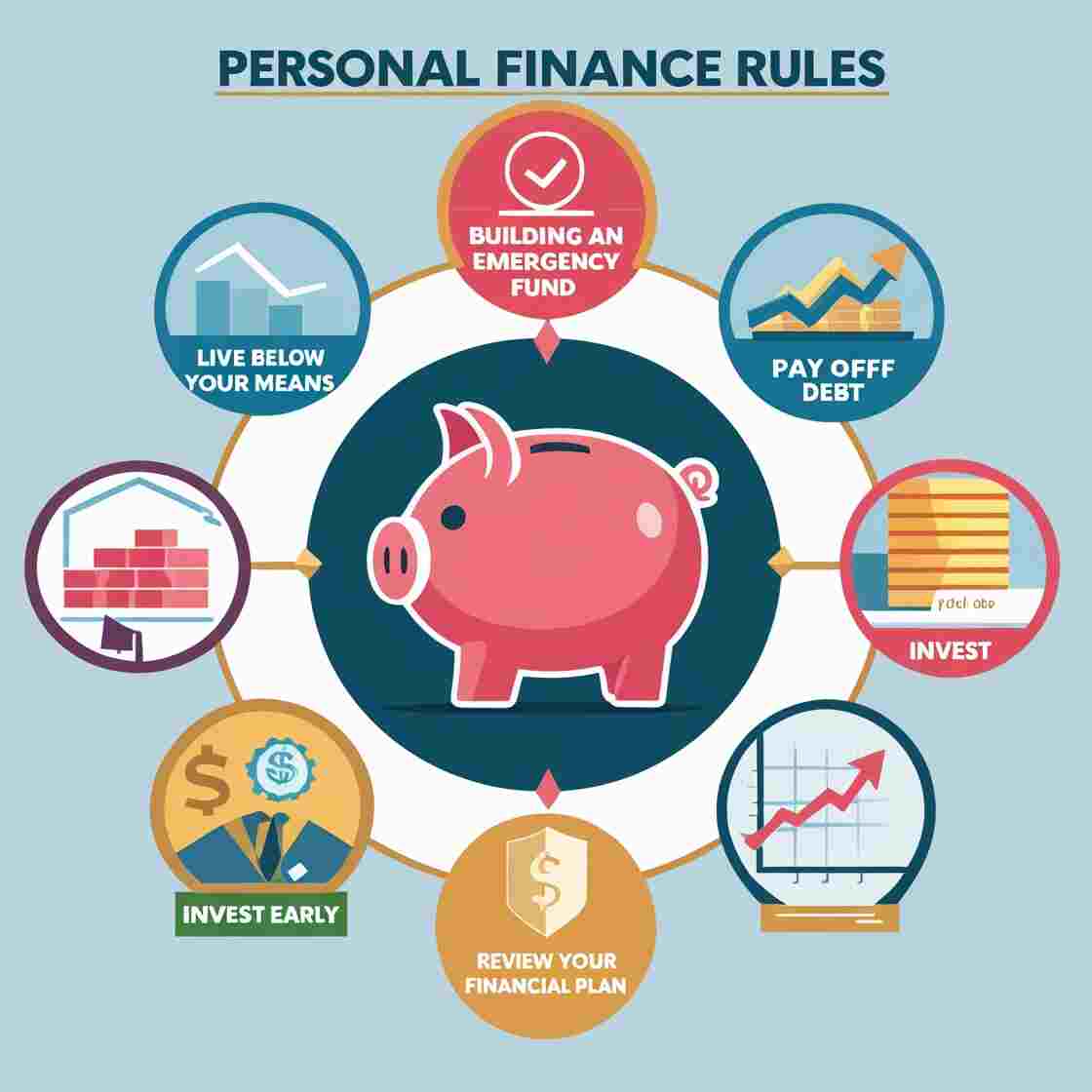

Discover 5 key personal finance rules often forgotten but critical for financial success. Learn how to live below your means, build an emergency fund, and more. #key personal finance rules, #essential personal finance rules, #personal finance tips, #money management rules, #financial planning advice, #Key personal finance rules people forget, #KeyFinanceRules,#SmartMoney

Introduction

Financial freedom is based on efficient money management. However, a lot of people fail to follow the key personal finance rules that could determine their course in life. Five crucial guidelines that are frequently overlooked but shouldn’t be will be revealed in this post. These suggestions will help you keep on track with your financial habits, regardless of whether you’re just starting out or want to improve.

Why Key Personal Finance Rules Matter

Making wise choices with what you have is more important in personal finance than simply increasing your income. By adhering to these key personal finance rules, you can steer clear of typical errors and create a stable future. Now let’s explore the five rules you should be aware of.

1. Live Below Your Means

Cutting back on expenses is one of the most often disregarded key personal finance rules. Being frugal enables you to invest, save, and get ready for unforeseen costs.

- How to Complete It: Make a budget to keep tabs on your earnings and outlays. Apply the 50/30/20 rule: set aside 20% for debt repayment or savings, 50% for needs, and 30% for wants.

- Why It’s Forgotten: A lot of people put their lifestyle before their finances, which causes stress.

- Pro Tip: Prioritise developing wealth over consumption by automating savings transfers.

Spending less than your income on a regular basis will free up more funds for future investments.

2. Build an Emergency Fund

Despite being one of the most important money rules that many overlook, an emergency fund is the foundation of financial security. Life is unpredictable; without a safety net, a medical emergency, a job loss, or auto repairs could throw your finances off balance.

- How to do it: Put three to six months’ worth of living costs into a high-yield savings account.

- Why It’s Forgotten: Short-term spending frequently takes precedence over long-term security.

- Pro Tip: Begin modestly by setting aside $500 as a starting money and then progressively increasing it.

Without depending on debt, an emergency fund guarantees that you’re ready for life’s unexpected turns.

3. Pay Off High-Interest Debt

A quiet wealth killer is carrying high-interest debt, such as credit card balances. One of the key personal finance rules that many people overlook is paying it off.

- How to Do It: To keep motivated, use the snowball approach (pay off the smallest balances first) or the avalanche method (pay off the highest-interest debt first).

- Why It’s Forgotten: Interest grows quickly, but minimum payments seem doable.

- Pro Tip: To save money, consolidate debt or bargain with creditors for reduced interest rates.

Reducing high-interest debt frees up funds for investments and savings.

4. Invest Early and Consistently

One of the key personal financial rules for both novice and experienced savers is investing. You can greatly increase your money by starting early thanks to the magic of compound interest.

- How to Do It: Make contributions to retirement funds such as an IRA or 401(k). Start with inexpensive index funds or ETFs if you’re new.

- The Reason It’s Forgotten: Many put off investing because they believe they require a sizable initial investment.

- Pro Tip: To gradually increase money, automate monthly investments, even if they are little $50.

Your money has more time to grow if you invest early.

5. Review and Adjust Your Financial Plan Regularly

Your plan should change as your financial circumstances do. One personal finance best practice that is frequently overlooked is assessing your investments, budget, and goals on a regular basis.

- How to Do It: To evaluate the success of your investments, savings, and budget, schedule a quarterly or annual review.

- Why It’s Forgotten: Financial planning can seem overwhelming when life gets hectic.

- Pro Tip: To streamline reviews and monitor progress, use applications like Mint or YNAB.

Being proactive helps you keep your finances in line with your objectives.

Common Personal Finance Mistakes to Avoid

While following these key personal finance rules sets you up for success, watch out for these pitfalls:

- Ignoring Small Expenses: Subscriptions and other minor, ongoing expenses can mount up.

- Failure to Diversify Investments: It is dangerous to place all of your money in a single stock or asset.

- Depending on Future Income: Don’t think that today’s excessive spending will be resolved by a rise or bonus.

Avoiding these errors will help you get the most out of the aforementioned guidelines.

How to Stay Committed to These Rules

Sticking to key personal finance rules you shouldn’t ignore requires discipline. Here are actionable tips:

- Clearly define your goals: Establish both immediate (such as debt repayment) and long-term (such as retirement) objectives.

- Educate Yourself: Read financial blogs or books like The Millionaire Next Door.

- Find Accountability: Hire a financial expert or discuss your objectives with a trustworthy friend to establish accountability.

The secret to forming these guidelines into lifelong habits is consistency.

Conclusion: Start Applying These Rules Today

Following key personal finance rules is all you need to do to become financially literate. You can achieve financial freedom by living within your means, saving for emergencies, paying off debt, investing early, and revising your plan. Begin modestly, maintain consistency, and see your money increase.

FAQ about Personal Finance Rules

Q1. What are the most important personal finance rules to follow?

Living below your means, setting up an emergency fund, paying off high-interest debt, investing early, and routinely reviewing your financial plan are some of the most important guidelines. By taking these actions, a solid basis for financial security is established.

Q2. Why do people forget key personal finance rules?

Many people disregard these guidelines because of their hectic schedules, a lack of financial literacy, or a preference for immediate gratification over long-term objectives. Education and automation can assist in staying on course.

Q3. How can I start following these personal finance rules?

Start with a single rule, such as setting aside $500 for an emergency fund or making a budget. Use budgeting applications, set specific goals, and read books or blogs to educate yourself.

Q4. How much should I save in an emergency fund?

Aim to cover three to six months’ worth of living costs. Begin by setting a modest savings target, such as $500, and work your way up.

Q5. Why is investing early a key personal finance rule?

Early investing takes advantage of compound interest, which enables your money to increase dramatically over time. Consistently making tiny investments can result in significant wealth.

Disclaimer

This blog post’s content is intended exclusively for general informational purposes and does not represent expert financial advice. Prior to making any financial decisions, always get advice from a certified financial counsellor. Any monetary losses or damages brought on by the use of this information are not the responsibility of the author or the website. Financial circumstances vary from person to person, and past performance does not ensure future outcomes.

Related Article: