Learn about the automatic PF transfer process after Form 13 approval in 2025. Discover how EPFO’s revamped system simplifies PF transfers for over 1.25 crore members, key requirements, and steps to ensure a seamless process. #Automatic PF transfer 2025, #EPFO Form 13 update 2025, #PF transfer without employer approval, #How to transfer PF online 2025, Taxable PF components Form 13, #EPFO updates 2025 PF transfer, #UAN PF transfer process

Introduction

It can be difficult to transfer your Provident Fund (PF) account to your new employer when you change jobs. With its updated Form 13 functionality, the Employees’ Provident Fund Organisation (EPFO) transformed this procedure in 2025, allowing for the automatic PF transfer process after Form 13 approval. More than 1.25 crore members gain from this update as it simplifies transfers, cuts down on delays, and typically does away with employer clearance. This tutorial will cover the prerequisites, how this process operates, and advice for a seamless PF transfer.

What is the Automatic PF Transfer Process After Form 13 Approval?

The improved EPFO system known as the “automatic PF transfer process after Form 13 approval” transfers the PF balance to the member’s new account automatically without requiring further approvals at the destination office once Form 13 has been granted by the source EPFO office. This feature, which was first introduced in January 2025, expedites processing times and makes job transfers easier for employees. In order to facilitate precise Tax Deducted at Source (TDS) computations, it additionally features a distinct division of taxable and non-taxable PF components.

Key Benefits

- No Employer Approval Needed: Employer approval is typically not needed, which lessens reliance on HR departments.

- Faster Processing: Delays brought on by cooperation between the source and destination EPFO offices are eliminated by automatic transfers.

- Tax Compliance: By separating taxable PF interest, the system guarantees precise TDS computations.

- Significant Impact: Enables more than 1.25 crore members to receive yearly remittances totalling ₹90,000 crore.

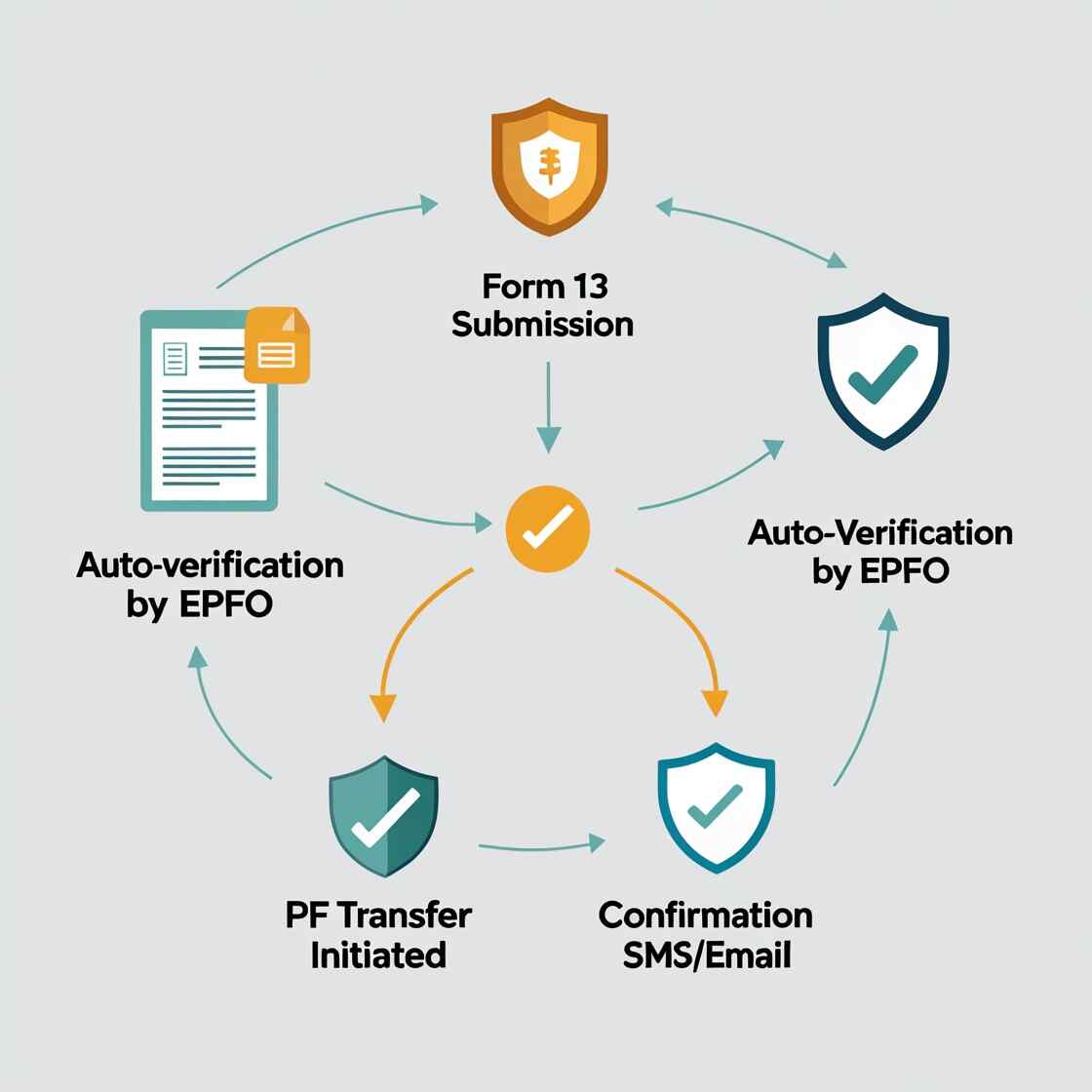

How Does the Automatic PF Transfer Process after Form 13 approval Work?

The automatic PF transfer process after Form 13 approval is designed to be seamless. Here’s a step-by-step breakdown:

- Activate Your UAN: Verify that your Universal Account Number (UAN), which is connected to your bank account, Aadhaar, and validated KYC information, is active on the EPFO portal.

- Submit Form 13 Online: Log in to the EPFO Member Portal, click “Online Services,” and then choose “One Member – One EPF Account (Transfer Request)” to submit Form 13 online. Enter your current and former employers’ information, upload Form 13, and submit.

- Source Office Approval: The Form 13 claim is examined and approved by the source EPFO office, which is connected to your former employer. This step confirms your eligibility and PF account information.

- Automatic Transfer: Without requiring additional permissions, the system instantly transfers your prior PF balance to your new account at the destination office when it has been approved.

- Track Status: To keep tabs on developments, use the tracking ID that was created after submission to access the EPFO portal’s “Track Claim Status” section. An SMS will be sent to you when you’re done.

Requirements for Automatic PF Transfer

To leverage the automatic PF transfer process after Form 13 approval, ensure:

- Your Aadhaar, PAN, and bank information are all connected to your active UAN.

- Your employer verifies your KYC information.

- The EPFO site is updated with the Date of Exit (DoE) and Date of Joining (DoJ).

- Each member ID can only have one active transfer request.

- Authorised signatories have been digitally registered with EPFO by both past and present employers.

Why the 2025 Update Matters

Prior to 2025, source and destination EPFO offices had to approve PF transfers, which frequently resulted in delays. Launched in January 2025, the updated Form 13 feature allows for the automatic PF transfer process after Form 13 approval by doing away with the need for destination office approval. This update promotes EPFO’s “Ease of Living” strategy and expedites remittances for 1.25 crore members, according to reports from The Economic Times and X postings from @socialepfo. Furthermore, the tax bifurcation feature of the system guarantees compliance by displaying taxable PF interest in an understandable manner.

Tips for a Smooth Automatic PF Transfer

To maximize the benefits of the automatic PF transfer process after Form 13 approval, follow these tips:

- Verify KYC Details: Make sure your bank, Aadhaar, and PAN information are current and validated on the EPFO portal.

- Submit Form 13 Timely: To prevent delays, submit the transfer request as soon as possible after starting a new job.

- Track Your Claim: Using the tracking ID, check the transfer status frequently to stay updated.

- Coordinate with employers: Make sure the signed Form 13 is submitted on time within 10 days if employer attestation is needed (for example, for accounts that are not connected to Aadhaar).

- Stay informed: Because features like UPI-based withdrawals are scheduled for June 2025, keep an eye out for EPFO announcements.

Common Challenges and Solutions

While the automatic PF transfer process after Form 13 approval is streamlined, some challenges may arise:

- Issue: Inactive UAN or unverified KYC.

- Solution: Log in to the EPFO portal, update KYC details, and request employer verification.

- Issue: Missing Date of Exit/Joining.

- Solution: Update these details via the Member Portal or request employer assistance.

- Issue: Delays in source office approval.

- Solution: Contact the regional PF office or file a grievance on https://epfigms.gov.in.

Tax Implications of PF Transfers

There is a separation of taxable and non-taxable PF components in the 2025 Form 13 modification. Accurate TDS computations are guaranteed by the automatic transfer mechanism, and interest received on contributions over ₹2.5 lakh per year is taxable. The EPFO web, for instance, will show any taxable components of your PF interest separately, making tax compliance during transfers easier.

Conclusion

For EPFO members in 2025, the automatic PF transfer process after Form 13 approval is revolutionary. Over 1.25 crore members now handle their PF accounts more quickly and effectively because to EPFO’s automation of transfers and removal of employer consent in the majority of circumstances. Verify your KYC information, activate your UAN, and submit Form 13 as soon as possible to guarantee a smooth process. To maximise your PF advantages, stay up to date on EPFO’s latest announcements, such as scheduled ATM withdrawals by June 2025.

FAQ about automatic PF transfer process after Form 13 approval

Q1. What is the automatic PF transfer process after Form 13 approval?

A 2025 EPFO update speeds up Provident Fund (PF) transfers by implementing an automatic PF transfer procedure after Form 13 approval. The PF amount is automatically transferred to the member’s new account without further permissions once Form 13 is accepted by the originating EPFO office, helping more than 1.25 crore people.

Q2. Do I need employer approval for the automatic PF transfer?

Usually not. As long as your UAN is active and your KYC information (Aadhaar, PAN, and bank) is validated, the 2025 upgrade removes the need for employer permission. However, for accounts that aren’t connected to Aadhaar, employer attestation can be necessary.

Q3. What are the requirements for the automatic PF transfer process?

You must have one valid transfer request, an active UAN connected to Aadhaar, confirmed KYC information, and an updated Date of Exit (DoE) and Date of Joining (DoJ). Signatories should be digitally registered with EPFO from both past and present employers.

Q4. How long does the automatic PF transfer take after Form 13 approval?

Although the procedure varies, transfers usually finish with the 2025 automation 5–10 working days following source office permission, contingent on portal updates and KYC certification. Use the tracking ID on the EPFO portal to keep tabs on your situation.

Q5. What happens if my Form 13 is rejected?

Inactive UANs, unconfirmed KYC, or missing DoE/DoJ information are typically the reasons why Form 13 is denied. Verify the EPFO portal’s rejection reason, make the necessary updates, and submit again.

Q6. How does the taxable PF interest work with this process?

The taxable and non-taxable PF components are separated in the 2025 Form 13 modification. In addition to ensuring precise TDS calculations during the automatic transfer, interest on contributions over ₹2.5 lakh per year is taxed and is shown separately on the EPFO webpage.

Q7. Can I track the automatic PF transfer status?

Indeed, sign on to the EPFO Member Portal, select “Track Claim Status,” and input your tracking ID (which is produced following the filing of Form 13). After finishing, you will also receive an SMS update.

Q8. What should I do if there’s a delay in the transfer?

Verify your UAN and KYC information, make sure your employer has updated, and get in touch with your local PF office if there is a delay. Use the EPFO Grievance Management System (https://epfigms.gov.in) to submit a grievance for unsolved concerns.

Q9. Is the automatic PF transfer available for all members?

Yes, it affects 1.25 crore members and is accessible to all EPFO members with confirmed KYC and valid UANs. However, portal upgrades and employer compliance are prerequisites for complete automation.

Disclaimer

Based on EPFO updates as of April 25, 2025, the details of the automatic PF transfer process after Form 13 approval are provided solely for informational purposes. Individual circumstances may differ, and policies may change. Check the information on https://www.epfindia.gov.in or speak with a financial counsellor. Any errors or losses are not the responsibility of the author.

Also Read: