Uncover how the RBI AIF investment proposal reshapes opportunities for banks and NBFCs with new caps, provisioning rules, and strategic exemptions. Dive into this comprehensive guide to understand its implications. #RBI AIF investment proposal, #AIF investment rules, #RBI guidelines AIF 2025, #AIF investment caps for banks, #RBI provisioning requirements, #evergreening AIF regulations, #strategic AIF exemptions,

Introduction

A crucial draft proposal that reinterprets the relationship between banks and non-banking financial companies (NBFCs) and alternative investment funds (AIFs) was presented by the Reserve Bank of India (RBI). In order to strike a balance between risk management and capital flow into high-growth industries including startups, infrastructure, and private lending, the RBI AIF investment plan specifies additional investment restrictions, provisioning criteria, and possible exemptions. This suggestion, which reflects trust in the financial discipline being displayed by regulated entities (REs), builds on the RBI’s December 2023 efforts to restrict evergreening. The RBI AIF investment plan promotes openness while opening up investment options in accordance with the Securities and Exchange Board of India’s (SEBI) more stringent due diligence requirements. Seven revolutionary effects of the RBI AIF investment proposal are examined in this essay, offering practical advice for banks, NBFCs, investors, and financial professionals navigating this changing regulatory environment.

1. Structured Investment Caps for Risk Control

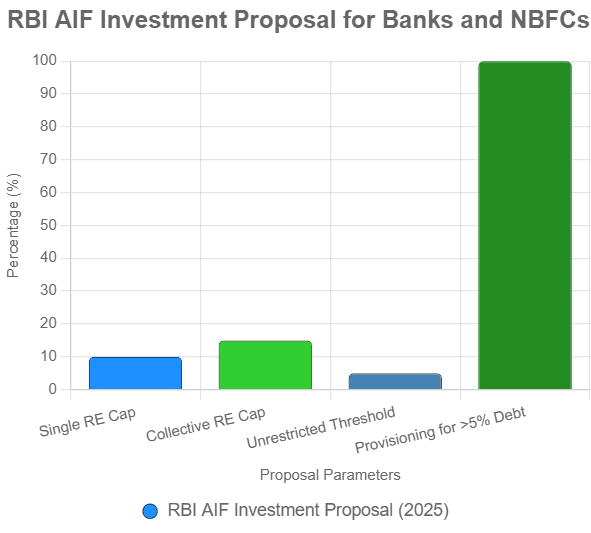

The RBI AIF investment proposal introduces precise limits to regulate RE investments in AIFs, ensuring prudent participation. The maximum amount that a single RE can contribute to an AIF scheme is 10% of the fund’s corpus, while the maximum amount that a group of REs can invest is 15%. Furthermore, there are no further restrictions on investments up to 5% of the corpus, providing flexibility for smaller stakes. These limits allow banks and NBFCs to invest new areas through AIFs while preventing overexposure. For example, a bank can promote capital flow by investing up to 5% in an AIF that focusses on fintech firms without subjecting it to strict scrutiny. As a result, the RBI AIF investment proposal establishes a structure that permits REs to properly support high-growth funds while striking a balance between risk mitigation and investing freedom.

2. Robust Provisioning to Address Debt Risks

A cornerstone of the RBI AIF investment proposal is the requirement for 100% provisioning when the fund has downstream debt exposure to a borrower associated with the RE and the investment of a RE surpasses 5% of the corpus of an AIF. This law solely targets debt instruments and does not apply to equity shares, compulsorily convertible preference shares (CCPS), or compulsorily convertible debentures (CCDs). Evergreening, in which REs may employ AIFs to indirectly finance troubled borrowers, is addressed by the provisioning obligation. To ensure financial accountability, an NBFC must provision 100% of its exposure, for instance, if it invests 8% in an AIF that lends to a connected borrower. The soundness of India’s financial system is reinforced by the RBI AIF investment proposal emphasis on debt risk.

3. Strategic Exemptions for High-Impact AIFs

The RBI AIF investment proposal proposes exemptions for AIFs established for strategic purposes, such as those promoting green energy, infrastructure, or other government-sponsored projects, subject to consultation. By enabling banks and NBFCs to invest above the customary 10% and 15% restrictions, these exemptions may encourage involvement in initiatives vital to the advancement of the country. For example, banks may be able to promote sustainable growth with possibly better returns if an AIF finances renewable energy projects, which could qualify for reduced regulations. The proactive strategy of the RBI AIF investment proposal pushes REs to match national priorities, and stakeholders have until June 8, 2025, to offer input to improve these exemptions.

4. Prospective Application for Seamless Transition

In contrast to regulations that are retrospective, the RBI AIF investment proposal only applies to new investments; current commitments made under the parameters from December 2023 and March 2024 remain unaltered. For REs who have already been exposed to AIF, this potential strategy reduces disruption. To maintain market stability, a bank that currently owns a 7% share in an AIF connected to a borrower won’t be subject to provisioning requirements right away. Because of the RBI AIF investment proposal’s clarity, banks and NBFCs can make strategic plans and match new investments with the most recent caps and regulations. As REs adjust to the new framework, this gradual implementation helps to maintain trust in the financial industry.

5. Alignment with SEBI’s Due Diligence Framework

By enhancing SEBI’s more stringent due diligence standards, the RBI AIF investment proposal unifies the regulatory framework. In order to eliminate regulatory gaps, such as those that could be circumvented through intricate fund structures, SEBI’s standards require extensive inspections on AIF investors and their downstream investments. The RBI AIF investment plan guarantees that banks and NBFCs carefully verify AIF investments by integrating with these regulations. To lower the risk of evergreening, for example, an NBFC must verify that an AIF’s downstream investments meet both RBI and SEBI rules. This collaboration improves accountability and transparency throughout India’s financial system.

6. Boosting Domestic Capital in AIFs

As AIFs currently rely on foreign capital for 70% of their funding, the RBI AIF investment proposal seeks to expand domestic capital participation in AIFs. The plan encourages banks and NBFCs to invest in private lending, real estate, and startups by easing the limits that will be in place until December 2023. Clear guidelines are provided by the 15% collective cap and the 10% single RE cap, which let REs contribute without controlling fund choices. More bank investments, for instance, might support fintech companies and improve financial inclusion. By emphasising domestic capital, the RBI AIF investment plan has the potential to revolutionise India’s venture capital ecosystem and spur economic growth and creativity.

7. Strengthening Defences Against Evergreening

In order to prevent evergreening, the December 2023 circular that forbade REs from investing in AIFs with downstream investments in recent borrowers was improved upon by the RBI AIF investment proposal. With the current approach, 100% provisioning is required for bigger debt exposures, although investments up to 5% are permitted without limitations. By preventing banks and NBFCs from using AIFs to conceal troubled loans, this encourages financial restraint. For example, a bank that lends to a linked borrower in excess of the 5% level in an AIF must fully provision its exposure, discouraging risky behaviour. The focus on transparency in the RBI AIF investment proposal establishes a strong foundation for ethical investing.

Additional Insights for Stakeholders

Expert input shows that the RBI AIF investment proposal takes industry feedback into consideration. Industry executives point out that since just 30% of AIF capital is presently generated domestically, the loosened regulations may open up funding for infrastructure and entrepreneurs. Concerns over evergreening, in which REs exploited AIFs to indirectly extend credit to distressed borrowers, are addressed by the proposal’s limitations and provisioning rules. The RBI AIF investment proposal establishes a transparent, investor-friendly environment by establishing clear boundaries and complying with SEBI’s due diligence. While NBFCs can use AIFs to support creative financing models like co-lending with fintechs, banks can participate in high-growth funds with more security.

The timing of the proposal is crucial because the RBI’s “Connect 2 Regulate” section will be open for comments until June 8, 2025. In order to influence the final rules, especially with regard to strategic exemptions, stakeholders such as banks, NBFCs, and AIF managers should contribute. The emphasis on prospective application in the RBI AIF investment plan guarantees that current investments won’t be impacted, allowing REs time to adjust. India’s financial sector is positioned for sustainable growth with this strategic strategy, which addresses regional issues and conforms to international norms.

Conclusion

An important step towards a transparent and balanced financial environment was taken with the announcement of the RBI AIF investment proposal on May 19, 2025. It enables banks and NBFCs to make responsible investments in high-growth industries by imposing 10% single RE and 15% collective limitations, requiring 100% provisioning for hazardous debt exposures, and suggesting exemptions for strategic AIFs. The RBI AIF investment proposal tackles evergreening while increasing domestic capital involvement, in compliance with SEBI’s due diligence criteria. To have an impact on the final rules, stakeholders must take action by June 8, 2025. The RBI AIF investment proposal puts REs in a position to spur innovation, promote economic expansion, and uphold financial discipline as India’s financial environment changes.

FAQ

Q1: What is the RBI AIF investment proposal?

Feedback on the May 19, 2025, draft guideline, which outlines guidelines for banks and NBFCs participating in AIFs, including 10% single RE and 15% collective caps, is due on June 8, 2025.

Q2: How does the proposal affect banks and NBFCs?

The RBI AIF investment proposal balances risk and opportunity by limiting investments, requiring provisioning for debt exposures over 5%, and providing exemptions for strategic AIFs.

Q3: Why focus on evergreening?

Through stringent provisioning guidelines, the RBI AIF investment plan ensures transparency by prohibiting REs from indirectly funding problematic borrowers through AIFs.

Q4: Are existing AIF investments impacted?

No, current commitments under previous regulations are preserved; the RBI AIF investment proposal only applies to new investments.

Q5: How does it align with SEBI?

The RBI AIF investment plan requires extensive inspections on AIF investments to improve accountability, which is a complement to SEBI’s due diligence obligations.

Disclaimer

This article does not provide legal or financial advice; it is merely meant to be informative. Prior to making any investment decisions based on the RBI AIF investment proposal, get advice from a certified expert.

Also Read:

- 7 Compelling Reasons the Power of Staying Invested Builds Lasting Wealth

- Why Silver Might Outperform Gold in 2025: The Ultimate Guide

- 9 Transformative Ways How Specialised Investment Fund Impact Investor Positively in 2025

- RBI proposes to ease AIF investment rules: What this means for banks and NBFCs

- Business Standard – RBI Draft Norms for AIF Investments