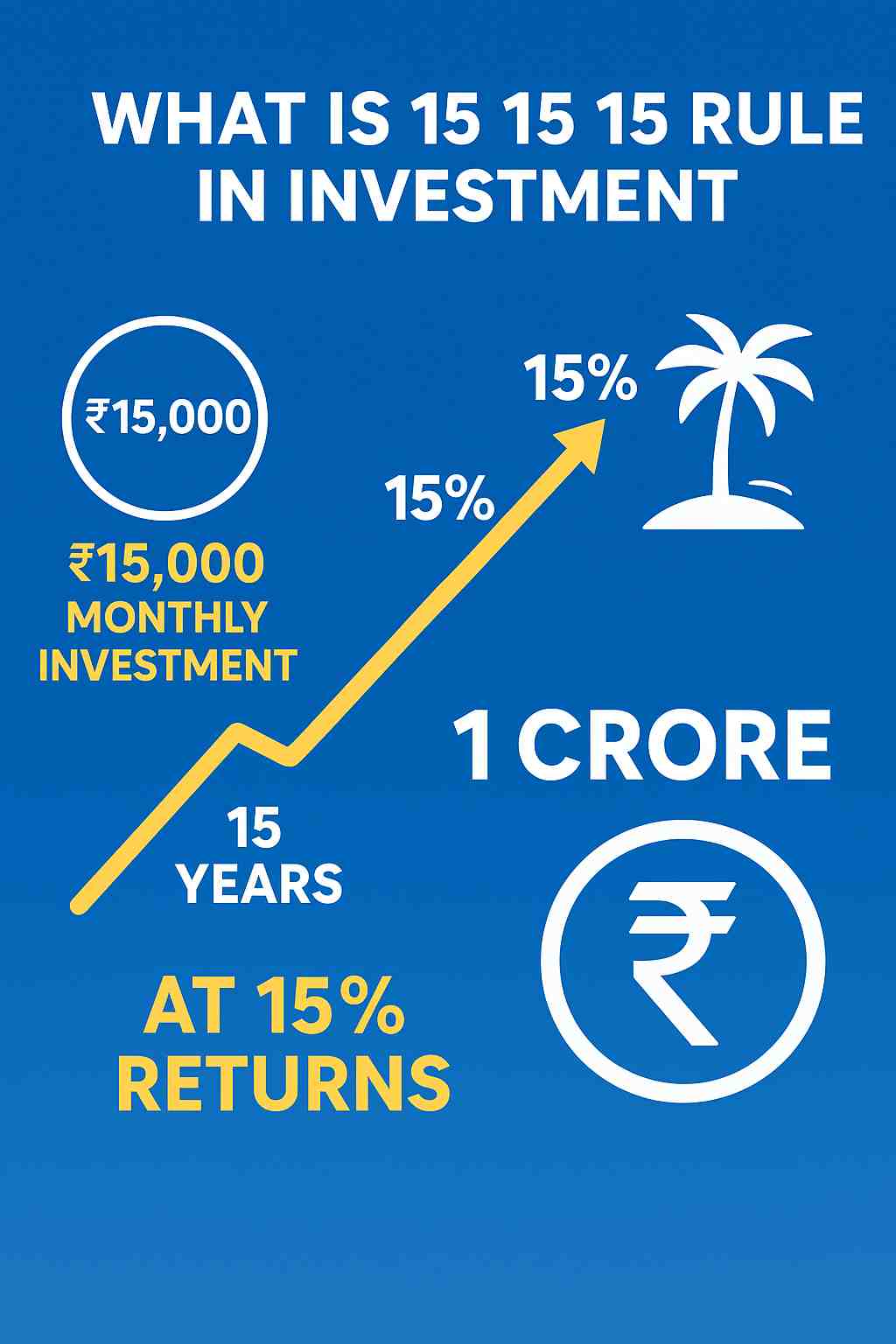

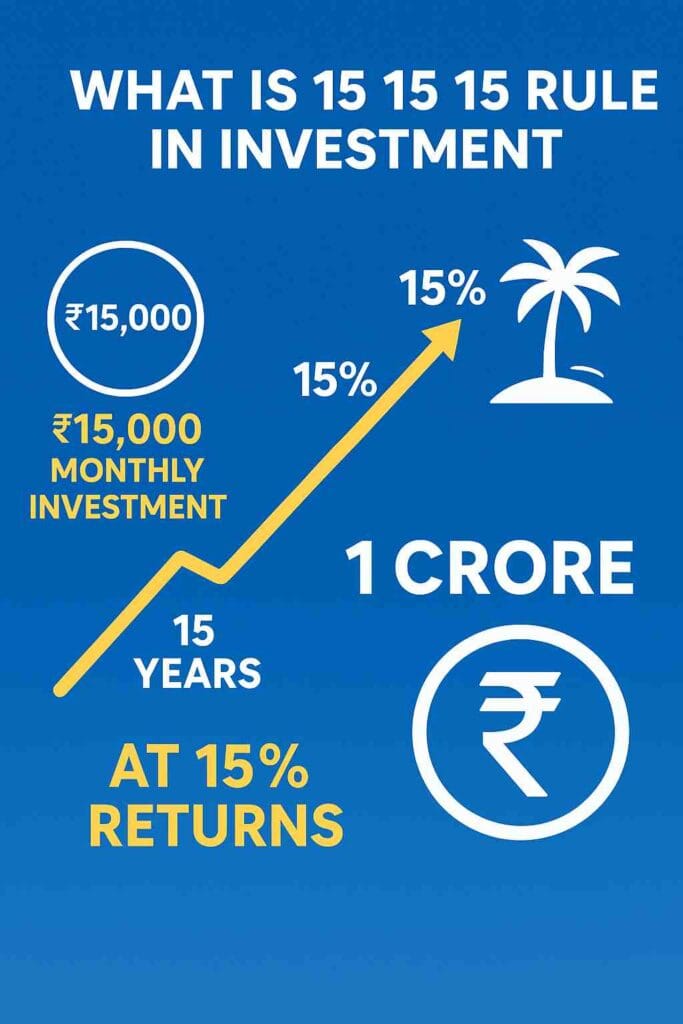

What is 15 15 15 rule in investment? This powerful strategy reveals how investing ₹15,000 monthly for 15 years at 15% returns can build ₹1 crore, paving the way for early retirement. Explore benefits, limitations, real examples, and expert insights to secure your future. #15 15 15 rule in investment, #what is 15 15 15 rule in investment, #early retirement India, #compounding wealth strategies, #SIP investment tips, #financial independence rules, #15x15x15 SIP rule, #15000 per month 15 years 15% return India, #15 15 15 rule early retirement

Introduction

Many young Indians are looking for tried-and-true routes to wealth in the fast-paced world of today, where financial security seems more and more distant. Enter the question here: what is 15 15 15 rule in investment? As a guide for reaching early retirement and financial freedom, this fascinating formula has generated a lot of interest. The 15 15 15 rule in investing, which was made popular by financial advisor Sarthak Ahuja at a 2025 youth summit, promises to use compound interest to turn little monthly savings into a sizable corpus. But is it a dangerous gamble or a ticket to riches? In this comprehensive manual, we’ll unpack what is 15 15 15 rule in investment, Examine its workings, advantages, drawbacks, successful real-world examples, and situations in which it might not be appropriate. This article seeks to enable you to make well-informed judgements by providing precise facts on inflation and market returns. Regardless of your level of experience as an investor, understanding what is 15 15 15 rule in investment could be the key to unlocking your financial dreams—or avoiding common pitfalls that lead to regret.

In India, where longer lifespans and growing expenditures necessitate more intelligent planning, the 15 15 15 rule of investing is particularly pertinent. This rule capitalises on demonstrated growth potential, as historical equity returns have averaged 12–15% per year. Let’s take a closer look at the 15 15 15 rule of investing and how it might change your course in life.

Also Read: 8-4-3 Compounding Rule Explained: The Secret to Building Wealth Faster

What Is 15 15 15 Rule in Investment Exactly ?

At its core, what is 15 15 15 rule in investment? It’s a straightforward, memorable tactic: Aim for an average annual return of 15% by investing ₹15,000 each month for 15 years. The outcome? a corpus that, with compounding, is roughly ₹1 crore. Ahuja shared this guideline, which is designed for young professionals in their 20s who want to be financially independent by the time they are 40.

To better understand the 15 15 15 rule in investing, let’s look at its elements:

- ₹15,000 Monthly Investment: Many people with salaries of ₹50,000 or more can afford it.

- 15 Years Duration: Provide room for development without becoming overly dedicated.

- 15% Annual Return: Based on the market history of India, this can be accomplished through equities mutual funds.

With P = 15,000, r = 0.15/12≈0.0125 (monthly), and n = 180 months, the precise computation provides ₹1,00,27,601 using the SIP future value formula: FV = P × [((1 + r)^n – 1) / r]. This confirms the ₹1 crore milestone. This demonstrates the application of the 15 15 15 rule in investing, which prioritises discipline over speculation.

But according to Ahuja, ₹1 crore is only a starting point; for a meaningful retirement, scale investments as income increases to reach ₹8.8 crore, or $1 million in India.

Also Read: Master the 50 30 20 Budget Rule for Beginners

How Does the 15 15 15 Rule in Investment Work?

Understanding what is 15 15 15 rule in investment requires breaking down the process. Start with an equities fund Systematic Investment Plan (SIP). Your contributions over a 15-year period amount ₹27 lakh, but the compounding effect adds almost ₹73 lakh in gains.

This is supported by historical data: over the last 20 years, the Nifty 50 has produced a CAGR of roughly 12.5%, whilst the top equities mutual funds have averaged 12–15%. Over a 15-year period, some funds, such as specific large-cap SIPs, have even produced a 23% return. Diversify into flexi-cap or multi-cap funds to reach 15%.

The 15 15 15 rule in investment’s strong returns is essential to outpacing inflation, which has been eroding value for the past 60 years at an average of 7.3% yearly but has recently been around 6%. For actual growth, adjust by raising SIPs by 10% every year.

Benefits of the 15 15 15 Rule in Investment

The appeal of what is 15 15 15 rule in investment lies in its numerous advantages, making it a game-changer for wealth building:

- Exponential Growth Through Compounding: Increase the return by 270% by turning an investment of ₹27 lakh into ₹1 crore. At 15%, it might reach ₹10 crore if it is extended to 30 years.

- Path to Early Retirement: Establish a strong foundation by age 25 and retire by age 40. This speeds up freedom in India, where the average retirement age is 60.

- Inflation Protection: Your corpus maintains its buying power when returns exceed the average inflation rate of 6–7%.

- Tax Savings and Accessibility: cheap entry through Groww and other applications; ELSS funds are eligible for a ₹1.5 lakh deduction under Section 80C.

- Psychological and Habitual Gains: Reduces impulsive spending and fosters discipline. According to studies, regular investors beat market timers by two to three percent a year.

- Scalability for Higher Objectives: Reach ₹2 crore in 15 years, increasing to ₹30,000 each month.

These benefits highlight why what is 15 15 15 rule in investment is hailed as a positive force for financial empowerment.

Also Read: Ultimate 30-30-30-10 Budget Method Explained

Limitations of the 15 15 15 Rule in Investment

Despite its strengths, what is 15 15 15 rule in investment has limitations that could lead to negative outcomes if ignored:

- Market Volatility Risks: Risks associated with market volatility include the possibility of a 2008-style crisis delaying growth. According to historical data, average mutual fund returns range from 9 to 12%, therefore 15% is not a guarantee.

- Cost Underestimation and Inflation: At 6% inflation, ₹1 crore today may not buy as much in 15 years, or ₹41 lakh in current currency.

- Assumption of Steady Income: Needs a steady ₹15,000; crises or job loss interfere.

- No Return Guarantee: According to research, only five equity funds have returned more than 15% over the last three years. A bad fund selection might only produce 10%.

- Opportunity Costs: During downturns, investing in stocks involves forgoing safer alternatives.

- Tax and Exit Loads: 10% tax is applied to gains above ₹1 lakh, and early withdrawals are subject to fines.

These drawbacks remind us that what is 15 15 15 rule in investment isn’t foolproof and demands risk awareness.

Real-Life Examples of the 15 15 15 Rule in Investment

Real stories bring what is 15 15 15 rule in investment to life. Consider a 45-year-old who began SIPs in 1998 without stocks or enterprises and who retired in 2025 with ₹4.7 crore. Similar to the 15 15 15 method of investing, he made constant investments in mutual funds, compounding his corpus. No fancy profession, just hard work, with typical returns of 12–15%.

As an additional illustration, Harsh Jain of Mumbai funds his daughter’s education, marriage, and retirement with ₹40,000 each month using SIPs. According to the 15 15 15 formula of investing, he is on course to reach ₹5 crore or more by 50.

A YouTube video describes using SIPs to reach FI in seven years, with a concentration on equity and early starts. These illustrations demonstrate what the 15 15 15 rule in investment actually works, with SIPs yielding long-term returns of 10–15%.

Also Read: Warren Buffett’s Revolutionary 90/10 Rule for Indian Investors

When the 15 15 15 Rule in Investment May Not Be the Right Fit

While powerful, what is 15 15 15 rule in investment isn’t for everyone. It may not fit if:

- You Have Low Risk Tolerance: Conservatives like FDs at 7%, while adventurous investors benefit from volatility.

- Short-Term Horizons: Compounding deteriorates and markets may perform poorly for less than ten years.

- Unreliable Income: Flexible plans are more effective for freelancers than fixed ₹15,000 plans.

- High Debt Burden: Put loan repayment ahead of investing because interest (10–15%) sometimes outpaces gains.

- Economic Downturns: Patience is essential during recessions, such as the 23% decline in the Nifty in 2020, but it’s not for the weak of heart.

- Advanced Age: Traditional pensions may be more appropriate; starting after the age of 35 limits time.

Only 97% of stock investments made over a ten-year period turn a profit, according to data. Assess your situation before adopting what is 15 15 15 rule in investment.

Tips to Maximize the 15 15 15 Rule in Investment

To succeed with what is 15 15 15 rule in investment:

- SIPs should be automated for consistency.

- Choose three to five different funds.

- Review every year, taking inflation into account.

- First, create an emergency fund.

- Upskill to increase income, as Ahuja suggests.

Also Read: Want to retire early? Investment banker reveals a secret 15:15:15 rule

Conclusion

What is 15 15 15 rule in investment? It’s a revolutionary approach that builds ₹1 crore and more by combining compounding power with simplicity. It gives promise with advantages like early freedom and growth that beats inflation, but drawbacks like volatility necessitate prudence. It’s not the best for everyone, but real-world instances demonstrate its effectiveness. Equipped with precise information—historic returns of 12–15%, inflation of 6–7%— embrace what is 15 15 15 rule in investment wisely to thrive, or risk stagnation. Start today for a brighter tomorrow.

FAQs

Q1: What is 15 15 15 rule in investment, and how does it create ₹1 crore?

Investing ₹15,000 per month for 15 years at a 15% annual return is known as the 15 15 15 rule. Using normal SIP calculations, this increases to approximately ₹1 crore through compounding, utilising the growth potential of equities funds.

Q2: Are the 15% returns in the 15 15 15 rule in investment realistic?

Indeed, over the course of more than 15 years, equities mutual funds in India have historically generated returns of 12–15% on average, with some even hitting 20%. To adhere to the 15 15 15 guideline of investing, pick diverse funds and seek advice from professionals when market conditions change.

Q3: What are the main benefits of the 15 15 15 rule in investment?

It encourages early retirement, outpaces India’s inflation rate of 6–7%, and cultivates frugal saving practices. The rule is perfect for achieving financial independence since it transforms modest investments into substantial riches.

Q4: What are the disadvantages of investing according to the 15 15 15 rule?

Inflation may cause ₹1 crore to lose value, while market volatility can reduce returns (9–12% on average for some funds). Additionally, it necessitates a consistent income, which not everyone can afford.

Q5: Could you give a concrete illustration of the 15 15 15 rule in investing?

Using regular SIPs that began in 1998, a 45-year-old retiree built ₹4.7 crore by 2025. This is comparable to the 15 15 15 rule in investing, which achieves 12–15% returns through disciplined stock investing.

Q6: When is it inappropriate to use the 15 15 15 rule when investing?

People with poor risk tolerance, erratic incomes, or short investment horizons (less than ten years) shouldn’t use it. Economic downturns or high debt levels also reduce the effectiveness of the 15 15 15 rule when it comes to investing.

Disclaimer

This article about the 15 15 15 rule in investing is not meant to be financial advice; rather, it is meant to be instructive. Returns on equity investments are not assured, and there are market hazards. Always consult a certified financial advisor before applying what is 15 15 15 rule in investment or any strategy. Future outcomes might not be predicted by historical data, such as equity returns of 12–15%. Financial results are not the responsibility of the publishers or authors.