Learn the Warren Buffett cash cushion strategy to safeguard your finances in India. Uncover 7 compelling reasons why 90% of Indian investors overlook this vital formula and how to secure your future. #Warren Buffett cash cushion strategy, #cash cushion for Indian investors, #Buffett emergency fund tips, #why Indian investors need cash reserves, #Warren Buffett liquidity strategy India, #how to build a cash cushion like Buffett, #Buffett cash reserve advice for beginners, #Indian investors ignoring emergency funds, #Warren Buffett safe investing India, #cash cushion strategy for Indian markets

Introduction: The Power of the Warren Buffett Cash Cushion Strategy in India

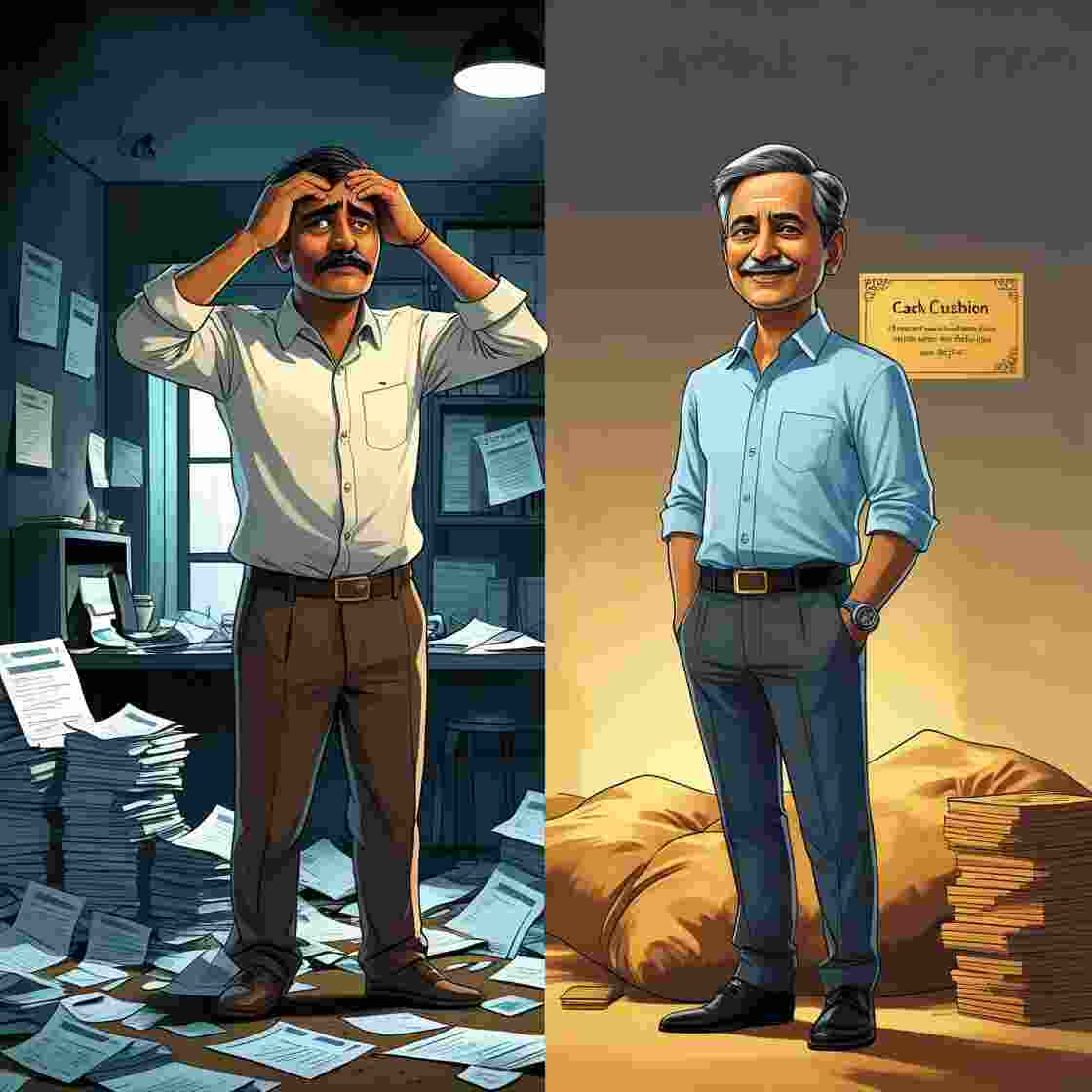

Most investors struggle with financial security in India’s fast-paced economy, where stock markets fluctuate and unforeseen costs can arise. Remarkably, 90% of Indian investors overlook the Warren Buffett cash cushion strategy, a tried-and-true method that might revolutionise their financial situation. This approach, which is supported by the legendary investor Warren Buffett, places a strong emphasis on keeping a liquid cash reserve in order to take advantage of opportunities and guard against emergencies. Adopting the Warren Buffett cash cushion method is not only wise, but essential for Indian investors who are dealing with high living expenses, inflation, or market volatility.

The Warren Buffett cash cushion strategy is essential for Indian investors for seven strong reasons, as this blog post explains. We’ll describe it, explain why so many people overlook it, and offer doable, India-specific implementation strategies. This technique can help you avoid financial ruin and open the door to financial freedom, regardless of your level of experience.

Understanding the Warren Buffett Cash Cushion Strategy

In order to serve as a safety net for finances, the Warren Buffett cash cushion strategy calls for keeping a sizeable reserve of liquid assets, such as cash, savings accounts, or liquid mutual funds. Buffett compares money to “oxygen,” which is essential for surviving hardships and seizing opportunities. Buffett is one of the wealthiest investors in the world because he uses the billions of dollars he has on hand at Berkshire Hathaway to purchase cheap assets during market downturns.

The Warren Buffett cash cushion strategy advises Indian investors to maintain six to twelve months’ worth of living costs in readily available funds. This reserve helps you avoid missing out on market deals or having to sell investments at a loss in an emergency. It is the ideal combination of offence (opportunity) and defence (protection) for India’s economic environment.

7 Compelling Reasons Indian Investors Need the Warren Buffett Cash Cushion Strategy

1. Safeguarding Against Life’s Uncertainties

The cost of living in India’s cities, such as Bengaluru or Delhi, is quite high; a family’s monthly expenses may reach ₹60,000 or more. Without a cash reserve, unexpected expenses like medical costs or abrupt job losses can completely ruin finances. In order to prevent you from making rash investments or taking out expensive loans, the Warren Buffett cash cushion strategy guarantees that you have ₹3.6–7.2 lakh (6–12 months of spending) in a savings account (3–7% yields) or liquid mutual fund (6.5–7%).

2. Capitalizing on Market Crashes

Buffett’s ability to purchase low when others panic is the key to his success. His cash reserves allowed him to make great deals during the 2008 financial crisis, which resulted in enormous profits. During Sensex or Nifty falls, Indian investors can imitate this by employing the Warren Buffett cash cushion strategy. For example, cash investors purchased high-quality equities for 30–50% off in March 2020, and they profited as the markets recovered. You’re left out of such wonderful opportunities if you don’t have a cash cushion.

3. Preventing Forced Liquidation

Due to a lack of liquidity, 90% of Indian investors take the risk of losing their money, which is a financial nightmare. Selling locks in losses if you require ₹2 lakh during a market downturn when your portfolio is down 25%. By offering available funds, the Warren Buffett cash cushion strategy removes this risk and allows you to keep onto investments until the market recovers. Your portfolio remains intact if you have a liquid mutual fund or fixed deposit.

4. Boosting Investment Confidence

Long-term investing requires peace of mind, which is fostered by the Warren Buffett cash cushion strategy. Having a reserve gives you the confidence to invest in stocks or SIPs without worrying about unforeseen costs upsetting your plans. You may develop wealth in a disciplined manner with this method, which provides you a psychological edge in India, where just 10–30% of investors keep emergency money.

5. Tackling India’s Economic Challenges

India faces particular challenges due to its 5–6% inflation rate, growing healthcare expenses, and weak social safety nets. Investors risk penalties or lost growth if they raid long-term assets like PPF or EPF without a cash cushion. By protecting your wealth-building assets and providing liquid funds for growing expenses, the Warren Buffett cash cushion strategy prepares you to manage these challenges.

6. Enhancing Financial Discipline

A key component of Buffett’s philosophy is discipline, which is fostered by keeping a cash reserve. By placing a higher priority on liquidity, the Warren Buffett cash cushion strategy discourages rash purchases or hazardous investments. Automating savings into a cash cushion helps Indian investors develop long-term financial success-oriented habits.

7. Preparing for Opportunity Costs

The Warren Buffett cash cushion strategy helps you be ready for unforeseen financial possibilities, such as investing in a promising initial public offering (IPO) or supporting a business, in addition to emergencies. Possessing liquid cash guarantees that you are prepared to respond without affecting your investment portfolio in India, where possibilities present themselves quickly.

Why 90% of Indian Investors Overlook the Warren Buffett Cash Cushion Strategy

Ninety percent of Indian investors avoid the Warren Buffett cash cushion strategy, despite its revolutionary potential. This is the reason:

- Misplaced Optimism: Many people underestimate threats like unemployment or economic downturns because they think stable jobs or businesses will handle catastrophes.

- Return-Chasing Mindset: Perceiving “low-yield” cash (3–7%) as ineffective, investors frequently prefer stocks or real estate (12–15% returns).

- Limited Financial Literacy: The Warren Buffett cash cushion technique is not given enough attention in India because the country’s financial education places more emphasis on investing than liquidity.

- Cultural Priorities: Investing in property, festivals, and weddings frequently takes precedence over setting aside money for a monetary reserve.

Since this oversight leaves investors vulnerable to financial shocks, the Warren Buffett cash cushion strategy must be implemented immediately.

How to Implement the Warren Buffett Cash Cushion Strategy in India

These four India-specific steps make it simple to build a cash cushion:

- Evaluate Your Costs: Compute the cost of living for six to twelve months. Aim for ₹3.6–7.2 lakh for a monthly budget of ₹60,000.

- Choose Liquid Assets: Make use of recurring deposits, liquid mutual funds (6.5–7%), or high-yield savings accounts (3–7%). Steer clear of illiquid choices such as long-term FDs or real estate.

- Automate Contributions: Establish SIPs or monthly transfers. In 25 months, saving ₹12,000 a month adds up to ₹3.6 lakh.

- Re-evaluate Yearly: Adjust for inflation or lifestyle changes. If expenses rise to ₹70,000, target ₹4.2–8.4 lakh. Every year, re-evaluate and account for changes in lifestyle or inflation. If costs reach ₹70,000, aim for ₹4.2–8.4 lakh.

Benefits of the Warren Buffett Cash Cushion Strategy

Adopting Warren Buffett’s cash cushion technique has revolutionary benefits:

- Security: Guard against crises without affecting financial assets.

- Possibility: Like Buffett in 2008, purchase assets while the market is down.

- Discipline: Encourage wise financial practices.

- Flexibility: Manage unforeseen expenses or chances without taking out debts.

In an unstable economy, this approach is crucial for Indian investors.

Conclusion

Ninety percent of Indian investors disregard the tried-and-true Warren Buffett cash cushion strategy at their own risk. You may protect your money, take advantage of market opportunities, and develop unwavering confidence by keeping six to twelve months’ worth of spending in liquid assets. This approach is a ray of stability amid India’s difficult financial environment, which is characterised by high prices, inflation, and unpredictability.

Don’t be one of the 90% who endanger catastrophe. Small, systematic savings in liquid assets can help you start increasing your cash cushion right now. To take charge of your financial future, use the Warren Buffett cash buffer technique.

FAQs

Q1: What is the Warren Buffett cash cushion strategy?

In order to handle emergencies and take advantage of investing possibilities without having to liquidate assets, this financial strategy involves holding six to twelve months’ worth of living costs in liquid assets.

Q2: What is the recommended amount of cash cushion savings for Indian investors?

Depending on your circumstances, aim for 6–12 months’ worth of expenses, or ₹3.6–7.2 lakh for a household that spends ₹60,000 each month.

Q3: In India, where should I maintain my cash reserve?

For convenience and security, choose recurring deposits, liquid mutual funds (6.5–7%), or high-yield savings accounts (3–7%).

Q4: Why is the Warren Buffett cash buffer method disregarded by 90% of Indian investors?

Overconfidence, a focus on high returns, a lack of financial literacy, and cultural spending patterns all contribute to the disregard of cash reserves.

Q5: In times of market decline, how can Warren Buffett’s financial cushion plan assist?

It increases long-term gains by enabling you to purchase cheap stocks or funds during market downturns, like Buffett did in 2008.

Disclaimer

This essay is not financial advice; rather, it is meant to be informative. Prior to making any investing decisions, seek advice from a licensed financial advisor. There are risks associated with the Warren Buffett cash cushion strategy, and mutual fund or savings account returns are not certain. Before implementing any plan, always assess your financial status.

Also Read:

- Top 5 Warren Buffett Quotes for Success to Transform Your Investing

- Warren Buffett Achievements and Legacy: His Impact in 2025 and Beyond

- Essential Factors for Investing: 10 Key Principles for Success

- Warren Buffett Investment Secrets: 7 Proven Strategies to Build Wealth Like the Oracle of Omaha

- Warren Buffett’s cash cushion formula that 90% of Indian investors ignore