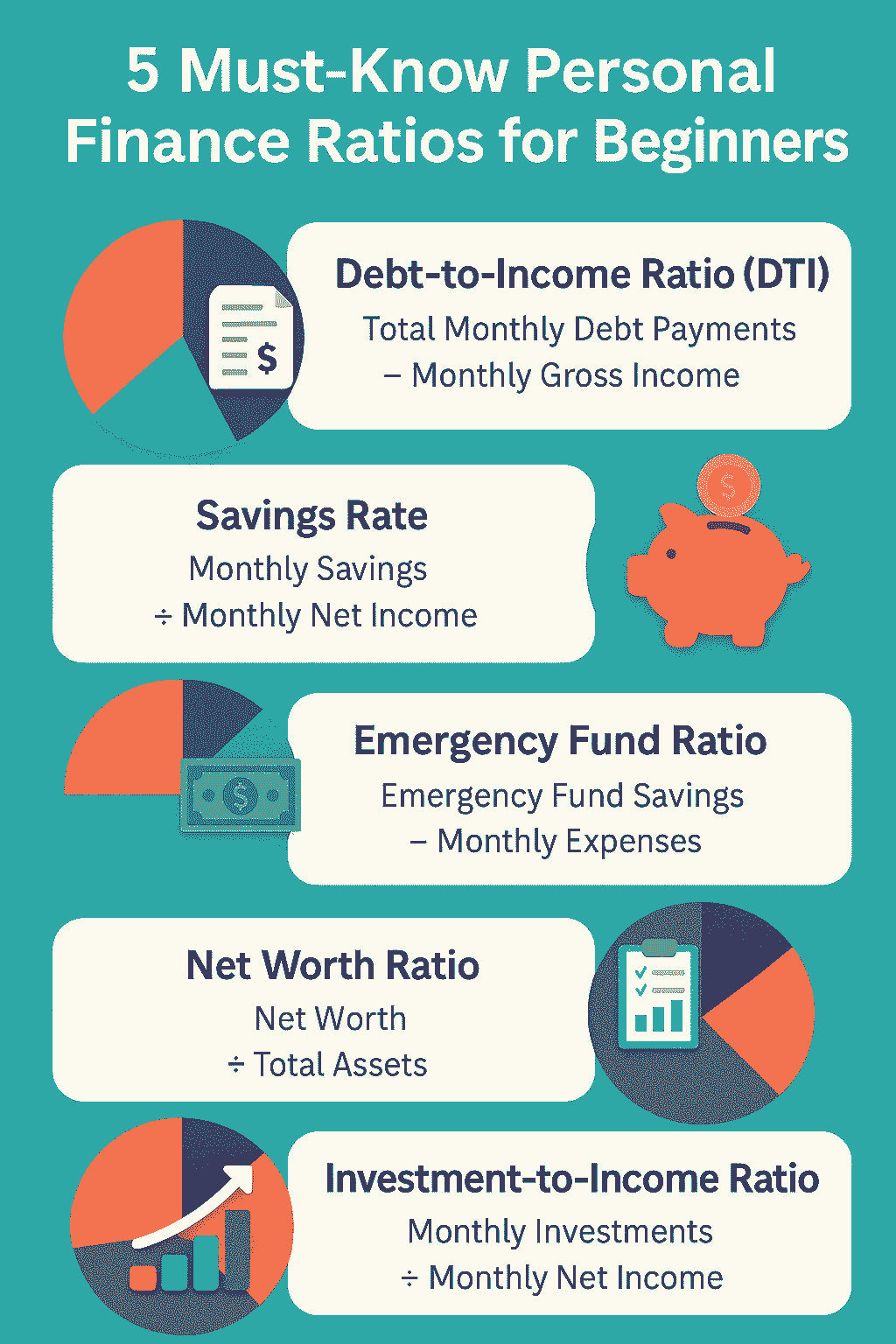

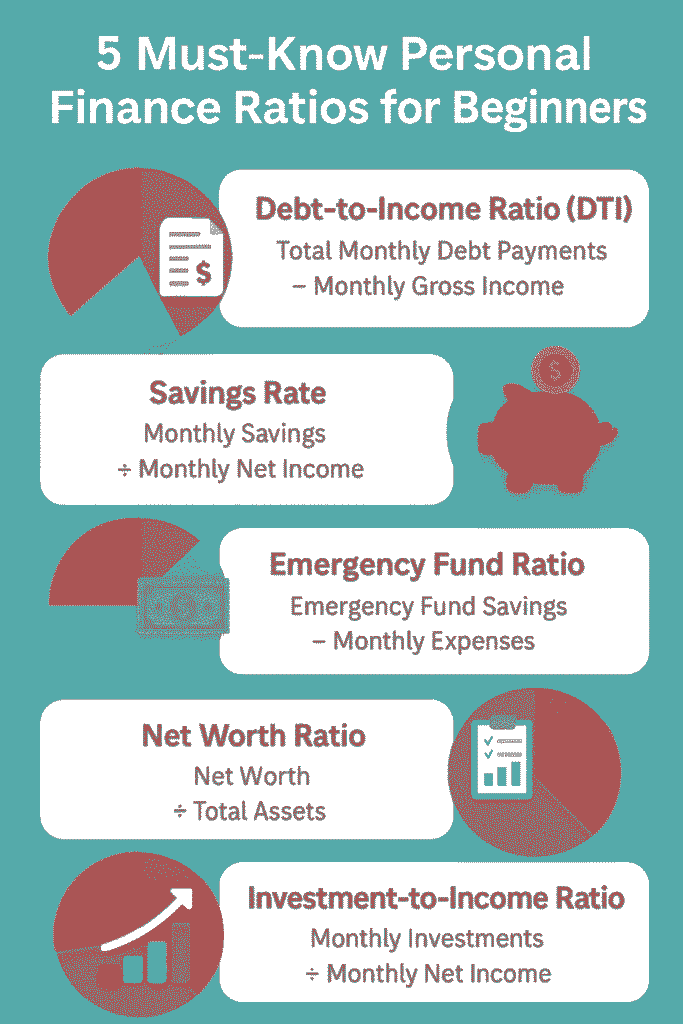

Discover 5 essential Personal Finance Ratios for Beginners to master your money. Learn how to calculate and use these ratios to boost savings, reduce debt, and achieve financial freedom. Start your journey today! #Personal Finance Ratios for Beginners, #financial ratios explained, #basic financial metrics, #debt-to-income ratio, #savings rate, #personal finance tips, #budgeting for beginners, #financial planning basics

Introduction

Money management might seem like a difficult undertaking, particularly for those who are just getting started. However, mastering Personal Finance Ratios for Beginners can simplify the process and empower you to take charge of your financial future. These ratios serve as a kind of road map that helps you make more informed choices regarding your investments, savings, and expenditures. Five essential personal finance ratios for beginners that simplify complicated financial ideas into useful information will be covered in this extensive book. These Personal Finance Ratios for Beginners can help you succeed whether your goal is to pay off debt, accumulate an emergency fund, or make retirement plans. Let’s get started and discover the potential of financial clarity!

Why Personal Finance Ratios Matter

Beginner’s personal finance ratios are crucial instruments for assessing your financial well-being. They show you exactly where your money is going and point out areas that need work. You can make wise decisions, steer clear of financial blunders, and work towards long-term objectives like financial independence by routinely computing these Personal Finance Ratios for Beginners. Are you prepared to discover the five essential personal finance ratios for beginners? Let’s dissect them.

1. Debt-to-Income Ratio (DTI): Your Debt Management Compass

A key component of Personal Finance Ratios for Beginners is the debt-to-income ratio (DTI), which calculates the percentage of your income that is used for debt repayment. You can determine whether your debt is manageable or becoming a burden by looking at this ratio.

How to Calculate:

DTI = (Total Monthly Debt Payments ÷ Monthly Gross Income) × 100

For instance, if your gross monthly income is $4,000 and your monthly debt payments (such as credit card, student loan, and mortgage) total $1,200, your DTI is: ($1,200 ÷ $4,000) × 100 = 30%.

What’s a Good DTI?

- Below 36%: Good and controllable, perfect for loan approvals.

- 36-43%: Be careful—review your spending plan to cut down on debt.

- Above 43%: High risk; prioritize paying down debt promptly.

Why It Matters: One of the most important personal finance ratios for beginners, a low DTI indicates sound financial standing and increases your chances of being approved for a loan or mortgage. Your ability to invest or save may be restricted by a high DTI, which could leave you trapped in a debt cycle.

Action Tip: Pay off high-interest loans, such as credit cards, if your DTI is higher than 36%. For immediate gains, look into techniques like the debt snowball method, which involves tackling smaller debts first.

2. Savings Rate: Your Path to Financial Freedom

Another essential personal finance ratio for beginners is the savings rate, which calculates the percentage of your income that you are putting aside for the future. It’s an effective strategy for reaching financial objectives and accumulating wealth.

How to Calculate:

Savings Rate = (Monthly Savings ÷ Monthly Net Income) × 100

Example: Your savings rate is ($500 ÷ $3,000) if you save $500 a month and your net income (after taxes) is:

What’s a Good Savings Rate?

- 10-20%: For individuals learning Personal Finance Ratios for Beginners, 10–20% is a good place to start.

- 20–50%: Perfect for lofty objectives like early retirement.

- Below 10%: Reduce wasteful spending to boost savings.

Why It Matters: One of the most important personal finance ratios for beginners, a higher savings rate speeds up your journey to objectives like home ownership or a comfortable retirement. Additionally, it creates a safety net for unforeseen costs.

Action Tip: Set up automatic monthly transfers to a high-yield savings account to start saving. To find competitive interest rates, look at options such as Ally Bank.

3. Emergency Fund Ratio: Your Financial Safety Net

One of the most important personal finance ratios for beginners is the emergency fund ratio, which determines how many months’ worth of expenses you can pay for out of your savings. When dealing with unforeseen circumstances like a job loss or medical emergency, this ratio is essential.

How to Calculate:

Emergency Fund Ratio = Emergency Fund Savings ÷ Monthly Expenses

Example: If your monthly costs are $2,000 and you have $6,000 in an emergency fund, your ratio is $6,000 ÷ $2,000 = 3 months.

What’s a Good Ratio?

- 3–6 months: Best for most users of Personal Finance Ratios for Beginners.

- 6 to 12 establishes the emergency fund ratio as a crucial personal finance ratio for novices, preventing you from depending on loans or credit cards in times of need and lowering your DTI.

Action Tip: Aim for three to six months’ worth of expenses after starting small by saving $1,000. To keep track of spending and distribute money, use a budgeting app such as YNAB.

4. Net Worth Ratio: Your Financial Big Picture

A fundamental personal finance ratio for beginners, the net worth ratio provides a comprehensive picture of your financial health by comparing your assets and liabilities. It’s a fantastic way to monitor development over time.

How to Calculate:

Net Worth = Total Assets − Total Liabilities

Net Worth Ratio = Net Worth ÷ Total Assets

Example: If your assets (e.g., savings, investments, home value) total $50,000 and your liabilities (e.g., loans, credit card debt) are $20,000:

Net Worth = $50,000 − $20,000 = $30,000

Net Worth Ratio = $30,000 ÷ $50,000 = 0.6 or 60%

What’s a Good Ratio?

- Above 50%: Suggests sound financial standing.

- Below 50%: Put your attention on growing your assets or decreasing your liabilities.

- Negative: Debt needs to be addressed immediately.

Why It Matters: A rising net worth indicates that you are accumulating wealth, as measured by Personal Finance Ratios for Beginners. This ratio assists in striking a balance between debt payments, investing, and saving.

Action Tip: Keep a close eye on your assets and liabilities by using a net worth tracker such as Personal Capital.

5. Investment-to-Income Ratio: Building Wealth for Tomorrow

A crucial Personal Finance Ratio for Beginners, the investment-to-income ratio calculates the percentage of income that is allocated to long-term growth investments. Securing your financial future requires it.

How to Calculate:

Investment-to-Income Ratio = (Monthly Investments ÷ Monthly Net Income) × 100

Example: If you invest $300 per month and your net income is $3,000:

($300 ÷ $3,000) × 100 = 10%

What’s a Good Ratio?

- 5–10%: Good for beginners who are unfamiliar with personal finance ratios.

- 10–20%: Good for accumulating wealth.

- Below 5%: As your budget permits, increase your investments.

Why It Matters: Compound interest, a key idea in Personal Finance Ratios for Beginners, is a benefit of early investing that helps you accumulate wealth over time. This ratio guarantees that you give future security top priority.

Action Tip: Begin by investing in inexpensive index funds offered by Vanguard or Fidelity. Small, consistent investments can grow significantly.

How to Use These Ratios Together

Understanding Personal Finances Ratios for Beginners is about doing something, not simply about numbers. To integrate them, follow these steps:

- Balance Debt and Savings: Increase your savings rate while managing debt by using your DTI.

- Build a Safety Net: Give your emergency fund ratio top priority to prevent taking on more debt in times of need.

- Track Your Progress: Keep an eye on your net worth ratio to make sure that assets are increasing more quickly than obligations.

- Invest for Growth: As you reduce DTI and free up money, raise your investment-to-income ratio.

To keep tabs on your financial situation, review these Personal Finance Ratios for Beginners every three months. Reminders and tracking can be automated with tools like Mint.

Common Mistakes to Avoid

- Ratio Ignorance: Ignoring Personal Finance Beginner’s ratios may cause them to spend too much or save too little.

- Focussing on One Ratio: For a thorough financial plan, balance all five.

- Not Adjusting Over Time: After a big purchase or a new job, recalculate personal finance ratios for beginners.

- Neglecting small Steps: Even tiny advances in Personal Finance Ratios for Beginners build up over time.

Conclusion

Your financial journey can be transformed by becoming proficient with these 5 Personal Finance Ratios for Beginners. These Personal Finance Ratios for Beginners provide you the ability to make better financial decisions, whether you’re using the debt-to-income ratio to manage debt or the investment-to-income ratio to grow wealth. Begin modestly, monitor your development, and maintain consistency. You’ll eventually acquire the self-assurance to use Personal Finance Ratios for Beginners to reach financial independence. Take the first step towards a stable financial future by calculating one of these ratios right now!

FAQs

Q1: What is the most important Personal Finance Ratio for Beginners?

Because it affects your ability to manage debt and qualify for loans, the debt-to-income ratio is frequently the most important.

Q2: How often should I check my Personal Finance Ratios for Beginners?

To keep on course, review them every three months or following significant changes in your finances.

Q3: Is it possible to raise my Beginner’s Personal Finance Ratios without raising my income?

Indeed! Reduce wasteful spending, settle high-interest debt, and set up automatic savings.

Q4: What happens if I have less than three months’ worth of emergency funds?

Start with $1,000 and work your way up to three to six months’ worth of spending.

Q5: Are ratios in personal finance just for novices?

No, anyone can use them to track and enhance their money management at any point in their financial journey.

Disclaimer

This article is not financial advice; rather, it is merely informational. Prior to making important financial decisions, seek advice from a professional financial counsellor. Although Personal Finance Ratios for Beginners offer some information, expert advice is advised for customised planning because every person’s situation is different.

Also Read:

- Personal Finance Tasks 2025

- 5 Key Personal Finance Rules Everyone Should Follow

- 7 Brilliant Smart Personal Finance Habits for Financial Freedom in 2025

- 7 Powerful Steps to Master the 50 30 20 Budget Rule for Beginners

- Personal finance basics: 5 ratios you must know

- 7 Personal Finance Ratios You Should be Tracking!