Learn how to start global investing in India with this ultimate guide. Discover 12 powerful reasons, practical steps, and top options to diversify your portfolio and boost returns. #start global investing India, #global investing for Indian portfolios, #how to invest globally from India, #global diversification for Indians, #international investing options India, #why Indian investors should invest globally, #benefits of global investing India, #international mutual funds India, #global investing platforms India,

Introduction: Why You Should Start Global Investing in India Today

It is a lost opportunity to restrict your investments to domestic markets, as 95.8% of the global market capitalisation is outside of India. Indian investors may access high-growth industries like semiconductors, luxury brands, and artificial intelligence (AI) through global investing, which also helps them diversify and lower risks. It makes sense to start global investing in India in order to create a robust portfolio in a world where the rupee is depreciating and domestic markets are volatile.

This report outlines the top investment alternatives for 2025, offers a detailed roadmap, and examines 12 strong arguments to start global investing in India. Through the Liberalised Remittance Scheme (LRS) and platform selection, you will discover how to begin international investing in India and unleash enormous wealth potential. Let’s get started!

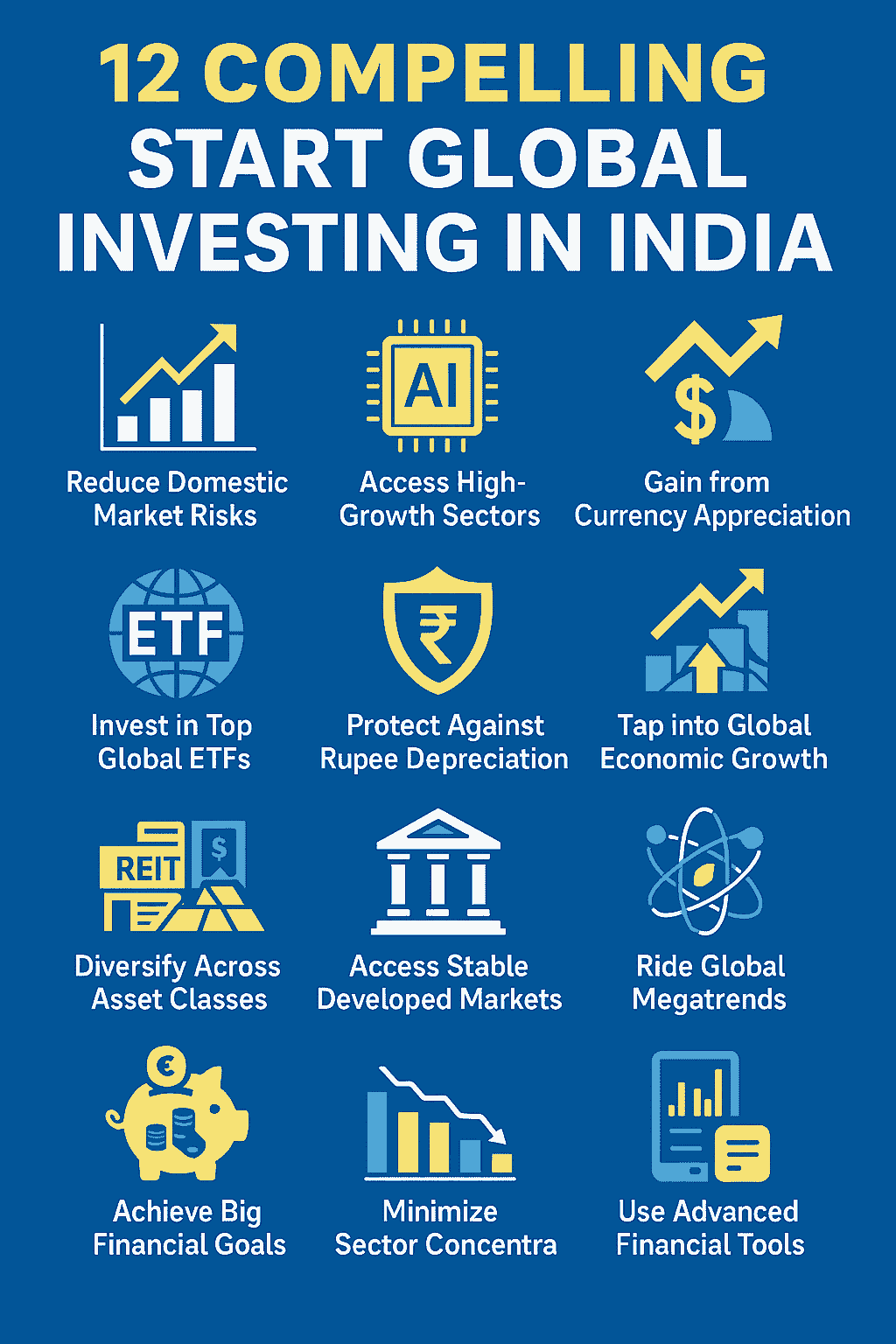

12 Compelling Reasons to Start Global Investing in India

Reduce Domestic Market Risks

Inflation and regulatory changes are two issues facing the Indian stock market. Starting global investing in India spreads your risk across global economies, ensuring stability when domestic markets falter.

Access High-Growth Sectors

Areas such as artificial intelligence (AI), semiconductors, and electric vehicles (EVs) are dominated by global marketplaces. Making your first international investment in India enables you to fund businesses like Tesla or NVIDIA, which spurs innovation and profits.

Gain from Currency Appreciation

Over a ten-year period, the Indian rupee has gained 38% in value alone, yet it depreciates 3–4% a year versus the US dollar. With this benefit, start global investing in India optimises returns.

Invest in Top Global ETFs

ETFs that offer exposure to over 9,000 worldwide stocks include the Vanguard Total World Stock ETF (VT). Access to these varied, affordable cars is made possible by beginning international investing in India.

Protect Against Rupee Depreciation

Wealth is eroded as the rupee declines. Your buying power is protected when you begin international investing in India with assets in USD or EUR.

Tap into Global Economic Growth

Strong returns in technology and healthcare are available in developed nations like the US and Europe. You can take advantage of this expansion by beginning your international investment in India.

Diversify Across Asset Classes

Commodities, bonds, and REITs are available on international markets. A diversified portfolio that goes beyond stocks is made possible by beginning international investing in India.

Access Stable Developed Markets

Strong regulations are a feature of developed economies such as the US. Exposure to these reliable markets is made possible by beginning international investment in India.

Ride Global Megatrends

Investing internationally in India gives you access to businesses that are setting global trends in fields like biotechnology and renewable energy.

Achieve Big Financial Goals

Global investing makes it easier to finance travel, retirement, or education. Wealth creation is accelerated by beginning international investments in India.

Minimize Sector Concentration

IT and finance play a major role in the Indian market. Initiating international investment in India expands into industries such as luxury goods.

Use Advanced Financial Tools

Fractional shares and robo-advisors are available on international marketplaces. Using these resources to begin international investment in India allows for more intelligent investing.

How to Start Global Investing in India: A Step-by-Step Guide

Here’s how to start global investing in India in 2025:

Step 1: Understand the Liberalised Remittance Scheme (LRS)

Under LRS, the RBI permits foreign investments up to $250k per year. Make sure that Tax Collected at Source (TCS) is being followed. Visit RBI’s LRS Guidelines to learn more.

Step 2: Select a Reliable Platform

To start global investing in India, choose:

- Indian brokers: Zerodha (via partnerships) or ICICI Direct.

- International Brokers: International brokers include Charles Schwab and Interactive Brokers.

- Apps: For easy access, utilise Groww or INDmoney.

Visit SEBI’s Investor Portal to confirm compliance with SEBI.

Step 3: Choose Investment Vehicles

Options to start global investing in India include:

- Global ETFs: The iShares MSCI World ETF (URTH) is a global ETF.

- International Mutual Funds: Parag Parikh Flexi Cap Fund is an example of an international mutual fund.

- Direct Stocks: Tesla, LVMH, or Apple.

- REITs: income-producing US or European REITs.

Step 4: Open a Foreign Brokerage Account

Create an account with Interactive Brokers to start global investing in India. Link your Indian bank account and submit your KYC.

Step 5: Plan for Taxes

International investments are subject to TCS (5–20%) and capital gains tax. Speak with a tax advisor. Go to Income Tax India.

Step 6: Start Small and Diversify

Start with ₹50,000 in a worldwide exchange-traded fund. Diversify geographically to lower risk.

Step 7: Monitor and Rebalance

Use Yahoo Finance like platforms to keep tabs on your investments and rebalance every year.

Top Global Investment Options for Indian Investors in 2025

- Vanguard Total World Stock ETF (VT): Broad global exposure.

- iShares MSCI World ETF (URTH): Developed market focus.

- Franklin India Feeder US Opportunities Fund: US market exposure.

- Direct Stocks: Microsoft, Tesla, LVMH.

- SPDR S&P 500 ETF (SPY): Tracks US S&P 500.

Compare at ETF Database.

Conclusion: Start Global Investing in India Now

A game-changing move to diversify your portfolio, lower risks, and take advantage of international wealth potential is to begin international investing in India. You may reach long-term objectives, protect against rupee depreciation, and obtain access to high-growth industries with 95.8% of market capitalisation outside of India. To begin international investing in India, follow these steps, pick the appropriate platforms, and make prudent investments. Start now to open up a world of financial opportunities.

FAQs

Q1: For global investing, what is the LRS?

According to RBI regulations, the LRS permits Indian citizens to send $250,000 annually for foreign investments.

Q2: Is it safe to start global investing in India?

Yes, within the bounds of LRS and on regulated platforms. Speak with a financial counsellor.

Q3: Which taxes are imposed on foreign investments?

TCS (5–20%) and capital gains tax (12.5% for long-term) are applicable. Consult with a tax expert.

Q4: What venues facilitate the start of international investment in India?

ICICI Direct, Zerodha, Groww, or Interactive Brokers are reliable.

Q5: Can I use my Indian money to invest in global ETFs?

Yes, through foreign brokers like Vanguard VT or feeder funds.

Disclaimer

Risks associated with international investing include market volatility and currency changes. Before making an investment, speak with a SEBI-registered advisor. This guide is not meant to be a financial advisor; rather, it is meant to be informative. Check for adherence to tax and RBI LRS regulations.

Also Read: