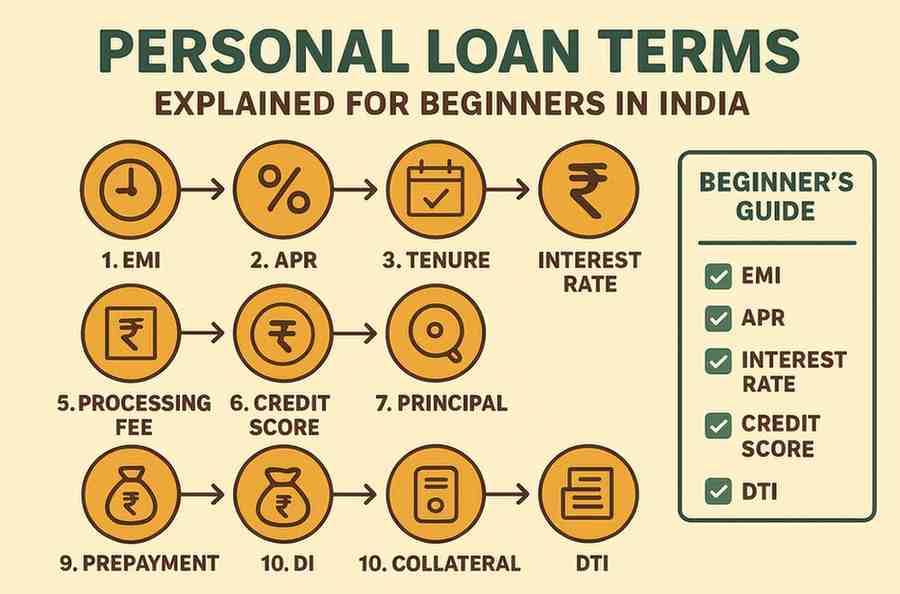

Personal loan terms explained for beginners in India – Unlock EMI, APR, interest rates, and RBI guidelines to borrow wisely, dodge fees, and secure low-cost funding in October 2025. #Personal Loan Terms Explained for Beginners, #personal loan terms, #personal loans India, #beginner personal loan guide, #RBI loan guidelines 2025, #unsecured personal loans India.

Introduction

For first-time borrowers in India, grasping personal loan terms explained for beginners in India is essential to navigate the lending maze confidently. If you can understand the lingo, personal loans provide speedy funding for crises, weddings, or debt reduction, especially with the rise of digital platforms and the RBI’s new 2025 regulations encouraging openness.

These personal loan terms, such as principal and debt-to-income ratio, are more than just catchphrases; they are your safeguard against overspending, and research indicates that knowledgeable borrowers can reduce expenses by up to 20%. We’ll break down each personal loan term with examples, advice, and RBI-backed information, whether you’re looking at offers from SBI or HDFC. Why now? With the RBI’s October 1 modifications strengthening borrower protections, 2025 is the ideal year to learn the ins and outs of personal loans and borrow like an expert in India.

Principal: The Core Amount in Personal Loan Terms Explained for Beginners in India

The principal forms the bedrock of personal loan terms explained for beginners in India—it’s just the amount you borrow, without any fees or interest. This number is the basis for all computations in your loan agreement, therefore it’s crucial to carefully review it up front.

For example, your principal is ₹3 lakhs if you require that amount to cover medical expenditures. To prevent disagreements, the RBI requires that it be clearly listed in sanction letters. Misunderstanding this personal loan term causes excessive borrowing, pushing EMIs above manageable amounts like ₹10,000 per month for many salaried people in urban India, where average loan sizes reach ₹2–5 lakhs.

Examine a principal of ₹2 lakh spread over 36 months at an interest rate of 11%: The entire amount plus roughly ₹30,000 in interest will be repaid by you. According to aggregator insights, novices frequently make mistakes here by failing to match the principle with the needs. Expert advice: Test situations using EMI tools; remaining lean on principle can reduce overall outflow by 10% to 15%. The transparency of this personal loan term is guaranteed by authentic RBI data, empowering you in personal loan terms explained for beginners in India.

Interest Rate: Decoding the Cost Factor in Personal Loan Terms

Among the most critical personal loan terms explained for beginners in India is the interest rate, the yearly % charge on your borrowed money’s principal. Rates range from 9.99% to 24% annually as of October 2025, depending on the lender and credit score.

While floating rates allow possible drops, fixed rates guarantee stability by tracking the RBI’s repo rate, which is now 6.5%. For salaried borrowers, HDFC starts at 9.99% and SBI at 10.05%. For restricted budgets, a 2% increase on a loan of ₹4 lakh over 48 months adds ₹15,000+, which is a significant disadvantage.

On the plus side, comparator sites show sub-11% rates for solid profiles. According to new regulations, the RBI’s 2025 disclosures require complete rate breakdowns. In personal loan terms explained for beginners in India, always compare nominal and effective prices while negotiating wins.

Also Read: How to Reduce Personal Loan Interest Rate: A Step-by-Step Guide

Annual Percentage Rate (APR): The All-In Cost in Personal Loan Terms

Elevating beyond basic interest, APR in personal loan terms explained for beginners in India encompasses the full annual cost, folding in fees and charges. It is your actual measure of expenses, rising 12–28% in 2025 and frequently 2-4% over headline rates.

APR reaches 12% if you take out a loan with a 10.5% interest rate and 1.5% expenses. Comparisons are equalised with this personal loan term—Axis is at 9.99% base, but verify the actual APR. By requiring comprehensive APRs in agreements, RBI’s July 2025 rule eliminates the unpleasant surprises that 25% of newcomers faced.

Power move: Turn a potential trap into savings by using APR to negotiate charge reductions. Important personal loan terms provided for newcomers in India to ensure fair transactions.

Tenure: Timeframe Mastery in Personal Loan Terms

Tenure, a cornerstone of personal loan terms explained for beginners in India, is the time frame for repayment, which is normally 12–60 months. Longer periods alleviate cash flow but increase interest; shorter periods speed up debt repayment but increase EMIs.

For sustainability, the RBI caps at five years. 24 months translate into ₹7,000 EMI for a ₹1.5 lakh loan at 12%; 48 months reduces that to ₹4,000 but adds 40% interest. For balance, urban averages are about 36 months.

Avoid extensions that drive up costs; this personal loan term requires decisions that are in line with your employment. Calculators can be used to simulate personal loan terms for beginners in India and make the best decisions.

Equated Monthly Instalment (EMI): Budget Anchor in Personal Loan Terms

The EMI makes personal loan terms easier to understand for new Indian borrowers, through combining principle and interest into consistent monthly withdrawals. EMI = [P × r × (1+r)^n] / [(1+r)^n – 1], where P is the principal, r is the monthly rate, and n is the tenure months.

EMIs for a ₹5 lakh loan at 10.85% over 60 months come to ₹11. Waiting? Although auto-debits avoid dings, the RBI permits penalties of up to 3%. Your personal loan term is your monthly schedule; allocate 30–40% of your revenue to it.

In personal loan terms explained for beginners in India, timely EMIs build credit, unlocking future perks.

Credit Score: Eligibility Key in Personal Loan Terms

Your credit score (CIBIL 300-900) unlocks favourable personal loan terms explained for beginners in India, signalling reliability. More than 750? Rates fall below 10%; premiums should be at least 18% below 650.

Enquiries cost five points under RBI’s digital regulations, which tie permissions to scores. Increase through bill payments—low scores are linked to 40% of rejections. Your leverage is this personal loan term; keep it for empowered borrowing in India.

Processing Fee: Entry Cost in Personal Loan Terms

Processing fee, an upfront hit in personal loan terms explained for beginners in India, covers admin (0.5-2% of principal). October 2025 caps: 1.5-2% for Axis, 1.5% for SBI.

That is ₹4,500—deducted immediately from ₹3 lakhs. For high scores, bargain for waivers. This personal loan period is highlighted by RBI transparency standards, which facilitate avoidance.

Also Read: 7 Shocking Hidden Charges in Personal Loans You Must Avoid

Prepayment and Foreclosure: Exit Options in Personal Loan Terms

Prepayment (partial) and foreclosure (full) in personal loan terms explained for beginners in India allow early payoffs, with the RBI prohibiting floating rate penalties starting in January 2026. Despite charging 2-4%, pre-2026 fixed rates save a significant amount of money—more than ₹10,000 on mid-tenure closes.

Verify terms in accordance with RBI modifications from October. Positively, this personal loan period releases you more quickly.

Also Read: 5 Proven Desi Borrowers Personal Loan Repayment Tips to Save Money

Collateral: Risk-Free Aspect in Personal Loan Terms

Personal loans shine as unsecured in personal loan terms explained for beginners in India—in accordance with RBI’s priority sector push, no collateral is required. 95% don’t require collateral, making them perfect for borrowers with few assets.

Defaults only affect scores; they have no effect on possessions. In India’s heterogeneous society, its emancipatory personal loan term democratises access.

Debt-to-Income Ratio: Sustainability Gauge in Personal Loan Terms

DTI measures debts against income (<40% ideal) in personal loan terms explained for beginners in India, RBI-required authorisation. High DTI? 30% chance of rejection.

(Monthly obligations / income) times 100 is the calculation. Reduce with green light budgeting. essential for long-term personal loan conditions.

Also Read: 10 key personal loan terms every first-time borrower should know

Conclusion

Armed with these 10 personal loan terms explained for beginners in India, You’ll overcome any obstacles to lending. Every personal loan term, from principle to DTI, prepares you for wise decisions, enhanced by RBI’s 2025 protections. Your empowered financial journey is waiting for you as you evaluate offers, put insights to use, and take risks with borrowing!

FAQs

Q1: What is the average personal loan interest rate in India for October 2025?

According to the most recent bank updates, averages range from 10.5 to 15% per year, with top credits from lenders like as HDFC and Axis starting at 9.99%. Score and tenure have an impact. Always compare using aggregators for personalised lows.

Q2: Are there any penalties if I pay off my personal loan early?

Absolutely for floating rates after January 2026 due to RBI prohibitions; fixed-rate loans may charge 2-4% until then. According to the new criteria, evaluate agreements and time prepayments to reduce interest and save thousands on mid-tenure closes.

Q3: What effect does credit score have on the terms of personal loans?

Lower scores raise costs to 18%+ and restrict approvals; higher scores (750+) unlock rates below 10%, larger limits, and fee waivers; develop gradually with on-time payments and low utilisation for 20–50 point gains over months.

Q4: Does India require collateral for personal loans?

Rarely—more than 95% are unsecured according to RBI regulations, releasing you from asset commitments such in gold loans; this is advantageous for novices but emphasises the need of score because defaults only impact credit and do not pose a risk to real estate.

Q5: For a first-time borrower, what is the optimal tenure?

24-36 months prevent interest creep and make EMIs affordable for those with incomes under 30%; if income is steady, extend to 60 months for lower monthly hits, but use tools to calculate totals; shorter periods save 20–30% overall.

Disclaimer

This guide on personal loan terms explained for beginners in India, is not a financial advice; it is merely informational. A certified advisor should be consulted prior to borrowing. Rates and fees may change, and loan terms differ depending on the lender and borrower profile. We encourage sensible borrowing; only take out loans that you can pay back.