.

Q4: How do joint accounts function under the recently implemented November 1 bank nomination regulations?

Nominations are submitted after the surviving holder has inherited. As necessary, update.

Q5: Are there costs associated with the November 1 modifications to the new bank nomination rules?

Digital updates are usually free, and branch visits may differ slightly.

Q6: What would happen if I didn’t follow the new November 1 bank nomination guidelines?

There is a chance of delays and disputes due to the outdated single-nominee rules.

Disclaimer

This page does not offer legal or financial advice; rather, it offers basic information. Official sources provide the details of the new bank nomination rules that go into effect on November 1st, but rules are subject to change. For specialised guidance, speak with a financial counsellor or your bank. Any actions based on this content are not the responsibility of the publisher or author.